Bitcoin (BTC) volatility below $110,000 has raised questions about whether the asset is destined for further losses, but historical data suggests otherwise.

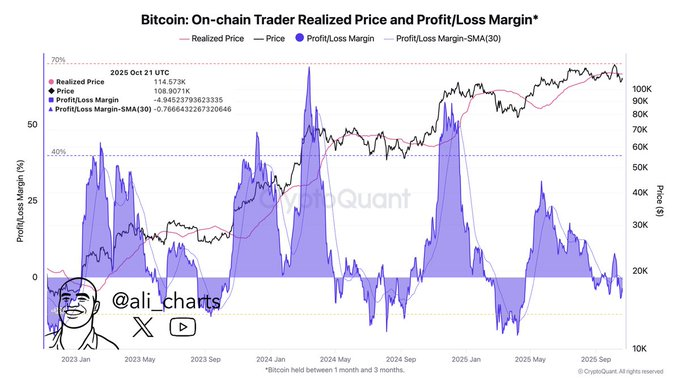

According to on-chain data shared by analyst Ali Martinez, the profit margin for Bitcoin traders currently stands at around -5%. According to historical patterns, when this margin falls below -12%, cryptocurrencies tend to rebound strongly, marking the end of a major downtrend.

Martinez data, taken from cryptoquant The stock price was significantly negative on October 22nd, indicating widespread unrealized losses among short-term holders, which have historically coincided with cyclical bottoms in Bitcoin prices.

Each case, including 2019, 2020, and 2022, was preceded by a critical recovery phase.

Meanwhile, Bitcoin’s realized price (the average price at which all coins were last moved on the chain) remains below the spot price, meaning the vast majority of investors are still making profits. This suggests that the market has not yet reached the level of widespread capitulation seen at past bear market lows.

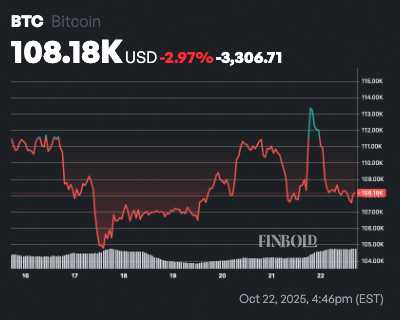

This encouraging data comes as Bitcoin has lost $110,000 levels in the past 24 hours, with the entire market suffering losses amid profit-taking. However, in the short term, technical indicators suggest that BTC is not out of the woods yet.

Bitcoin could fall to $100,000

For example, a pseudonymous cryptocurrency analyst Bitbull noted in an October 22nd X post that Bitcoin has fallen below the weekly bull market support band around $110,000, a technical zone that has recently become a key indicator of trend strength.

As it stands, Bitcoin’s next key objective remains a retrieval of the $110,000 resistance. However, a fall towards $105,000 could open the door to further losses towards the $100,000 level.

Featured image via Shutterstock