Bitcoin BTC$103,508.20 It has retreated significantly from all-time highs, weighing on the entire market, including Ethereum, and is facing a difficult few weeks. Ethereum$3,526.49, XRP$2.3078Solana sol$162.78 And others.

However, there are compelling reasons to expect cryptocurrencies to rise above the all-important $100,000 level this week, tied to positive changes in the U.S. financial system that signal new risk-taking potential for investors.

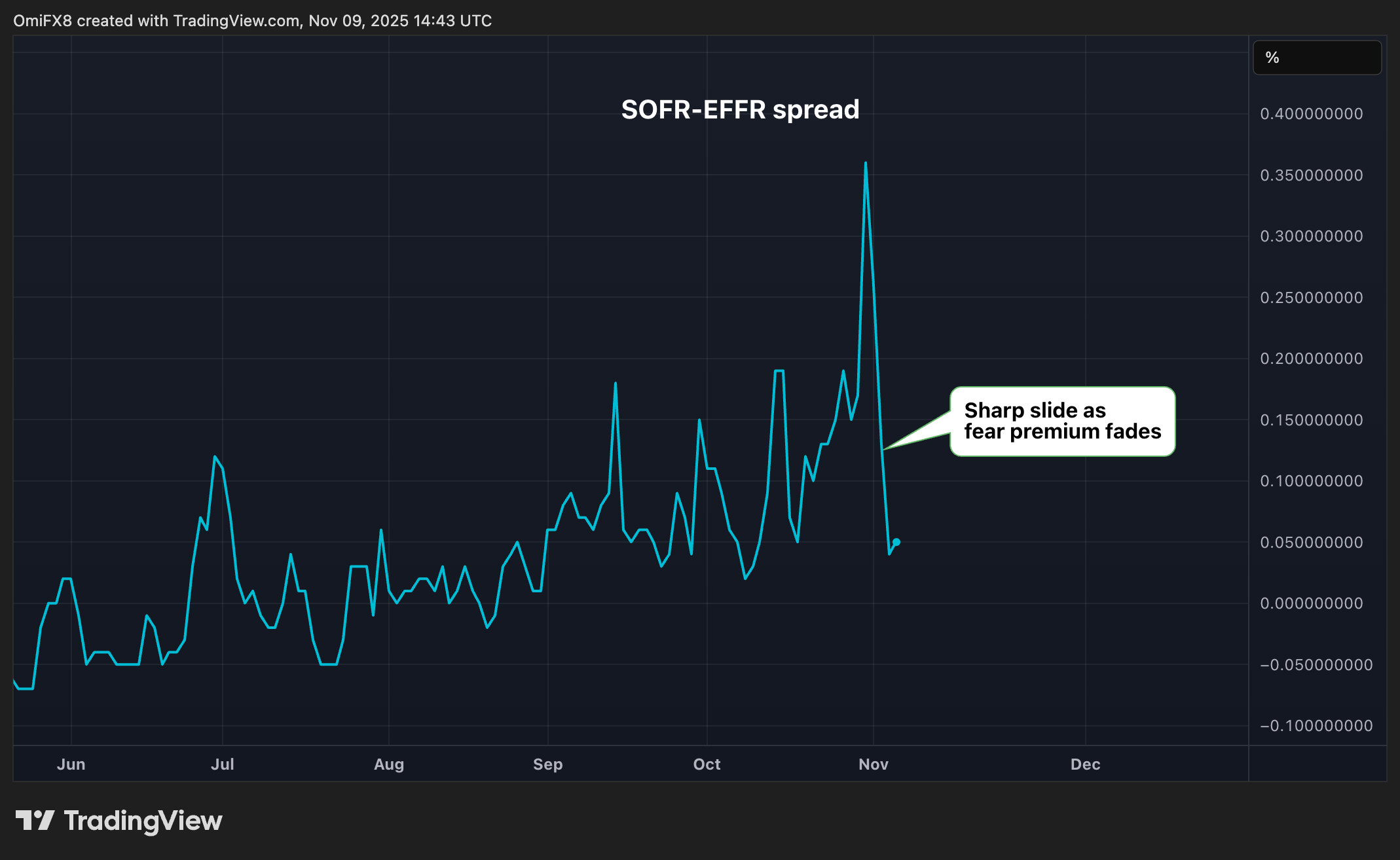

The focus of the discussion is the spread between SOFR and EFFR, which measures the dollar liquidity situation in the US banking sector. SOFR (Secured Overnight Financing Rate) is the overnight interest rate banks pay to borrow cash using U.S. Treasury securities as collateral. The effective federal funds rate (EFFR) is the interest rate at which banks draw their reserves against each other on an unsecured overnight basis.

The spread typically remains in a narrow range, but late last month it surged to its highest level since 2019, signaling stress in the financial system and tight liquidity. result? The dollar index, which tracks the dollar’s value against major fiat currencies, rose while Bitcoin plummeted, at one point topping the $100,000 level.

However, over the past few days, the SOFR-EFFR spread has dropped sharply from 0.35 to 0.05, eliminating that spike. This reversal suggests that financial conditions are easing. In other words, the fear premium is fading and liquidity is normalizing.

SOFR-EFFR spread. (Trading View)

All else being equal, this narrowing of spreads indicates a softening of financial conditions, which is favorable for risky assets like Bitcoin. And guess what, BTC is up at the time of writing, trading above $103,000, up 1.6% on a 24-hour basis, according to CoinDesk data. ETH, XRP, SOL, BNB rose 1.5% to 2.5% following BTC’s lead.

SRF borrowed slide, DXY rally stall

Other key indicators also point to easing liquidity stress. For example, bank borrowing from the Federal Reserve’s Standing Repo Facility (SRF), a key liquidity management tool, has returned to zero after hitting a record $50 billion earlier this month, according to ING data. Banks had borrowed billions of dollars through the SRF in response to temporary funding pressures.

At the same time, the dollar index’s rise has weakened due to resistance from the August high of 100.25, stalling its upward momentum. A fresh decline in DXY could bode well for BTC, which is seen as a hedge against dollar weakness and a proxy for inflation protection.

Daily chart of dollar index in candlestick format. (Trading View)

All of these factors combine to create a compelling case for Bitcoin and the broader crypto market to move higher next week.

Main risks

Watch for inflows into U.S.-listed spot ETFs after nearly $2.8 billion in outflows over the past four weeks.

If DXY rises above 100.25, the bullish outlook for BTC could collapse.