Prediction markets are pinning hopes for a modest rate cut at the Federal Reserve’s December meeting, even as policymakers publicly grapple with conflicting data and internal divisions.

Rate cut odds fluctuate as bettors react to Fed cracks and spotty data

Prediction markets are sending a clear message ahead of the December 9-10 Federal Reserve meeting. Smart money is leaning toward a further 25 basis point rate cut, even as officials continue to project a less-than-universal outlook. Polymarket, Calci, and CME’s FedWatch tools have all shifted toward expectations for a modest rate cut, but each platform is showing its own sense of market uncertainty.

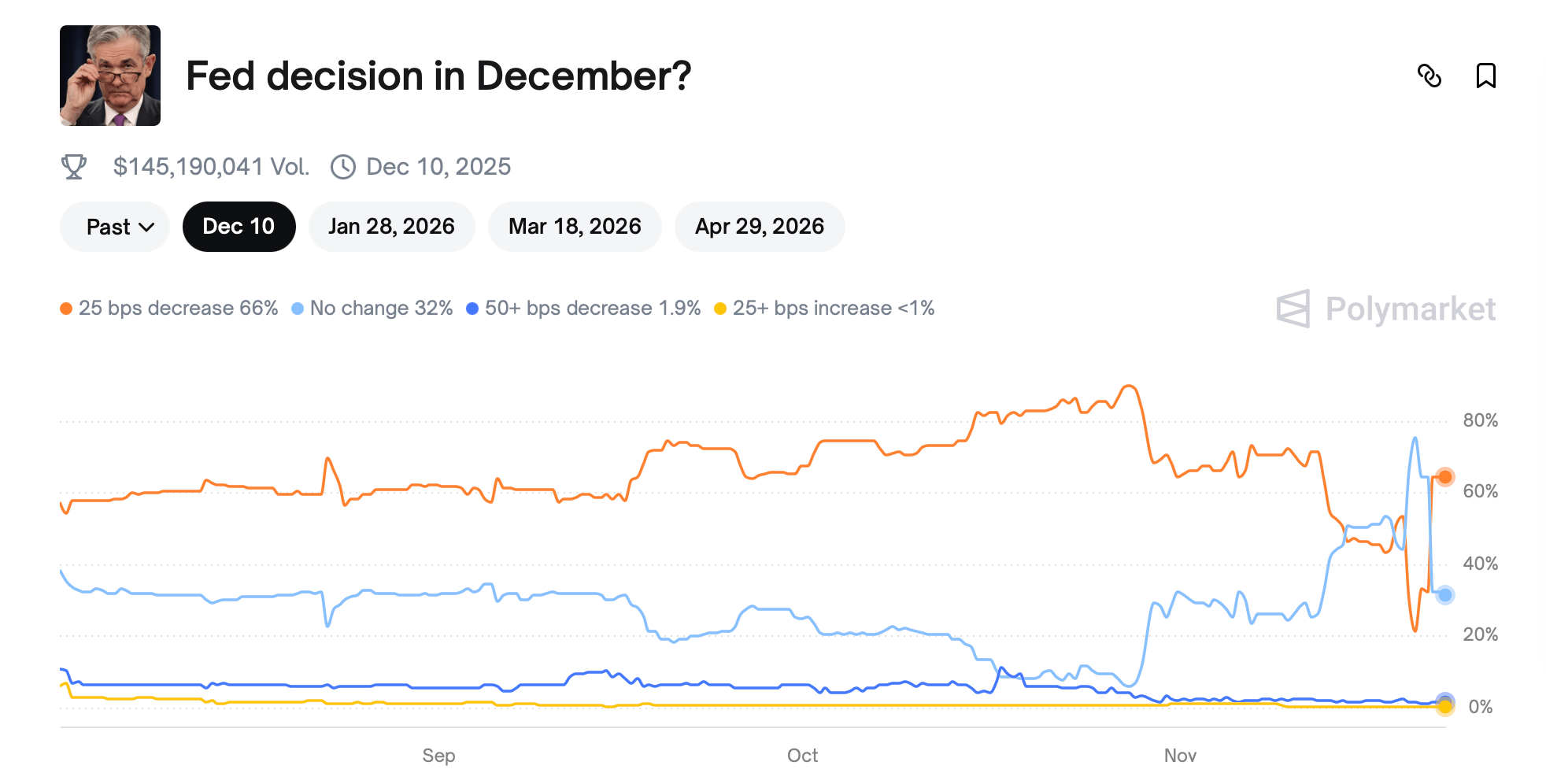

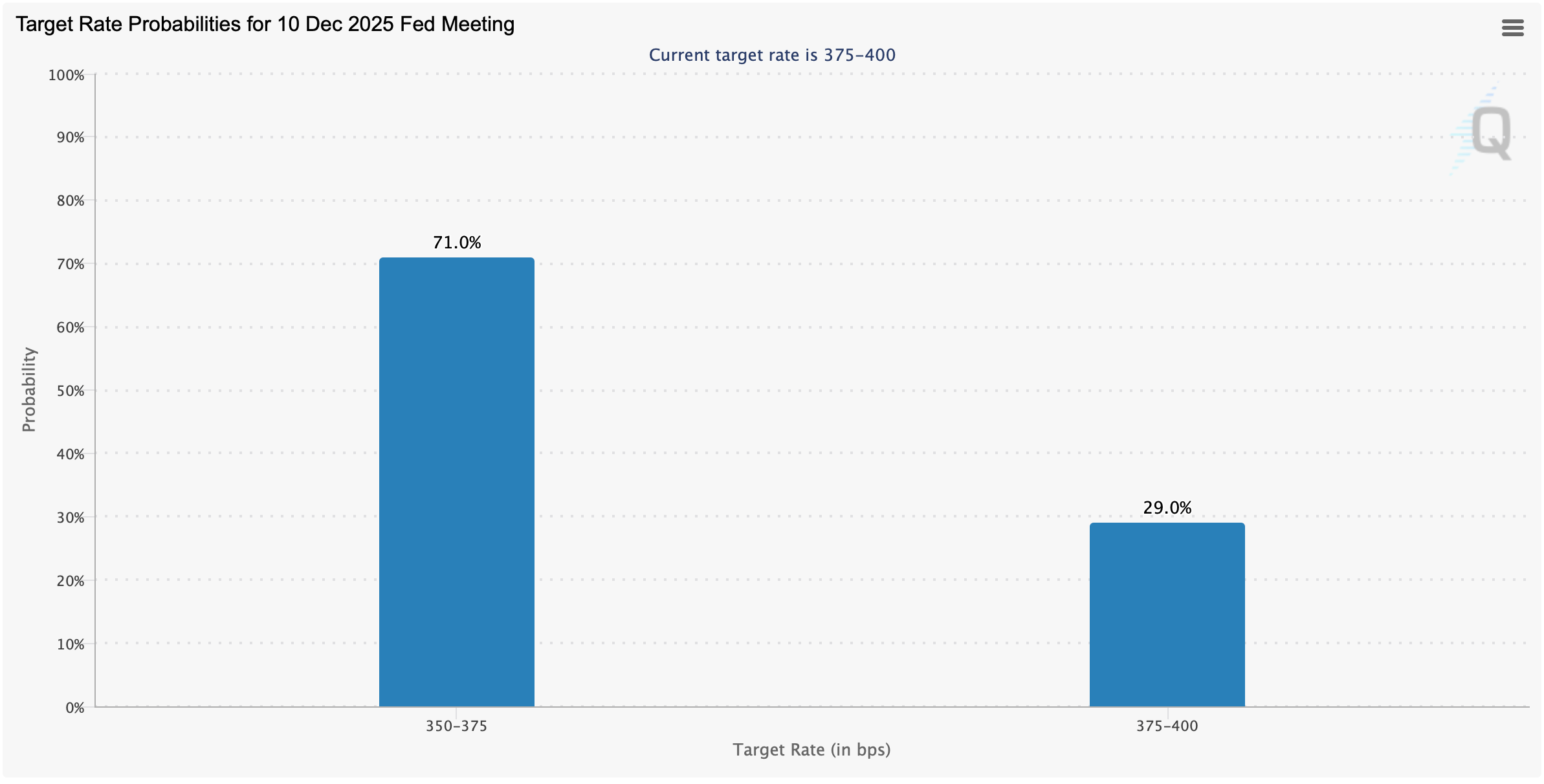

According to Polymarket data, bettors are currently assigning 66% odds on a 25bps cut, while 32% expect no change and just 2% are pricing in a larger-than-usual 50bps cut. The “25 bps or more rate hike” market is essentially dead at less than 1%, reflecting the near-universal view that the Fed is done tightening for now. The Kalsi market takes a similar view, with 64% expecting a 25bps rate cut, 36% saying it will remain unchanged, and 3% expecting a further cut. CME’s Fedwatch tool shows a 71% chance that the target range will drop to 350-375 bps, which is a clean 25 bps reduction from the current 375-400 bps band.

Polymarket bets on November 22, 2025.

But internally, the central bank is grappling with what internal minutes describe as “significantly different views”, with a rare rift making the December meeting a veritable coin toss. October FOMC meeting minutes revealed a “bilateral opposition” with some officials favoring deep interest rate cuts and others opposing any easing. Analysts cited in several reports say Chairman Jerome Powell is dealing with a “consensus problem” and that disagreements are spilling over into his public statements.

This friction is one reason why prediction markets continue to wobble. Traders thought the odds of a rate cut had fallen to 22% after the minutes were released, but they rebounded after dovish comments from New York Fed President John Williams, who said there was “room for a rate cut in the short term.” Conversely, officials in Boston and Cleveland insist there is “no urgency” to cut rates, citing the risk of easing too soon as inflation remains high. With cross-currents like this, it’s no wonder bettors treat every speech like a market-moving event.

Economic indicators haven’t made things any easier. The report outlines the impact of the 44-day government shutdown, which delayed the release of key worker numbers and inflation figures and left policymakers with a partial outlook heading into December. The long-delayed September jobs report showed that although employment rose by 119,000 jobs, the unemployment rate rose to 4.4%, the highest level since 2021. Wages rose only 3.8%, and a private sector tracker said employment would soften in October. With only piecemeal data available before the meeting, traders are effectively pricing decisions based on incomplete evidence.

Inflation remains strong enough to encourage hawks. September CPI recorded 3%, core at 3.1%, and core PCE remains hovering around the 2.8-2.9% zone. Officials have warned that “progress is stalling” and are increasingly arguing that a wait-and-see approach may be the safer path. All this sets up the December meeting as a balancing act between weakening labor signals and inflation refusing to cooperate.

Also read: Ron Paul warns that the Fed’s ‘fantasy money’ is fueling an AI bubble

Still, the betting market appears to believe the dovish side has momentum. Polymarket and Calci are both showing a strong trend towards a 25bp rate cut, and CME futures traders are following suit. The notable difference is in the “no change” category. Calci’s figure has risen to 36%, compared to Polymarket’s estimate of 32%, reflecting the nuanced differences in how individual bettors and event contract traders interpret the Fed’s communications. The small but persistent premium for “no change” likely reflects the Fed’s recent warning that further rate cuts are “not a foregone conclusion.”

CME Fedwatch Tools November 22, 2025.

Market volatility follows every development. Stocks, bonds, gold, and Bitcoin all reacted sharply to Fed-related headlines, with interest rate-sensitive sectors bearing the brunt of the odds changes. Traders appear keenly aware that while further rate cuts could boost risk assets, lower rates would support the dollar and further pressure on the economy. In other words, the December meeting is poised to set off fireworks in the market regardless of the outcome.

Ultimately, the question is not just what the Fed will do, but how Mr. Powell will justify it. With data gaps remaining, inflation still rising, and officials contradicting each other in public, prediction markets may be the most stable signal currently available. And, at least for now, these markets are looking at a further 25 points decline in December.

- What does the market expect the Fed to do in December?Most forecasting platforms indicate a 25 basis point rate cut as likely.

- Why do traders prefer cuts over holds?Soft labor data and recent dovish comments from key Fed officials have raised hopes for modest easing.

- How does CME FedWatch compare to the gambling market?CME futures show a similar probability, with over 70% expecting a 25bps move.

- Why is December’s decision unusually uncertain?Visibility is particularly limited due to data inconsistencies, internal Fed disagreements, and delays in government reporting.