Known for its scientific approach to development, strong academic foundation, and focus on scalability, Cardano has emerged as a leading blockchain platform. As the crypto market is constantly evolving and overall blockchain adoption reaches new heights, Cardano’s place in this scene continues to be very important. In this article: Cardano long-term price prediction 2026-2030 Based on its intrinsic value and growing use cases.

What is Cardano (ADA)?

Cardano is the first ever proof-of-stake blockchain Based on peer-reviewed research and research using evidence-based methods in development. Cardano aims to provide unparalleled security and sustainability to applications, systems, and society.

of Cardano’s total supply is limited to 44 billion ADA. Cardano is an environmentally friendly cryptocurrency because it uses a proof-of-stake mechanism on its blockchain.

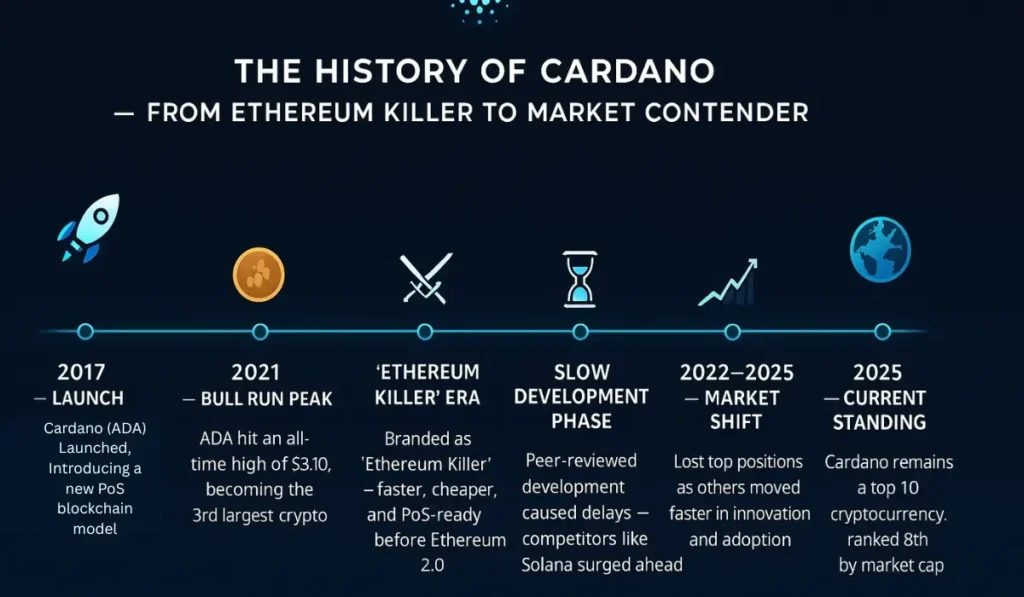

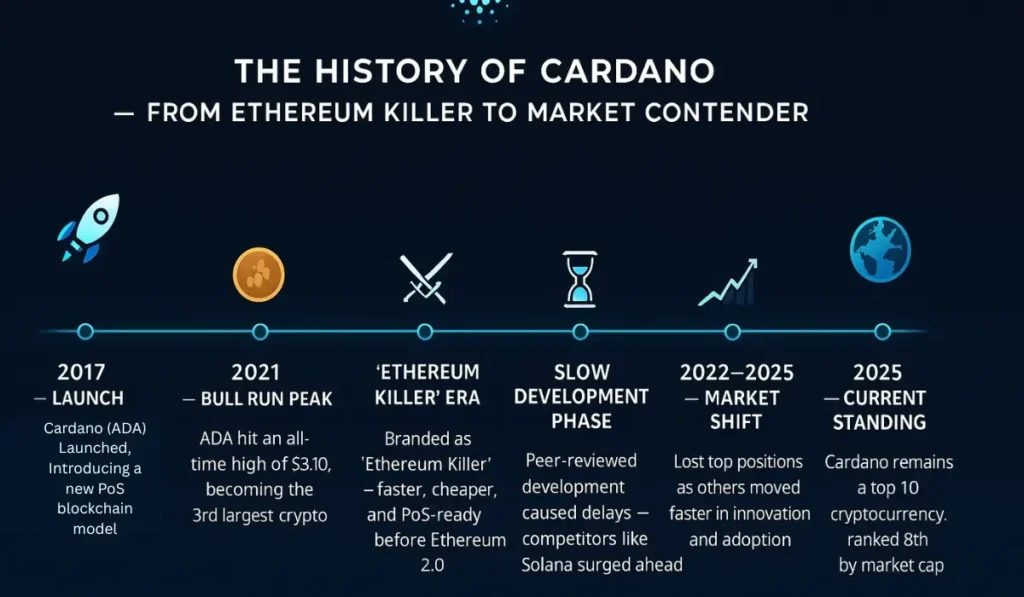

History of Cardano (ADA)

Cardano was launched in 2017. It has shown high volatility since it appeared on the market. Cardano’s price used to soar during market bull runs. In 2021, ADA reached an all-time high of $3.10.

At peak performance, Cardano was the third best performing cryptocurrency after Bitcoin and Ethereum. Market capitalization. Ethereum had not yet moved to a proof-of-stake mechanism, was slow, and had high fees, so Cardano was quickly branded the Ethereum killer.

Cardano, on the other hand, worked on PoS, had low fees and was very fast. These were enough reasons for Cardano to be branded an Ethereum killer, especially when it targeted Ethereum-dominated domains.

However, since its meteoric rise in 2021, Cardano has lagged behind competition from other coins like Solana. The main reason for this slow progress was the peer-reviewed development process. This took a lot of time to deploy, and Solana overtook Cardano. As of 2025, Cardano is the 8th largest cryptocurrency by market capitalization, after competition caused Cardano to retreat.

Cardano price prediction

Cardano price prediction is a complex journey as it is influenced by numerous factors that work together to determine the outcome.

This article aims to predict Cardano’s future price in the long term by analyzing the factors that contribute to price determination.

Looking at Cardano’s price history, we also see some sharp spikes and significant declines. But an interesting fact is that despite the ups and downs, Cardano seems to be stabilizing. Although the trend for Cardano looks somewhat bullish at the moment, higher momentum is needed to sustain this growth. If Cardano sustains the support above $0.67, it could rally to $0.7 or even $0.74.

On the other hand, if support breaks and Cardano falls below $0.64, the price could end up falling below $0.60. Based on the available information, Cardano appears to be on a cautious bullish path. The reason behind this bullish rise could be that the market is gradually gaining momentum towards more purchases.

At the moment, Cardano offers a variety of trading opportunities. While Cardano’s scalability and use cases are unquestionable, the volatile nature of the currency spooks most investors. Whether Cardano is a good investment is a much debated topic. One of the main reasons why Cardano was able to make it into the top three was its unique design with an emphasis on peer-reviewed development. However, the same peer-reviewed development slowed the pace.

So, to answer the question, is Cardano a good investment? We need to go beyond blockchain expertise and analyze market data as well. Whether Cardano can recover from the decline will depend on market sentiment and adoption. With major updates and releases planned, such as Hydra Layer-2 scaling, the buzz around Cardano’s resurgence is growing. This could have a positive impact on prices if investor sentiment becomes more optimistic.

Cardano Price Prediction 2026 – 2030

| year | low | average | expensive |

|---|---|---|---|

| 2026 | $1.31 | $1.35 | $1.61 |

| 2027 | $1.87 | $1.92 | $2.24 |

| 2028 | $2.94 | $3.02 | $3.36 |

| 2029 | $4.24 | $4.39 | $5.10 |

| 2030 | $5.38 | $5.57 | $6.50 |

The future of Cardano

Blockchains like Cardano have intrinsic value because of the technology behind them. The services they provide apply to real-world applications, so Cardano has a future if they can deploy blockchain to its full potential. As blockchain becomes more attractive to projects and users, Cardano will become more valuable. However, Cardano’s price also depends on factors other than user attractiveness. This is due to Cardano’s existing market environment.

Coins deployed in the market are also affected by market movements. While technological advantages can give such assets an edge over their competitors, technological advantages alone cannot determine whether prices will skyrocket.

However, you can consider the pros and cons of investing in Cardano.

Pros of investing in Cardano

- Cardano, like Bitcoin, has a limited supply, so its price can rise significantly depending on future demand.

- Cardano is a constantly evolving blockchain. This means that real-world use cases continue to be added to the system, making it more desirable and providing intrinsic value.

- Another advantageous aspect of investing in Cardano is its partnerships. Cardano currently partners with the following companies: european investment bank Japan Bank for International Cooperation. Such connections with financial giants are a positive sign when it comes to cryptocurrencies.

- The United States, one of the most dominant powers in the world, cryptocurrency As a strategic reserve, it is a good sign for investment.

Disadvantages of investing in Cardano

- Development delays are plaguing Cardano’s future. The peer review process takes quite a while. This was one of the big reasons why Cardano took four years to launch smart contracts, even though it was launched in 2017.

- Slow development gives room for competitors to get ahead of the curve and establish themselves among potential investors.

- Cardano’s high volatility makes it a bad choice for investors looking for short-term profits.

Conclusion – Cardano price prediction

As with any volatile asset, the price cannot be accurately predicted with Cardano. However, industry news, technical analysis, and market sentiment can help you make informed decisions. In cryptocurrencies, navigating the price realm is a complex and volatile task. The best way to approach this ever-changing situation is to be armed with knowledge and information.

| Disclaimer: These cryptocurrency price predictions are based on predictive modeling and should not be considered financial advice. |

FAQ

Cardano is constantly evolving. Technically, ADA, the currency of blockchain, may still have a future, as the technical nature of blockchain impacts a larger group of developers and users.

no. Tech updates have been found to fail from time to time. In such cases, if an asset is already volatile, its volatility will become even higher.

Cardano’s development delays cost Solana some of the key industry partnerships it was able to leverage. However, with many such institutional powers waiting to enter the market, Cardano still has the potential to threaten or even overtake Solana.

Cardano uses a peer-to-peer review model to verify the technical stability and validity of the project. This is a time-consuming process and is the main reason why some Cardano projects have been delayed.

Project and development success does not equate to market success. The final result will depend on whether the application is actually adopted. A successful project adopted by the global market could mean economic success for Cardano and, in turn, an increase in the price of ADA.