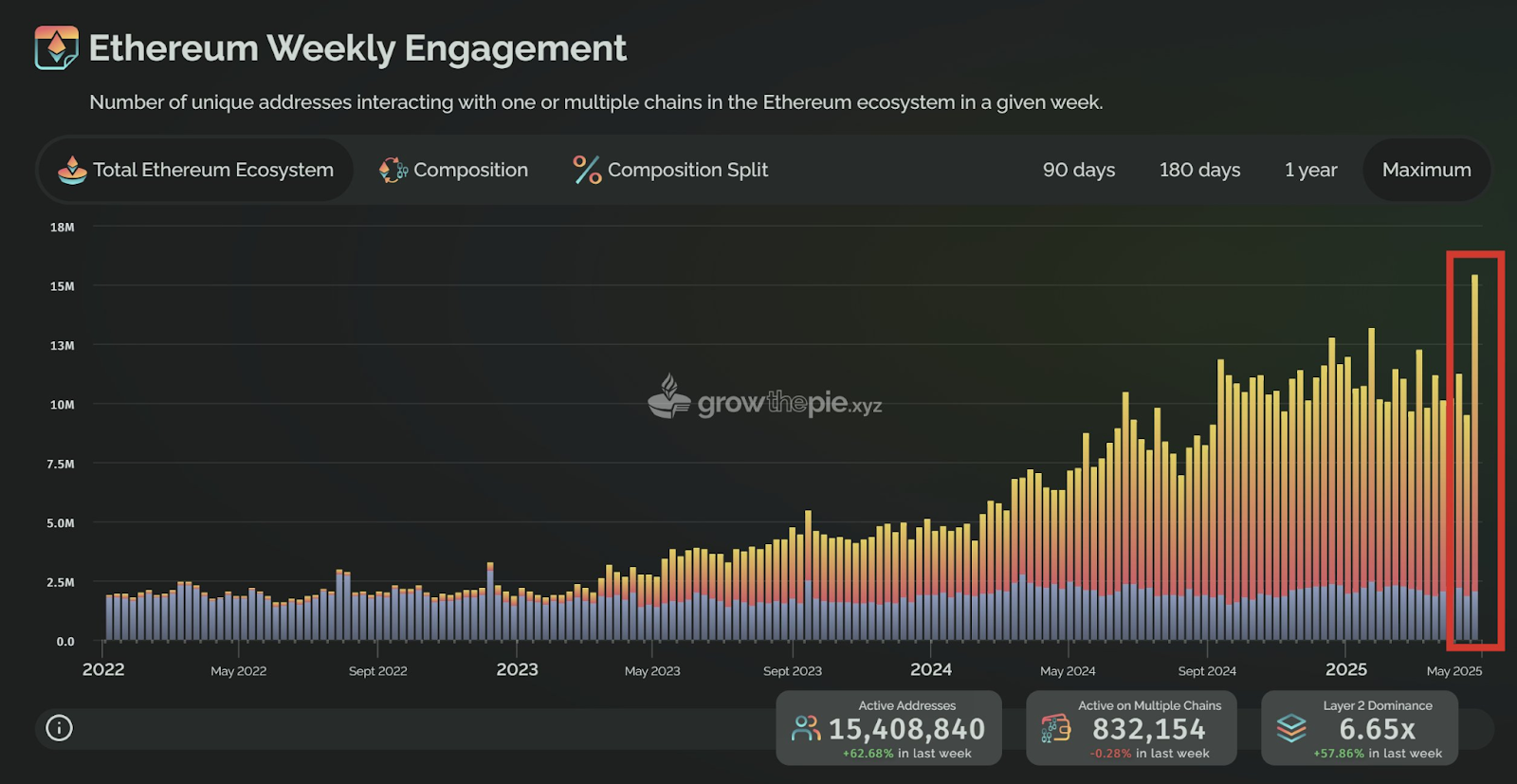

The Ethereum Ecosystem recorded the most active addresses, reaching 15.4 million people in a week. Surges are driven primarily by layer two-strand activities such as bases and unicanes.

Layer 2 network explains most of Ethereum activity

According to on-chain data shared by analyst Leon Waidmann, Ethereum-compatible chains saw 62.7% jumps per week at active addresses. Layer 2 networks now handle 6.65 times more transactions than Ethereum MainNet.

Related: Why Zksync founders believe that Ethereum’s true strength lies in staying neutral

Ethereum’s modular design pushes most user activity into a layer 2 chain, primarily using the mainnet for payments, allowing the ecosystem to scale without compromising security.

Unichain and Base Outpace Ethereum MainNet MainNet User Growth

Of all tracked Ethereum Virtual Machine (EVM) chains, Unichain reported the highest number of active addresses of 5.8 million. This figure accounts for 39.26% of the total, which is noteworthy given that Unicane is only two months old.

Base, another layer 2 chain developed by Coinbase, continued closely with 4.76 million active users, or 32.21% of the total. Both chains outperformed the Ethereum mainnet, which recorded 2.06 million active addresses, representing 13.94% of ecosystem activity.

These numbers indicate the accelerated shift from the Ethereum mainnet to the Layer 2 alternative. Users are looking for faster transactions and fee reductions that these networks are designed to provide.

Cross-chain activity indicates increased interoperability

In addition to the growth of users, the ecosystem is interconnected. The OP mainnet led all chains of cross-chain activity, with 42.2% of its addresses interacting in multiple chains. Arbitrum One continued at 29.6%, with gravity and ink recorded over 25% each.

This data highlights Ethereum’s successful strategy in scaling modular architectures. Rather than just upgrading the base layer, Ethereum has made it possible to share workloads with the thriving ecosystem of Layer 2 networks.

These developments support Ethereum’s long-term vision of becoming a scalable, decentralized global payments layer. The rise of emerging chains such as Soneium, Gravity and Taiko Alethia suggests continuous innovation and diversification in this space.

Critics question the reliability of metrics

Although the numbers are noteworthy, some market observers have raised concerns about the quality and implications of the data. William Peets commented that the 62% surge in active addresses is unlikely to be completely organic.

“I think the ethereum ecosystem is in good condition,” Peats said. “But presenting these types of statistics as evidence of something will only reduce reliability.”

Related: Four times more gas limits than Ethereum in Fusaka upgrades: Report

Other community members reflected skepticism, arguing that “active addresses” may not be a reliable indicator of meaningful user growth. One commenter said, “Active addresses are a scary metric. Solana can’t believe it. Ethereum can’t believe it.”

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.