Today’s Ethereum Price: $2,580

- Ethereum Exchange Supply has plummeted to its lowest since August 2024, showing dominant bullish momentum.

- Whales continue to buy pressure and will expand their balance by more than 670,000 ETH over the past nine days.

- ETH continues to be integrated near the $2,500 key level amid a lack of directional bias.

Ethereum (ETH) saw a 2% increase in its early Asian session on Thursday, recovering a key level of $2,500 after whales stepped on gas at purchase pressure.

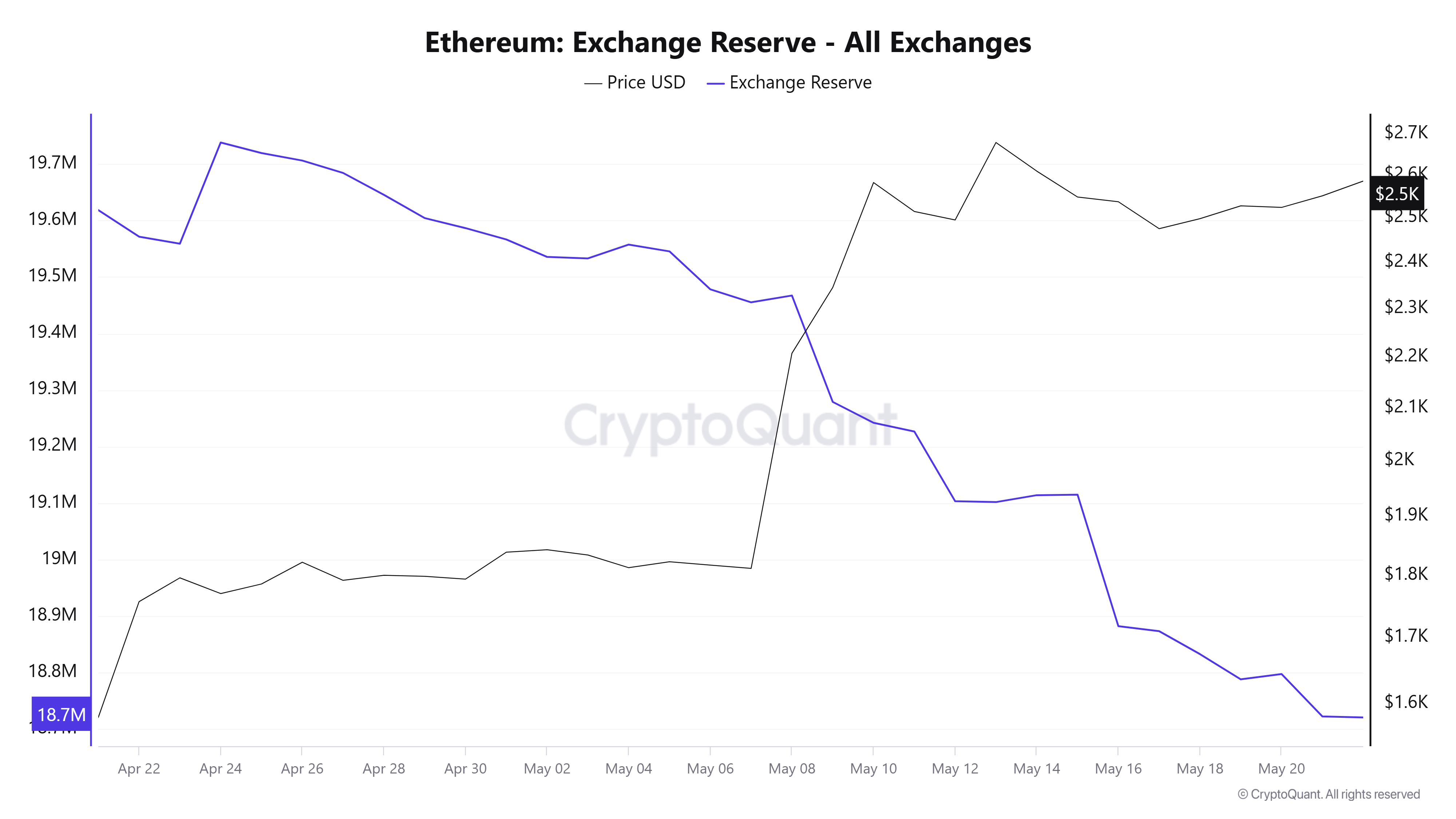

Supply of exchange Ethereum will shrink following whale demand

Ethereum’s exchange supply expanded its decline to 18.73 million ETH on Wednesday, indicating sustained spot market purchase pressure. Since Metric began the downtrend on April 24th, more than 1 million ETH have interacted with private wallets for potential long-term holdings. As a result, ETH’s supply to the exchange has reached its lowest level since August 2024.

The decline in exchange supply partly explains why ETH prices remain on an upward trajectory from the same date.

Eth Exchange Reserve. Source: Cryptoquant

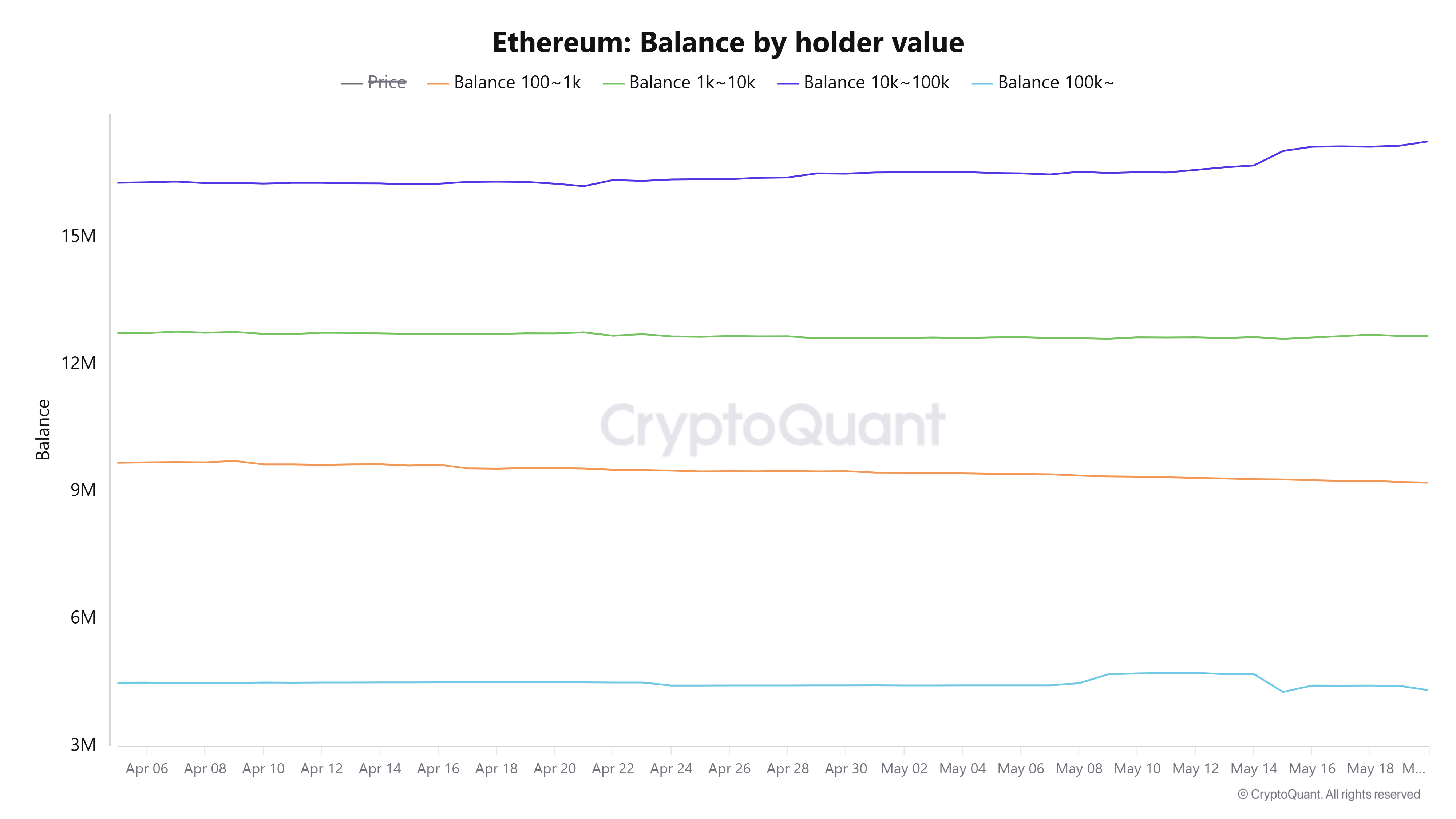

As in the previous week, whales with a 10K-100K balance have continued to lead their purchase activities, growing their holdings at a net worth of 670K ETH over the past nine days. However, small holders have been allocated, and the total balance has declined by 110K ETH at the same time.

ETH balance based on holder value. Source: Cryptoquant

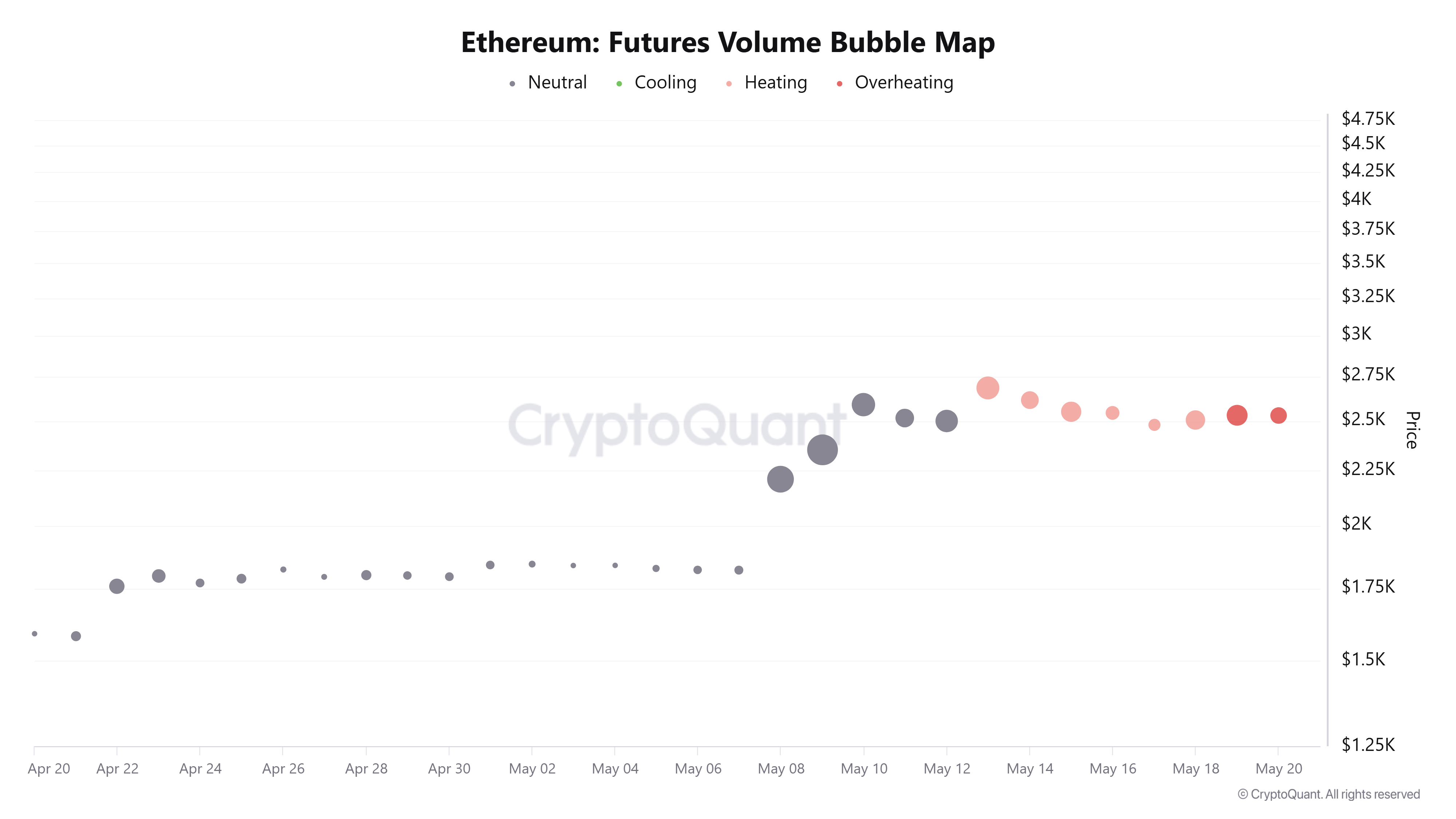

Despite the pressure to buy dominant spots, ETH continues to be bound by range near the $2,500 mark. The ETH futures bubble map shows an increase in trading volumes every time the price falls below $2,500, making it a key level where you can define the next major trend in Top Altcoin.

ETH futures volume bubble map. Source: Cryptoquant

Meanwhile, Ethereum’s search interest again rose to the 60-point mark from 45 on May 17, but fell from the 100-point level seen in the May 8-9 rally. This shows that the intense retail excitement is not leading ETH prices, leaving room for more robust price growth.

Interested in ETH search. Source: Google Trends

Ethereum price forecast: eth is waiting for catalyst amid lack of direction bias

Ethereum has experienced a $106.52 million futures liquidation over the past 24 hours per Coinglass data. The total amounts of liquidated long and short positions are $56.20 million and $50.32 million, respectively.

After closing nearly $2,500 on Tuesday, ETH briefly surpassed $2,600 on Wednesday, but saw rejections just below the 200-day Simple Moving Average (SMA). Top altcoins have risen by 2% at the time of writing as the Bulls try to maintain solid movement beyond the $2,500 level.

ETH must make massive movements beyond the $2,850 resistance or beyond the $2,260 to $2,100 range to establish the next direction. Moves above $2,850 can see the ETH rally towards a $3,250 resistance, while breakdowns below $2,100 can send prices to $1,688 support.

ETH/USDT Daily Chart

The relative strength index (RSI) continues the horizontal trend near excess area lines, indicating a slight weakness in bullish momentum. Meanwhile, moving average convergence divergence (MACD) is testing moving average lines because the histogram bar is about to reverse negatively. If the following crossing is successful, the downward pressure will increase.