Ethereum continues to be traded above the $2,700 level and is showing signs of new strength as it has recently reached $2,790. Price action is energizing the market, and many analysts are now hoping for a major breakout that could not only lift ETH more, but also trigger the much-anticipated Altseseason.

Bitcoin has led the rally for most of the year, but Ethereum appears to be catching up. According to top analyst Daan, ETH Spot Premium remains solid and shows sustainable demand even in the absence of ETF level inflows. “There’s not as much ETF influx as BTC,” Dern pointed out.

This relative strength, combined with the optimistic growth around Altcoins, encourages speculation that Ethereum can be tested immediately. As emotions turn bullish across the market and ETH gains momentum, not now, all eyes can go past key resistance and lead charges to a wider altcoin breakout. As Ethereum sets the tone for the next phase of its crypto market expansion, the coming days could prove crucial.

Ethereum is facing a pivotal moment, and tests critical resistance

Ethereum is currently facing what many analysts consider to be the most important level of resistance in the current cycle. The $2,700-$2,800 zone has become the battlefield for ETH’s next major move. A successful breakout could lead to a run to an all-time high, but rejection could lead to a healthy, but deeper redeployment.

Global macro conditions add weight to this moment. The US Treasury yields and sustained rising inflation continue to rattle traditional markets, increasing systemic stress. However, in this uncertain environment, Ethereum and Bitcoin are showing resilience, suggesting that investors are increasingly seeing them as alternatives or hedges against traditional financial risk.

Dern shared insights that reinforce this bullish outlook. His analysis shows that ETH Spot Premium remains solid despite the lack of ETF-driven influx seen in Bitcoin. ETH does not require much inflow compared to market capitalization to maintain its bullish momentum.

However, the $2,800 level remains a major barrier. This represents a significant inflection point in Ethereum’s price action and overall market sentiment. The next few days will be very important as Ethereum’s ability to break this resistance or be rejected could shape the direction of the Altcoin market for the rest of the quarter.

ETH Price Analysis: Testing Key Liquidity Levels

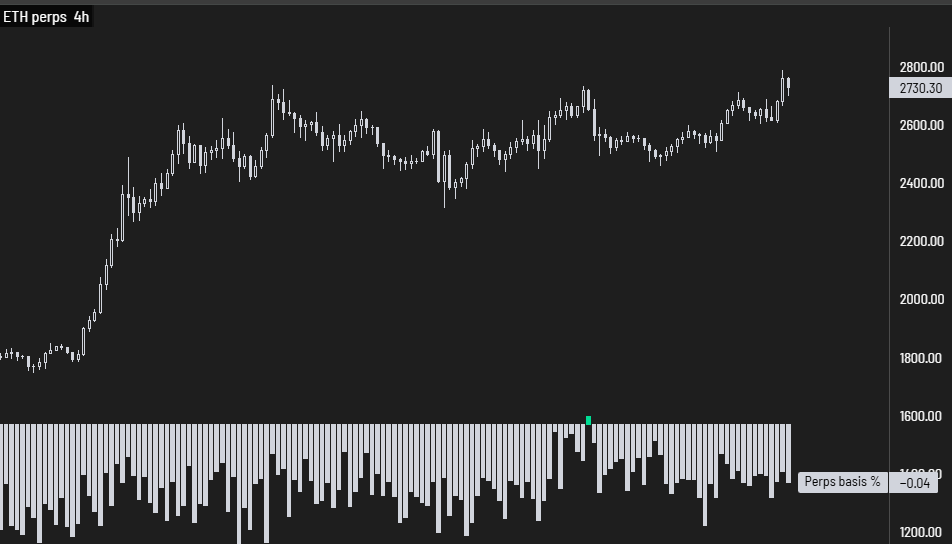

Ethereum is currently trading at $2,731 on the four-hour chart and shows strong bullish momentum as it tests its resistance level of $2,800. Between the weeks of consolidation between $2,500 and $2,700, ETH broke with confidence, resulting in an increase in the average and volume of higher movements. The $2,622-$34 EMA and $2,598-$50 SMA continue to serve as dynamic support, confirming the strength of the uptrend.

This breakout attempt follows a long period of compression where ETH has built a higher and lower base. Prices are now surged to challenge major zones of resistance that have historically reduced upward momentum. When the Bulls flip this level to support, they can open the door to sharp movements heading towards over $3,000.

Volumes featured the latest push. This is a positive indication that buyers are stepping in with more confidence. Still, traders need to monitor potential rejections and profits in this key zone. If Ethereum breaks beyond $2,800 and can’t hold it, it could be followed by a short-term pullback to 34 EMA.

Dall-E special images, TradingView chart