Hut 8 Bitcoin (BTC) mining company has extended its credit facility with crypto exchange company Coinbase to $200 million, setting itself apart among players in the struggling mining industry, building on momentum and strong stock performance from 2025.

Hut8 plans to use the funds for “general corporate purposes,” according to an amended filing with the U.S. Securities and Exchange Commission.

The credit expansion follows Hut8’s $7 billion deal in December with AI cloud platform Fluidstack to supply 245 megawatts (MW) of energy to AI data centers over 15 years.

The deal is one of the largest deals of its kind between a crypto-native company and an AI infrastructure provider.

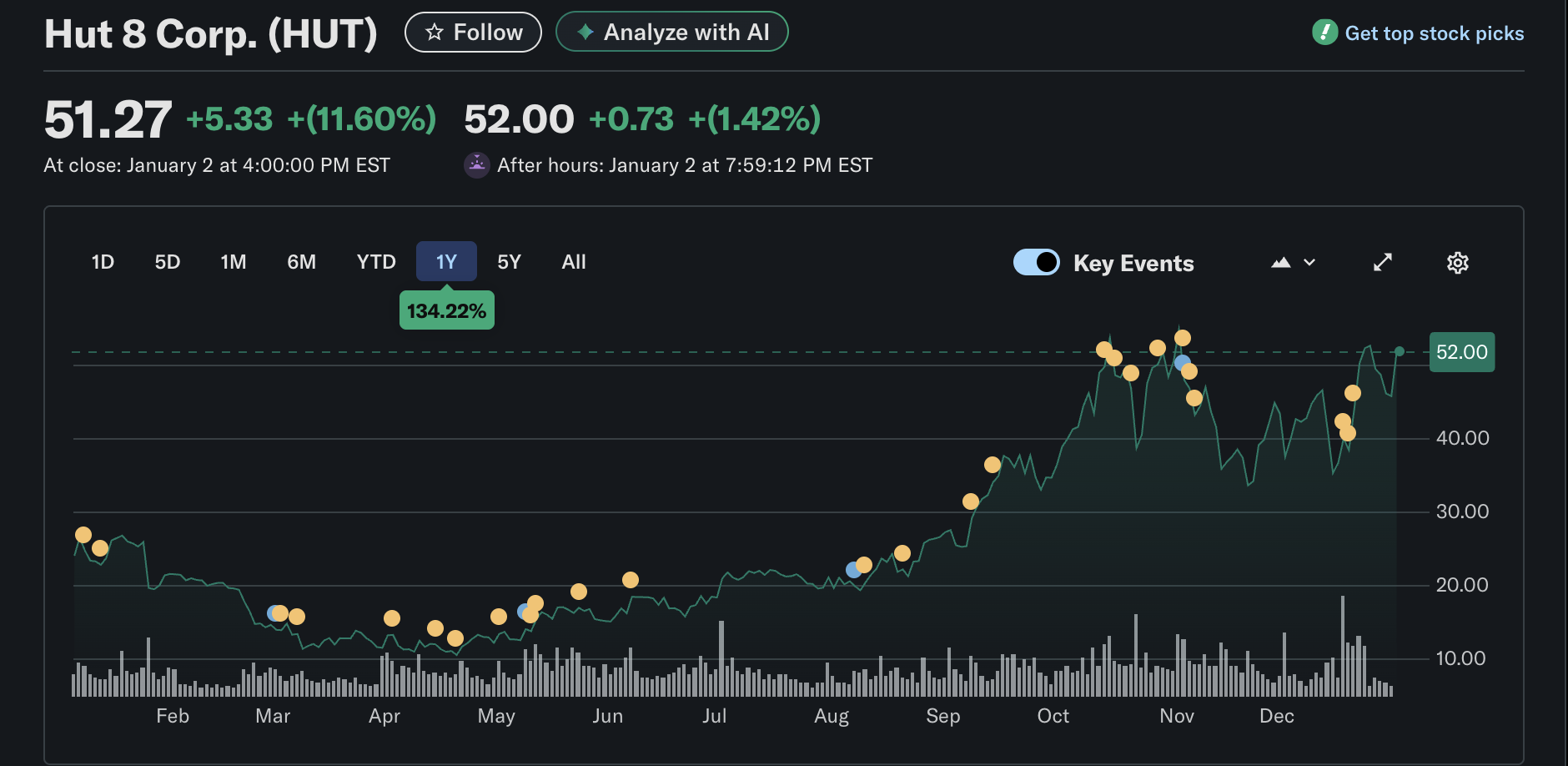

According to Yahoo Finance, Hut 8 stock has risen more than 134% in the last year, trading at around $51.27 at the time of writing.

While the company had a significant year marked by diversification into AI, high-performance computing, and expansion of its Bitcoin mining operations through majority ownership of mining and crypto treasury company American Bitcoin, the mining industry as a whole faced operational and economic headwinds.

Hut 8’s 1-year stock price performance. sauce: Yahoo Finance

Related: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Pressure, and Fight for Survival

Mining companies are struggling, but Hut8 and American Bitcoin continue to accumulate BTC

Bitcoin miners experienced one of the toughest margin environments in history in 2025 due to block subsidy reductions (reduced from 6.25 BTC to 3.125 BTC per block) following the April 2024 halving, rising energy costs, and macroeconomic pressures.

Miners are also feeling the squeeze from U.S. President Donald Trump’s tariffs, which are impacting hardware prices and raising concerns about equipment shortages due to supply chain problems caused by geopolitical tensions between the U.S. and China.

China is one of the largest manufacturers of application-specific integrated circuits (ASICs), the machines used to mine Bitcoin and other proof-of-work (PoW) cryptocurrencies.

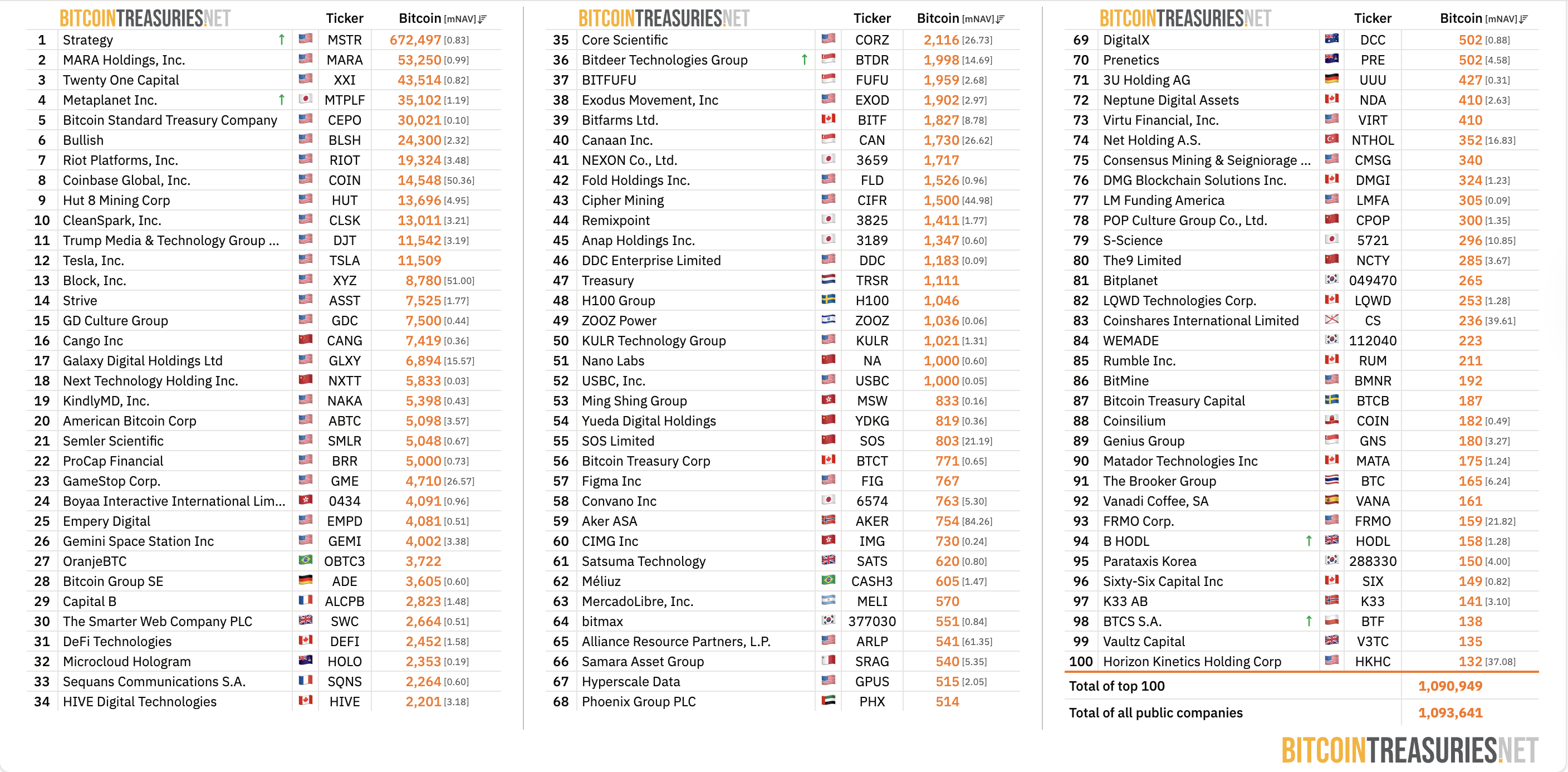

Rank Bitcoin treasury companies by BTC holdings. sauce: bitcoin treasury

According to BitcoinTreasuries.Net, Hut 8 ranks 9th among the top 100 Bitcoin treasury companies with 13,696 BTC in its corporate treasury, valued at over $1.2 billion as of this writing.

According to data from BitcoinTreasuries, America ranks 20th in Bitcoin, with holdings of 5,098 BTC, worth approximately $458 million.

magazine: Bitcoin mining industry will “extinct within two years”: Bit Digital CEO