Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

The soccer price for the Lion and Player is soft. I hate each of my arcu lorem, ultricy kids, or ullamcorper football.

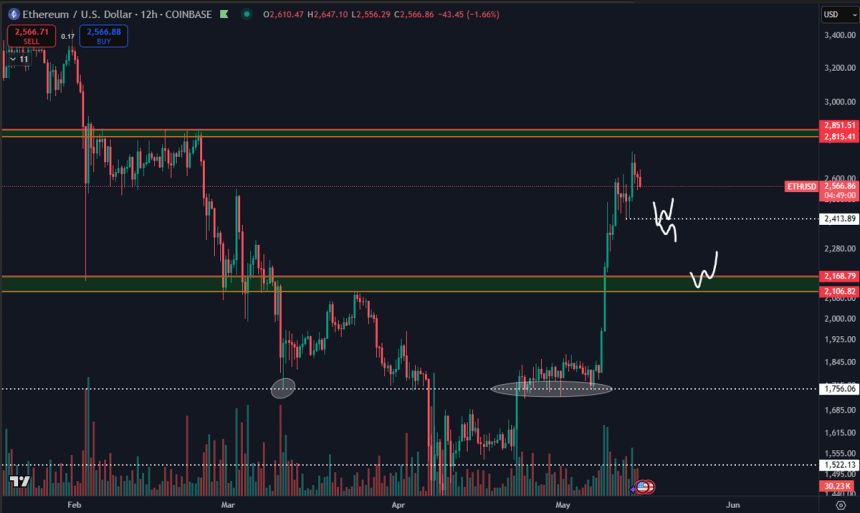

After days of intense buying pressure and strong bullish momentum, Ethereum finally suspends the rally and finds a $2,740 resistance. The move comes after ETH easily cleared key resistance levels at $2,000 and $2,200, marking one of the most powerful short-term performances in a few months. As excitement builds across the broader crypto market, Ethereum’s next move could define the strength and sustainability of this breakout.

Related readings

With prices stalling, analysts believe there is likely and perhaps even necessary for a consolidation before the next leg rises. Top analyst Dern shared a technical view that suggests that the $2,400 level will be extremely important in the coming days. He believes it makes sense to retest that local support.

However, Daan also points out a warning signal. It is a very high level of open interest throughout the ETH derivatives market. He is currently avoiding long positions until some of that leverage is flashed out, reducing the risk of a sharper pullback. For now, Ethereum Bulls While traders wait for clean conditions for a potential re-entry, they must keep at least $2,400 to check strength and keep the uptrend intact.

Ethereum’s surge faces a critical retest of around $2.4,000

Ethereum has skyrocketed over 50% since last week, regaining momentum after months of intense sales pressure. ETH is showing sustained strength for the first time since late December, promoting optimism that the broader Altcoin market could become next. Many analysts are looking for AltSeason, and Ethereum’s breakout is seen as a potential catalyst for larger movements across Altcoins, which have been performing badly in recent years.

However, after such a sharp movement, periods of integration and revision are not uncommon, and even healthy. According to Darnthe $2,400 level will be an important support zone to watch. He believes it makes sense for prices to test this area before continuing further. Dern is currently not interested in entering a long position until some of the billions of open interest are washed away from the system. How Ethereum responds can be about 2.4kk set the tone for the next phase.

When ETH swepts $2.4k and bounces straight away, Daan expects the local range to form between $2.4k and $2.7k. However, if the price is decisively lost that level, the next major support will be at $2.1k. Slow spills into that zone can indicate debilitating, but a simple flash can provide short-lived purchase opportunities.

Despite the short-term risks, Daan says that even a pullback to $2.1k will keep ETH at around 20% from the previous week. In his view, the larger trading range today is between $2.1k and $2.8k. This is the zone where Ethereum can define the next major trend if the Bulls can hold key levels and regain momentum. For now, Larry is alive, but the next test is important.

Related readings

Price integration occurs amid optimism

Ethereum (ETH) is currently trading at around $2,565 and is receiving a sharp pullback of nearly $2,740 from the recent local high. After a strong rally above both the 200-day Exponential Moving Average (EMA) and the Simple Moving Average (SMA), the price is consolidated at $2,702.93 just below the 200-day SMA. This level has served as resistance in the last few sessions, thwarting Ethereum’s attempts to continue its upward momentum.

Volume has dropped slightly, reflecting the market’s indecisiveness after last week’s breakout. If the Bulls can bring their 200-day EMA closer to $2,437 and maintain a higher low above $2,500, the structure will remain bullish. However, failing to hold these levels could lead to deeper pullbacks at $2,400 and $2,200 as potential support.

Recent price action suggests that Ethereum forms a short-term range between $2,400 and $2,700, and could last until a clear breakout that surpasses the 200-day SMA. Over $2,500 is important to maintain bullish momentum, especially as the Altcoin market eye becomes more profitable.

Related readings

If ETH can push more than $2,700 with a strong volume, check for updated strength and pave the way to a resistance zone of between $3,000 and $3,100. Until then, integration and attention dominate the short-term outlook.

Dall-E special images, TradingView chart