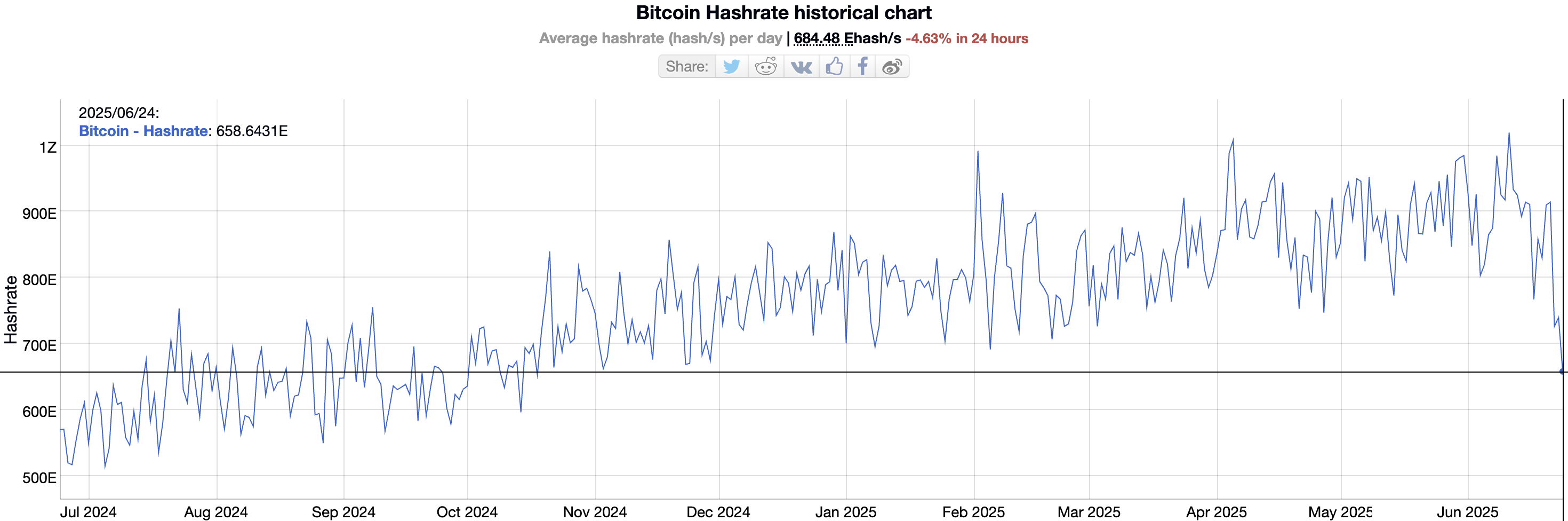

Bitcoin’s average daily hash rate has fallen to a low of 684.48 EH/S since mid-October last year, according to data from BitinFocharts.

This decline from the peak of 966 EH/s on June 20, 2025 raises important questions. Is this an opportunity or risk in the cryptocurrency market?

Hashrate has decreased, but not at the lowest

Bitcoin’s current hash rate has fallen to a low level, but is much higher than the 379.55 EH/S recorded in July 2023. This ensures that the Bitcoin network is somewhat secure.

Bitcoin hashrate. Source: BitinFocharts

The main cause of this decline may be related to a surge in Bitcoin mining costs. Bitcoin mining costs increased by more than 34% in the second quarter of 2025 when the hashrate reached a new high, as previously reported by Beincrypto. Increased power prices and hardware and maintenance costs have forced many miners to stop operations to avoid losses.

Furthermore, energy saving programs are contributing to hashrate reductions as some mining farms are taking part in grid load reduction initiatives. Or the war in Iran also contributed to this decline.

“Listen, ‘I know the hashrate is down because Iran was bombed’ is a great meme, but when you actually minify Bitcoin, we’re looking at the weather patterns. ” X user Robwallen shared.

The Bitcoin market remains prominently stable despite current hashrate situations. Bitcoin’s price is currently at $106,000, indicating positive investors’ sentiment.

Bitcoin ETFs, particularly BlackRock, with $70 billion in managed assets (AUM), continues to strengthen its trust in Bitcoin as a safe inventory asset, even as the US stock market plummets. This reflects the growing separation between Bitcoin and traditional financial markets.

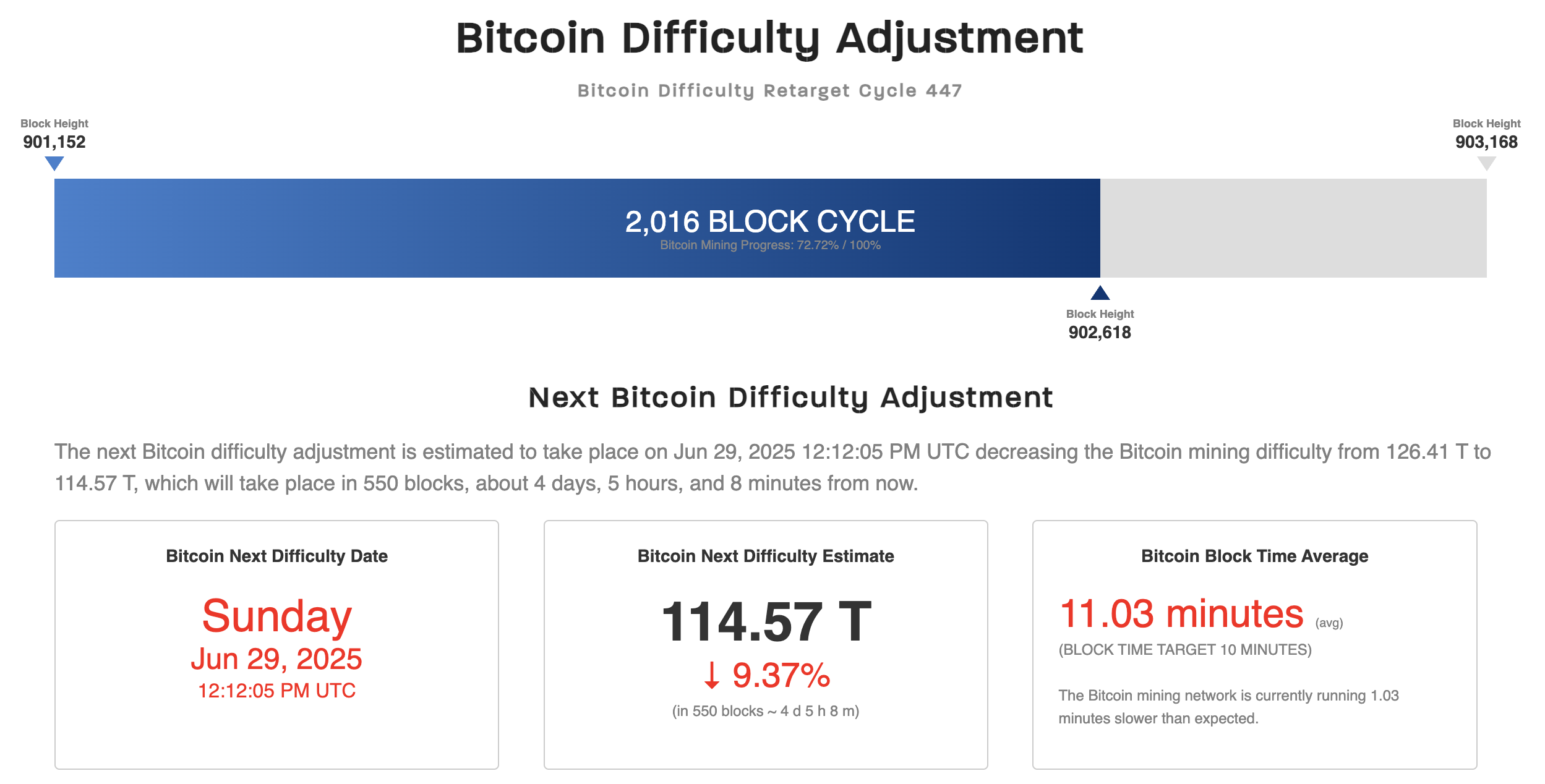

The difficulty of Bitcoin mining is expected to decrease by 9.37%

Another important factor is the future mining difficulty adjustments scheduled for June 29th, 2025. According to Coinwaltz, the difficulty level has dropped from about 126.41 T to 114.40 T, a decrease of about 9.37%.

The difficulty of bitcoin mining. Source: Coinwarz

This is an opportunity for miners. Lower difficulty will increase profits and encourage you to return to the network. However, if the hashrate does not recover in time, the Bitcoin network could face slight security risks, but the current 684.48 EH/s level is sufficient to protect the network from 51% attacks.

A lower hashrate can be a positive signal in the long term, as it weeds inefficient miners. At the same time, Bitcoin’s stable price is $106,000, coupled with the growth of ETFs, indicating that the market still believes in the potential of Bitcoin.

However, the risk remains. If the hashrate drops further and difficulty adjustments do not occur in time, selling pressure from miners could potentially lower the price of Bitcoin. Furthermore, macroeconomic factors such as geopolitical tensions and Fed interest rate policies can affect the crypto market.