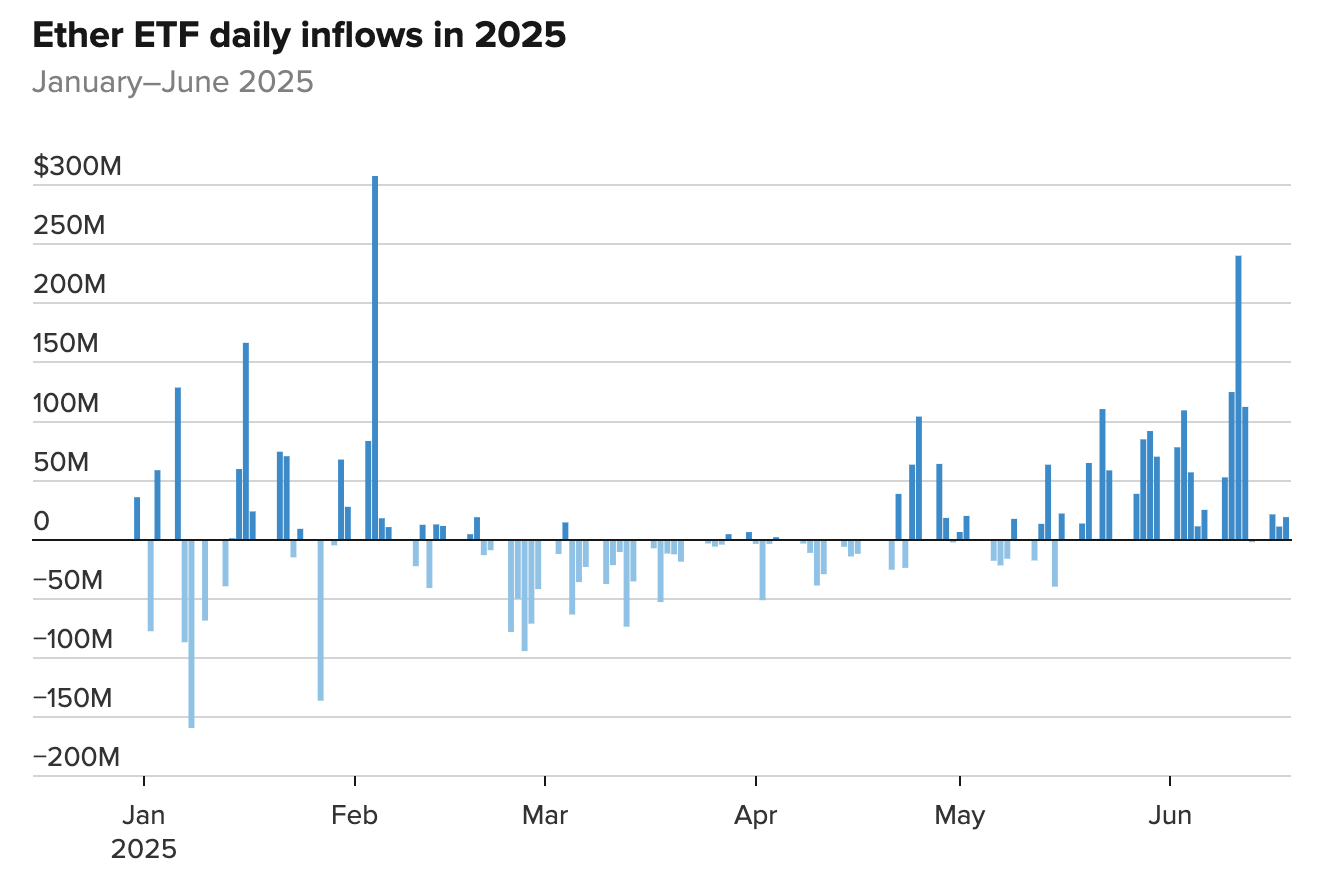

The Ethereum ETF is finally awake after months of neglect. After launching in July 2024 with barely excitement, these funds have pulled cash for six consecutive weeks and booked inflows in eight of the last nine weeks.

According to Sosovalue, this is the most consistent interest ETFs have seen since they began trading. The same product, which was called zombie funds earlier this year, is suddenly alive and attracting real money.

This new appetite comes as the second largest crypto by market capitalization has returned to the middle of US regulatory measures. Traders are paying attention again thanks to new advances around Stablecoins, which are mainly running on the Ethereum network.

Source: SOSO value

The key event was the IPO of Circle, the company behind the second largest Stablecoin. It combines with leadership reform at the Ethereum Foundation to bring the institution back.

As the arbitrage opportunities grow, the agency quietly reenters

Ben Kurland, CEO of research firm Dyor, said the major players are changing their strategies. “What we’re looking at is an institutional readjustment,” Ben said. “After the initial ETH ETF approval went on a whim without a price pop, Smart Money has betted not on price momentum but on unlocking utilities such as staking access, options listings and ultimately influx from retirement platforms.”

So far, Ethereum ETF inflows have reached approximately $3.9 billion. This was smaller than the Bitcoin ETF, drawing in $36 billion in its first year. But Ethereum is beginning to catch up. Chris Lane, who leads liquid active strategies at Galaxy Digital, pointed out one reason. “With increasing acceptance of crypto on Wall Street, investors are attracted to ETH ETFs, particularly as a means of payment and transfer,” Chris said.

Arbitrage windows are also useful. Currently, Ethereum’s CME base (the gap between futures and spot prices) is wider than Bitcoin. This gives traders a long way to go to Ethereum ETFs, giving them the opportunity to run short on futures and narrowing down profits. The strategy is simple and repeatable. It is also one of the forces behind the stable influx of ETFs we are currently seeing.

Money is flowing through the ETF, but the price of Ethereum itself is not moving. It’s down this month. It’s basically flat for the past month. During that year, it fell 25%. It’s not a small drop. Ethereum suffers from its identity. Revenues have been declining since the last major upgrade. Solana has achieved her position. Traders don’t know what the long-term value of Ethereum will look like any more.

There is also macro pressure. This year is full of geopolitical noise, which keeps volatility high throughout the cryptography. In March, Standard Chartered cut its Ethereum price target by more than half. Still, the bank said there is still a chance that the coins could recover by the end of the year. The recent ETF inflow spikes have already slowed down, but they have not turned back.

Bitcoin momentum adds fuel to Ethereum demand

While Ethereum catches up, Bitcoin is doing what it always does. Market movement. After hitting an all-time high in May, Bitcoin has dropped by 10% over the next nine days. Now it’s almost completely recovered.

Rebound is driven by institutions, policies and market structures. The IBIT ETF has already reached $70 billion in assets in just 341 days. This is more than five times faster than the SPDR Gold ETF record.

There is also a clear setup on the chart. The weekly Bitcoin futures chart has been rising since the second half of 2022. One important metric, the true range of average percent (APTR), shows how much the price moves over time under the percentage condition.

Currently, the 10-week APTR is 8.5%. It’s low and usually happens just before a breakout. Bitcoin was launched more expensively with each APTR dropping to around 9% or 7%.

On the daily charts, APTR has hovered between 3% and 4% over the past 10 trading sessions. It’s another low reading. Bitcoin is testing a third resistance level of $110,000. Some traders are looking for a breakout with Fibonacci targets set at $135,000.