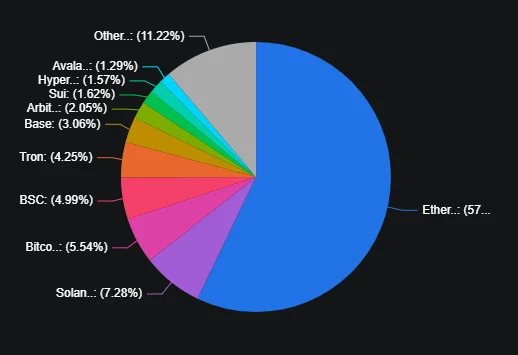

This week’s Defi multi-chain story is one of both integration and diversification. According to data from Defilama on July 12, the 10 blockchains that lock the most capital have a total of more than $114 billion (TVL), with Ethereum alone making up almost two-thirds of that total.

Ethereum’s TVL has grown nearly 11% behind the unlocked staking rewards from Shanghai upgrades, but capital has also flowed into high-speed networks and roll-ups, demonstrating the reality of Defi’s evolved multi-chain. From Bitcoin’s growing surrender device to the emergence of new tier 2 candidates, this week’s figures reveal both the enduring influence of old chains and the growing appeal of next-generation platforms.

Ethereum and Layer 1 Heavyweight

This week, Ethereum once again declared its hegemony in decentralized finance, with its total value rising by around 11% to around $72.1 billion. Much of that influx comes from updated activities in lending platforms and automated market manufacturers following the upgrade in Shanghai.

The Bitcoin defi ecosystem, powered primarily with wrapped BTC equipment and BTC page pools, shows that TVL has risen from around 11% to $6.9 billion, indicating that Bitcoin is no longer a valuable storage, but an increasingly active and active yielding asset.

Meanwhile, BNB Smart Chain (BSC) added about 4.5% ($6.2 billion, lifting TVL to $6.2 billion) as an attractive yield on BSC denial amms and fresh bridge sediments from other networks. Tron also booked profits of 11.4% each week, and currently holds $5.3 billion, thanks to an expansion of the lockbottom fee and USDT-backed liquidity pool.

layer -2 rollups and emerging candidates

Beyond Big 3, numerous Layer 2 solutions and alternative chains carve out the niche. Solana recorded a 7.4% increase to around $9.1 billion thanks to high-throughput DEX activity and its splate of new lending protocols over its fast, low-cost network. Coinbase’s base rollup was impressed by its 11.6% profit each week, bringing TVL closer to $3.9 billion.

Other notable performers include Arbitrum (only 0.9% to $2.5 billion of slips), Avalanches (+7.9% to $1.6 billion), Polygon (+1.4% to $1.1 billion), and Op Mainnet, leading the pack with a 16.1% jump, closing the top 10, collectively highlighting its Defi future.

As the capital continues to fade and flow between layer 1 behemoths, roll-ups and alternative networks, keeping an eye on these 10 chains remains essential for those tracking who are having the most exciting defi innovations and the deepest liquidity pools happen.