Ethereum (ETH) was closed in August with a strong memo, earning over 23% in 31 days.

The major Altcoin appears to be poised to expand the rally in September. On-chain data shows a surge in market confidence in its short-term performance, as well as a decline in sales.

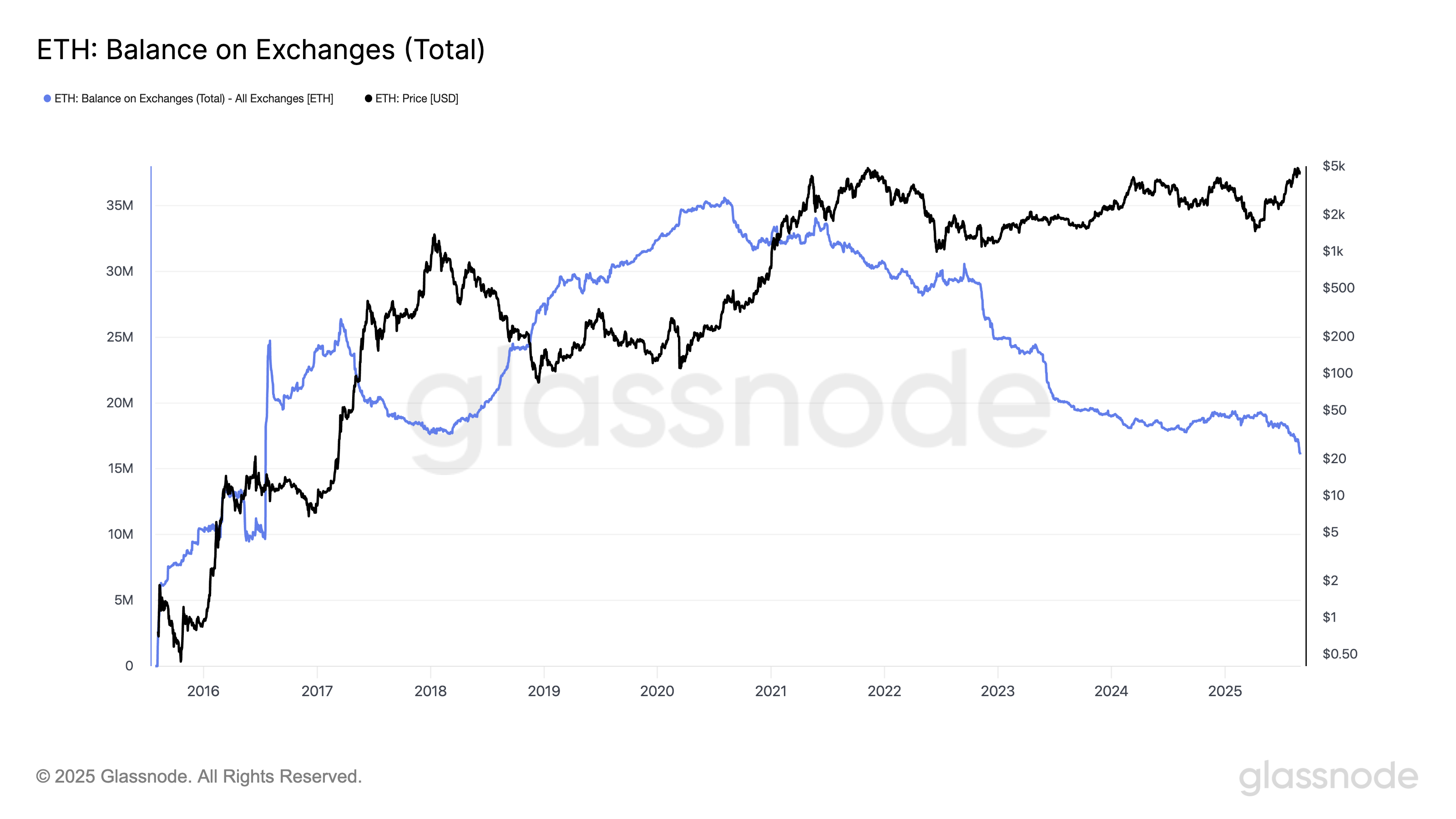

Ethereum Exchange balance is crashing up to 2016 levels

According to GlassNode, the total amount of ETH held in Exchange addresses has fallen to its lowest level since 2016. At the time of writing, 16 million ETHs are held in Exchange Wallet addresses, worth approximately $70.377 billion.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Exchange ETH Balance. Source: GlassNode

The decline in the exchange balance suggests that investors are moving their holdings to private wallets rather than keeping the shift, a shift associated with lower sales pressures, on trading platforms.

If there are few coins that are readily available for sale, a supply throttle will be created that will improve the momentum of the upward price when demand is strong.

In the case of ETH, this pattern reflects a growing confidence among holders who appear to be more likely to hold coins in anticipation of new benefits, reinforcing the possibility of sustained gatherings this month.

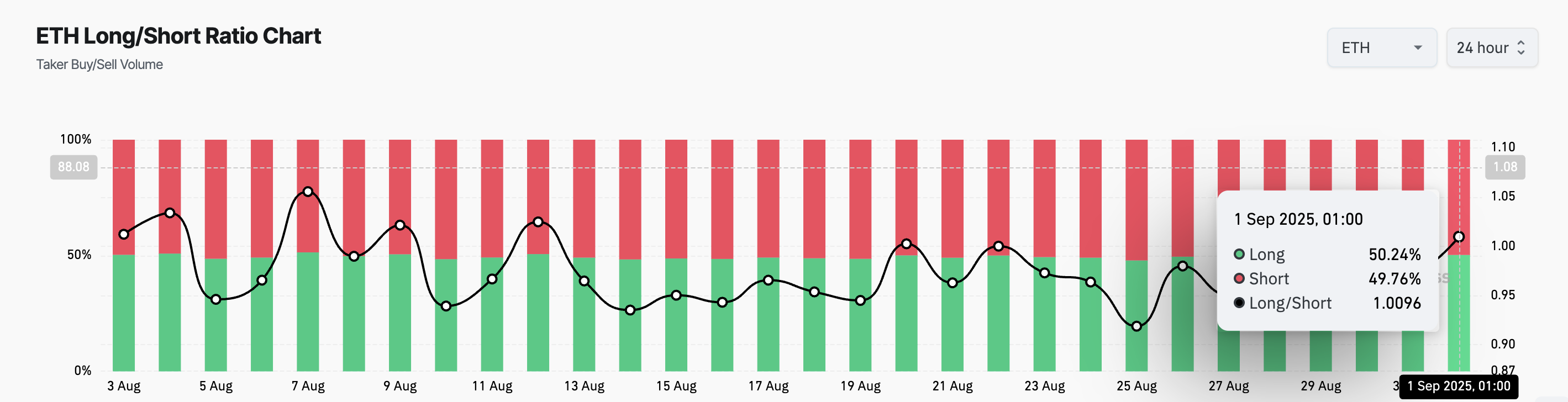

Furthermore, the rising long/short ratio of the coin supports this bullish outlook. According to Coinglass, this ratio is currently at 1.0096, indicating that more traders are now beginning to acquire longer positions than shorter positions.

ETH long/short ratio. Source: GlassNode

A long/short ratio measures that the percentage of people expected to increase (longer) asset prices decrease (short). A ratio above 1 indicates that long positions outweigh the shorts and show stronger bullish emotion, while a ratio below 1 indicates bearish domination.

ETH’s climb ratio highlights the growing inclination towards optimism among market participants. This suggests that traders are increasingly confident in the coin’s ability to maintain an upward trend over the coming weeks.

Pullback to $5,000 out of reach or $4,221?

If buy-side pressure continues to rise, ETH can attempt a breakout that surpasses immediate resistance at $4,664. This level of successful violation will pave the way for an all-time high of $4,957.

The sustained bullish domination could be increasingly likely to surpass the $5,000 mark.

ETH price analysis. Source: TradingView

However, this bull projection can be ineffective if demand slows down. In such a scenario, the coin price would be increased to $4,211.

Post Ethereum Exchange Holding reached its lowest level in nine years as the $5,000 breakout loom first appeared on Beincrypto.