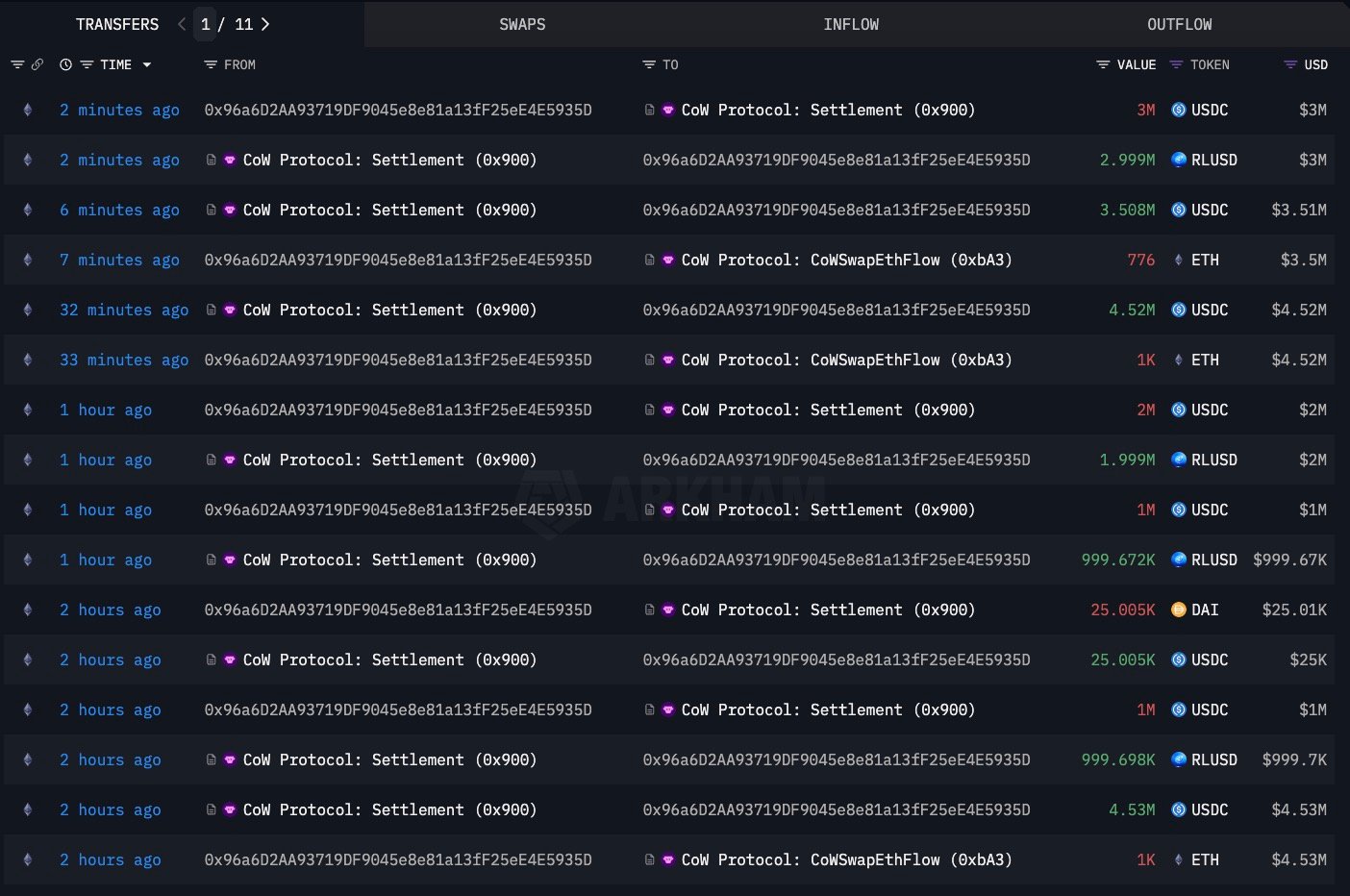

The old Ethereum wallet, which hasn’t moved coins for three years, suddenly decides that now is a good time to act, sending 2,086 ETH to stablecoins worth $9.48 million, spreading it to stablecoins like DAI, USDC, RLUSD, and sales are carried out through cow protocols.

The interesting part is that this wasn’t a complete exit as Ethereum OG still holds 2,779 ETH and is valued at around $12.6 million.

This move looks like someone is leaving ETH, but someone who believes the $4,544 level is strong enough to justify the lock on profits, but maintains plenty of exposure in case the rally has more room for driving.

When the 2017 tied up Ethereum address made headlines for moving 8,310 ETH worth $41.4 million into exchange, that’s a different story.

Ethereum (ETH) price opportunities

Ethereum’s price action explains part of the logic, indicating that Altcoin is reluctant to break $4,600-$4,700 around the $4,500 zone, with its weekly charts reluctant to break $4,600-$4,700, making it a natural area for long-term holders to reduce risk.

From their perspective, after embracing this year’s conflict, the fight for regulations, and the highest ever new height, the decision to sell here is not to timing the exact top, but to keep enough coins to get involved when the story is rising, while still being about the crystallization of profits that most traders can dream of.