After its near-July launch, Bitcoin has performed even more impressively in the past few days. After a short period of sideways momentum earlier this week, the best cryptocurrency achieved the new highest rating of all time in Prices are nearly $119,000. Naturally, the Bitcoin market is experiencing a wave of optimism. This is a reasoning that is still highly supported by the latest chain revelation.

Bitcoin Market Sentiment Changes Bull

Social Media Platform X’s July 11th post, Cryptocurrency analytics company Alphractal I delved into it It provides insight into the current price action of Bitcoin on the future trajectory of cryptocurrency.

Related readings

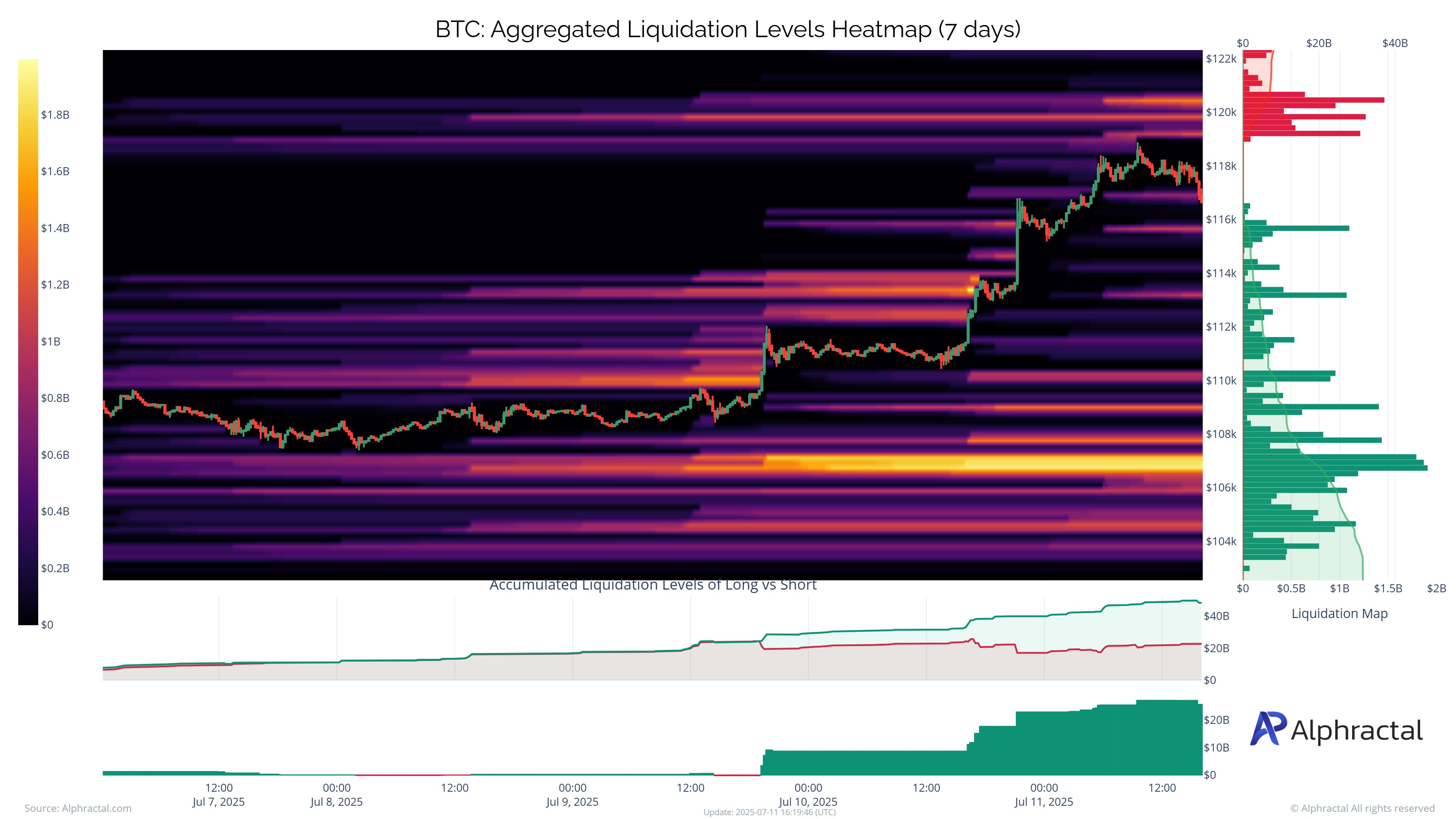

The company’s observations on the chain revolve around a total clearing level (7 days) metric that visualizes price ranges with high concentrations of long or short liquidation over seven days, and visualizes heatmap (one month) of quarterly or short liquidation levels that do the same except that this covers the monthly time frame.

After the latest Bitcoin prices rose to an all-time high, all over-covered bears have wiped out market positions. Usually aided by a short squeeze following such a major liquidation event, the flagship cryptocurrency still holds strong bullish momentum and continues to surge.

According to Alphractal, the aggregation liquidation levels across different time frames indicate that most leveraged locations currently bet on Bitcoin prices. As the market continues to move the charts up, investors’ optimism will become more positive and could further encourage more traders to open longer positions in the BTC futures market.

However, alfractal I warned Opposes the trend of reckless involvement in the current bull market. “For some reason, if, back in the $107,000 zone and lower it by $10,000, that could be the Bulls’ turn to face a massive liquidation,” the analytics company said.

The company went further and explained that the price decline of that magnitude of Bitcoin would have a negative impact on market optimism. On the bright side, Alphractal also said that such outbreaks could provide opportunities for new accumulation in the near future.

It’s still on Market Optimisma $10,000 decrease in Bitcoin’s value can lead to a phenomenon known as a long aperture, and Bitcoin’s price continues to plummet with increasing momentum.

Typically, a long aperture occurs when the price of cryptocurrency (in this case, Bitcoin) is forced to sell assets to traders with long positions to reduce losses or evenly break them. This contributes to the already existing bearish momentum, sending BTC prices further south.

During the current Bitcoin rally, Alphractal ultimately advised traders to take advantage of it wisely and carefully, as the next action in the market is in an unpredictable zone.

Bitcoin price at a glance

Bitcoin is valued at around $118,145 at press time, as it still shows signs of healthy bullish momentum. Coingecko’s data shows that the flagship cryptocurrency has increased by more than 3.34% over the last 24 hours.

Related readings

ISTOCK featured images, TradingView chart