Ethereum expanded the rally to a new all-time high of $4,960, but the momentum began to fade. The divergence of RSI’s bearish suggests that unless buyers lose strength and ETH is convicted and can regain its high, they may be increasing the risk of a correctional phase.

Technical Analysis

By Shayan

Daily Charts

On the daily charts, ETH recorded a slightly higher ATH, slightly higher than its previous peak. However, the RSI was unable to create new highs, forming a bearish divergence that reflected the decline momentum.

This was followed by the assets being pulled back to the midline of the rising channel, finding support in areas currently between $4,400 and $4,450. If this level is maintained, ETH can be integrated before another retest of the 4.9K zone. Conversely, a breakdown below $4,400 exposes the 4K dollar support range.

Overall, Ethereum trades within tight and dynamic ranges, and decisive breakouts in either direction can cause impulsive movements.

4-hour chart

In the lower time frame, ETH recently performed a liquidity sweep of over $4.8K, but that turned upside down sharply. This denial coincided with its distribution in the Bitcoin market, confirming short-term fatigue in majors.

Ethereum then went back to the $4.4K Fibonacci cluster (0.618–0.702 retracement), and is now outweighing trendline support. This confluence zone is an important battlefield. Over $4.4K could drive a retest of $4.9K high, but losing this level could open the door for a deeper fix towards 4K.

On-Chain Analysis

By Shayanmu

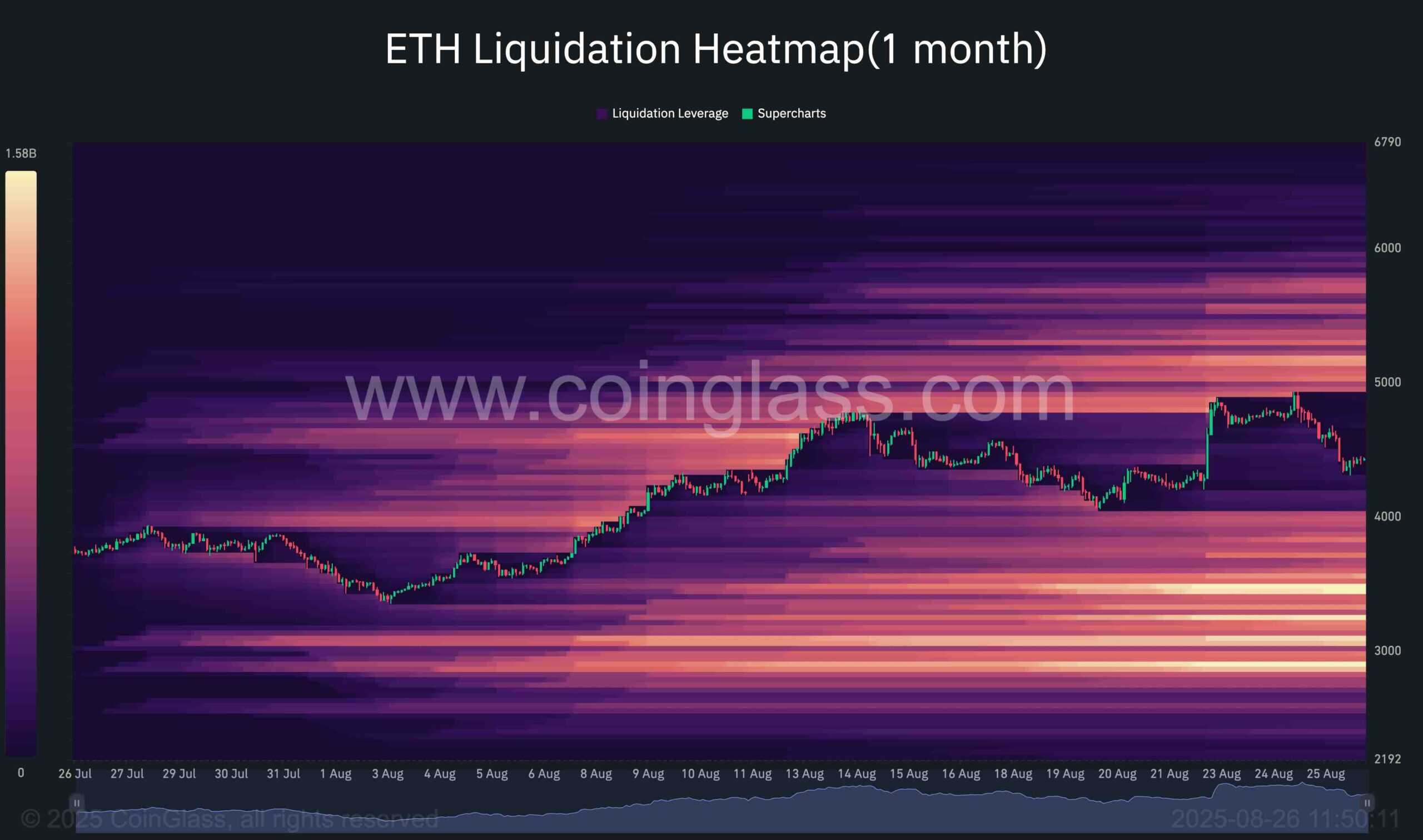

Ethereum experienced extreme volatility in August, with a similarly aggressive reversal following a rapid rally. The liquidation heatmap sheds light on where long and short positions of leveraged length are clustered, highlighting the level of functioning as a liquidity magnet for price action.

During the surge to $4.9,000, ETH caused a dense cluster of short liquidation, wiping off aggressive sellers. However, subsequent sharp rejection showed fatigue at those highs, trapping slow buyers in the process.

Currently, the heatmap reveals two important liquidity zones.

- Rise: Over $4.9k, untested short liquidation remains stacked, bullish momentum regains strength and provides magnets.

- Disadvantages: under $4K. If $4.2K support is not retained, a dense cluster of long liquidation can attract price action.

Currently, ETH is integrated within a liquidity-driven range of between 4.2k and $4.9,000. With large liquidity pools on both sides, the market remains extremely vulnerable to sharp and leveraged fuel movements as liquidity hunts continue to dominate short-term dynamics.