Ethereum price recently broke out of a bullish triangle pattern, suggesting new upward momentum.

However, that breakout now appears vulnerable. Ethereum After nearly three weeks of bearish divergence, there are growing concerns that the move lacks conviction.

Significant Ethereum holders withdraw

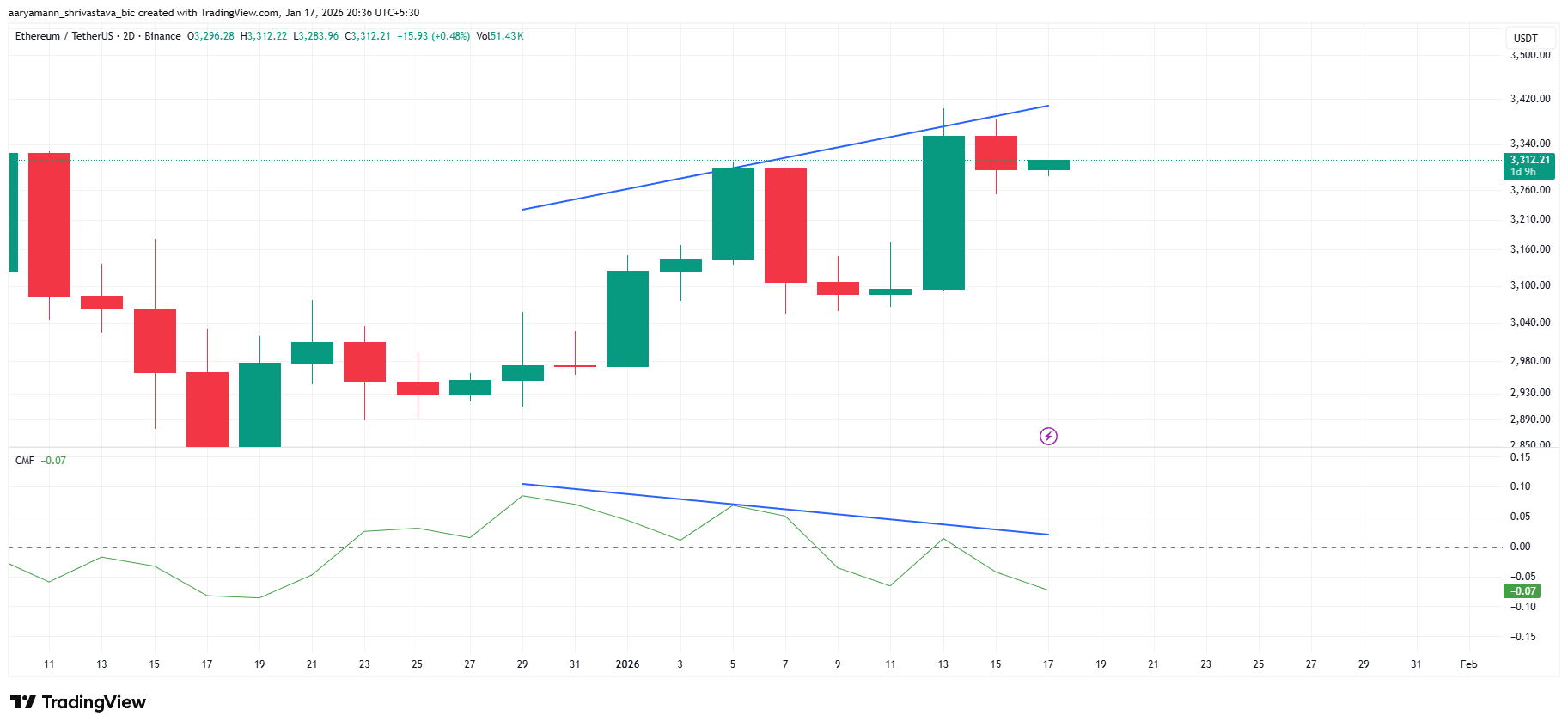

Ethereum has shown a clear bearish divergence over the past three weeks, suggesting weakening internal forces. on the other hand, Ethereum Prices continued to form highs, and the Chaikin Money Flow Indicator recorded further lows. This pattern suggests that price increases were accompanied by increased capital outflows rather than sustained capital inflows.

Such divergences often precede a trend reversal. It seems that investors are distributing Ethereum Instead of accumulating it, turn it into power. When capital exits the market during price expansion, the upward momentum weakens. This dynamic increases the chance of a breakout failing, especially in a cautious broader crypto environment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ETH Bearish Divergence”>

ETH Bearish Divergence”>

Ethereum bearish divergence. Source: TradingView

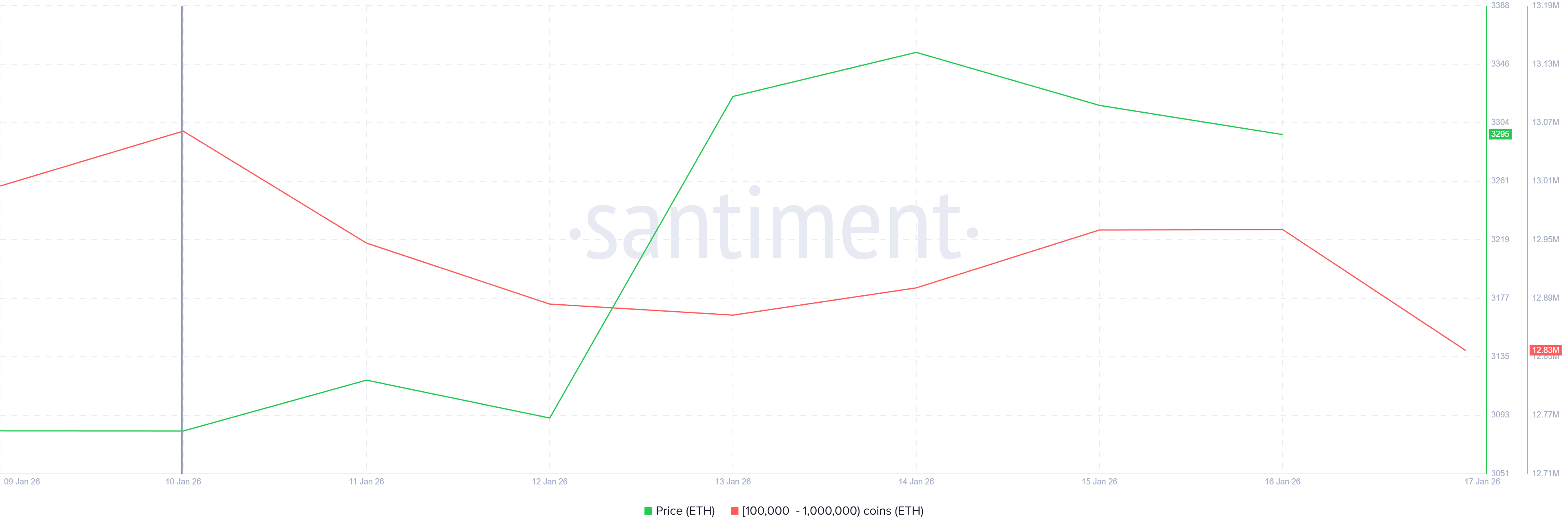

Macro data reinforces the bearish signals seen in momentum indicators. Ethereum whales have seen increased selling activity over the past week. Wallet containing 100,000 to 1 million Ethereum Over 230,000 units sold Ethereumaccording to on-chain data.

This selling pressure equates to approximately $760 million at current prices. The large outflows from the wallet coincide with the decline in CMF, confirming the decline in confidence among major holders. If the whale sells and breaks out, it weakens the sustainability of the price and increases the likelihood of further declines in the short term.

ETH Whale Holding”>

ETH Whale Holding”>

Ethereum whale holding. Source: TradingView

Ethereum prices may fall

Ethereum price is trading around $3,309 at the time of writing, hovering just above the $3,287 support level. The recent triangle breakout predicted a 29.5% upside move with a $4,240 target. However, a loss of momentum and a bearish divergence could invalidate that bullish structure.

Considering the current situation, Ethereum It is likely to lose support at $3,287. Once the breakdown is finalized, the price could head towards the $3,131 level, confirming that this move is a sham. Such a rejection would increase selling pressure and hint at the possibility of further correction below $3,000.

ETH price analysis. “>

ETH price analysis. “>

Ethereum Price analysis. Source: TradingView

Still, the downside is not guaranteed. if Ethereum If the price successfully rebounds from $3,287 and the whale selling subsides, bullish momentum may return.

If this support holds, Ethereum could rally towards $3,441. Further strength could extend the rally towards $3,802 and invalidate the bearish outlook.

The article This Major Reversal Could Cause Ethereum Bulls to Fail appeared first on BeInCrypto.