Ethereum ended October with limited price growth as long-term holders (LTH) significantly reduced their positions, causing bearish pressure across the market.

As November begins, the market is waiting for signs of renewed confidence among ETH holders.

Ethereum holders express skepticism

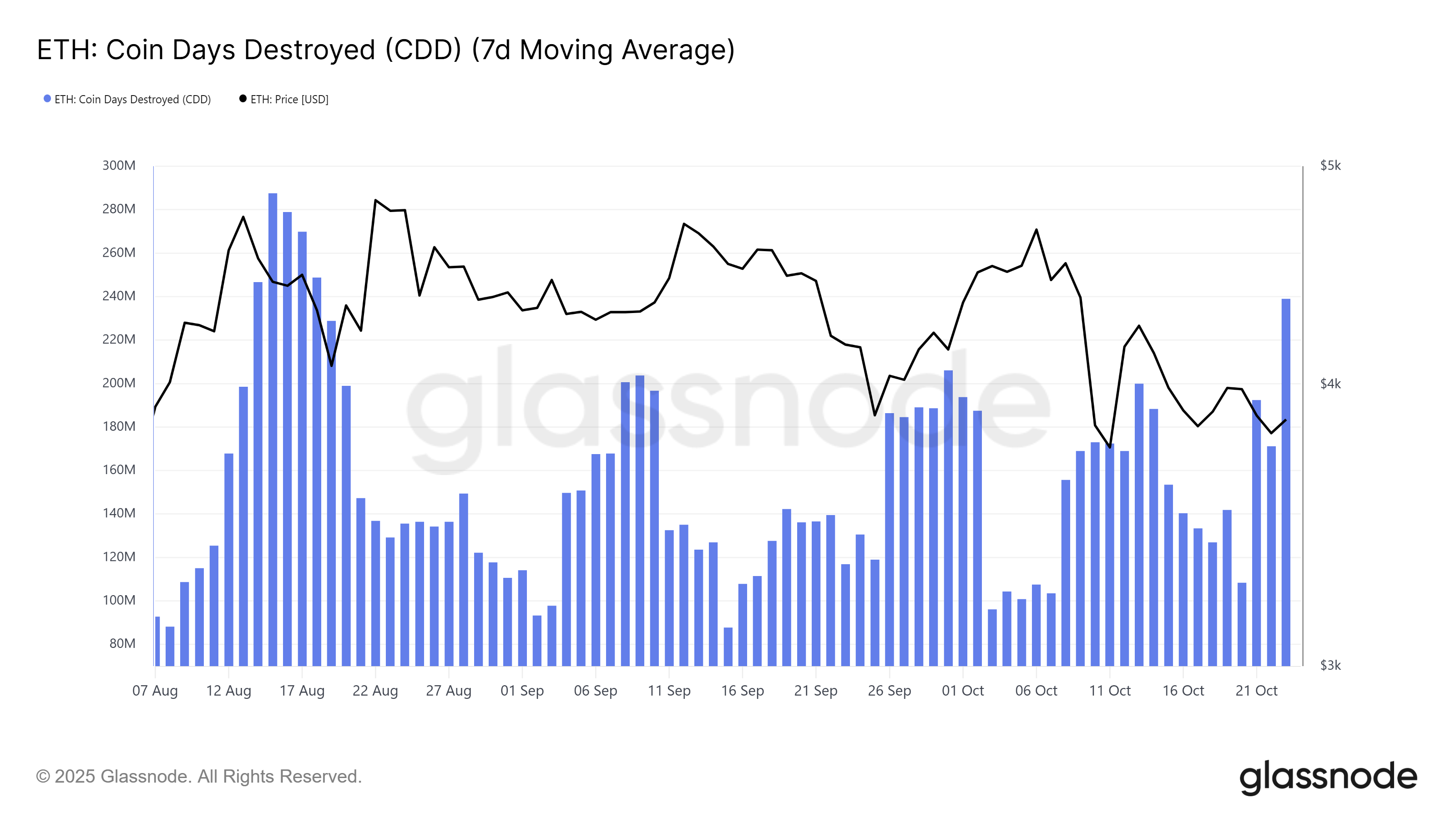

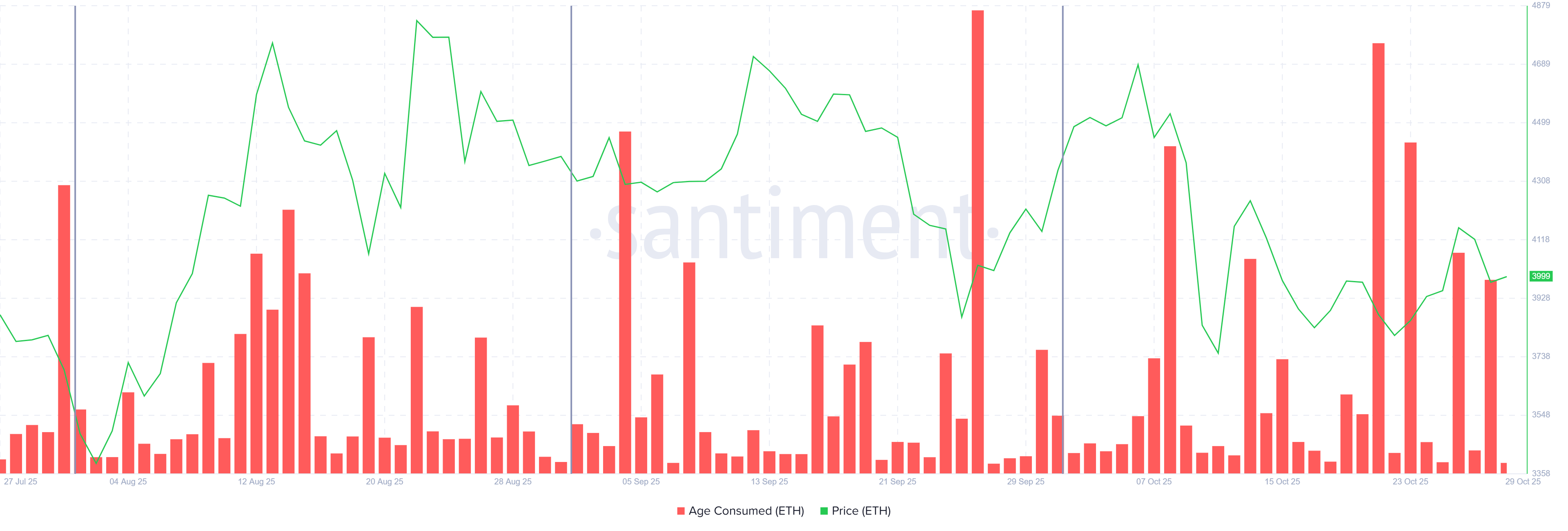

The Age Consumed indicator reveals that October saw the largest wave of activity among long-term Ethereum holders since July. A spike in the indicator indicates that older coins have been moved or sold, and often indicates increasing selling pressure from experienced investors. Cumulative activity in October far exceeded activity in the previous two months, highlighting a notable lack of belief among LTHs.

This surge in selling reflects growing uncertainty about Ethereum’s near-term performance. Many holders appear to be taking profits amid the stagnant price movement, which is likely contributing to the lack of upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum CDD. Source: Glassnode

On-chain data shows that Ethereum’s network activity follows a similar pattern. The number of new addresses rose steadily through most of October, but dropped sharply in the final week.

The decline highlights near-term market fatigue, suggesting that prices have failed to rise decisively and investor interest has waned. However, this slowdown may be temporary. Liquidity could once again flow into Ethereum once new addresses and network participation are restored in November.

Ethereum consumption age. Source: Santiment

ETH price needs investor support

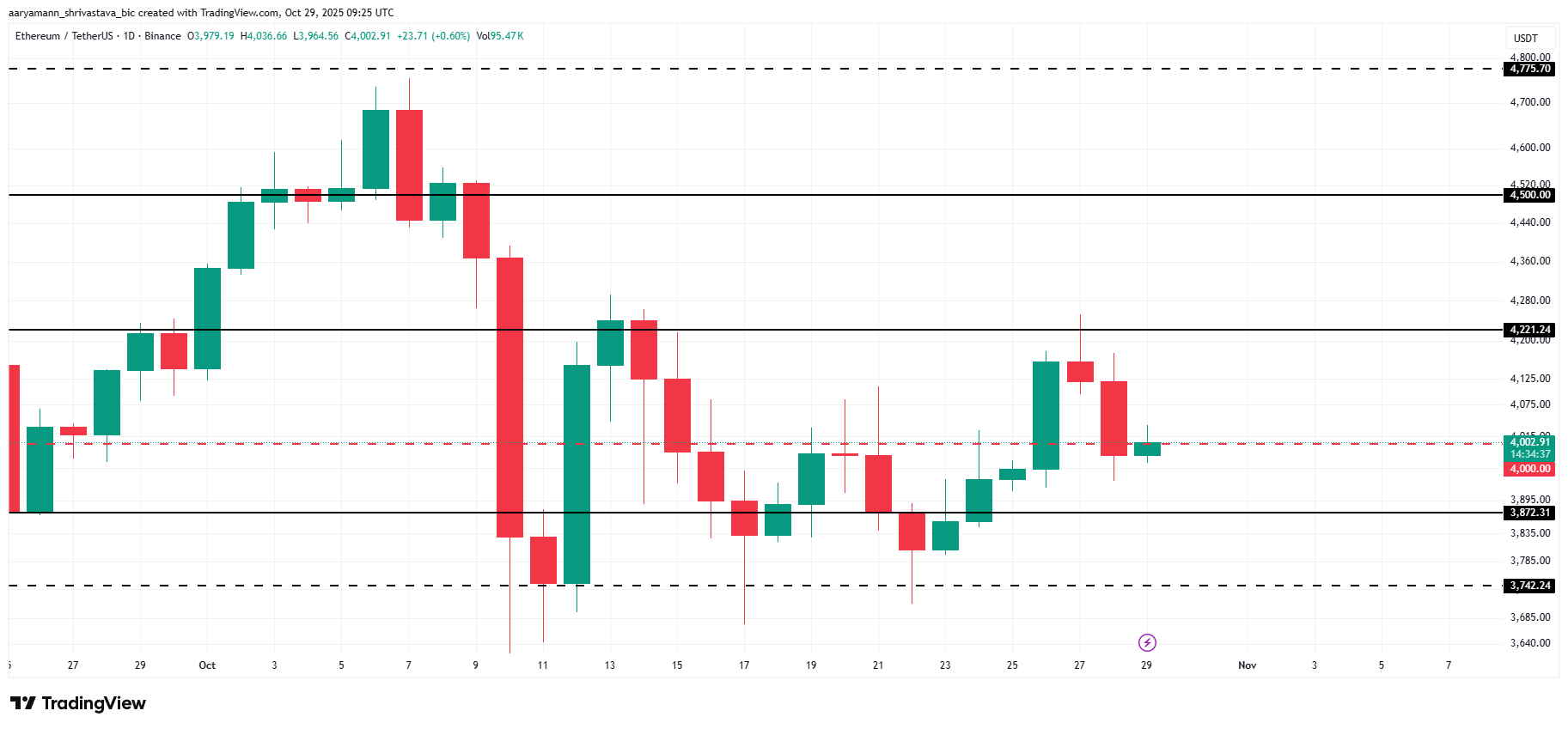

At the time of writing, Ethereum price is $4,002, and has remained in a narrow range around the psychological $4,000 level for almost three weeks. The inability to regain higher levels highlights the impact of continued selling and weak investor confidence.

In the short term, ETH is likely to test the $4,221 resistance level. However, absent stronger market conditions, it could remain trapped between that resistance and the support at $3,742.

ETH price analysis. Source: TradingView

If the broader environment improves, Ethereum could break above $4,221 and target $4,500. A continued rally towards the all-time high of $4,956 would invalidate the bearish outlook and restore market optimism.

The post October’s Ethereum LTH sales hit 3-month high — what’s the next price? The post appeared first on BeInCrypto.