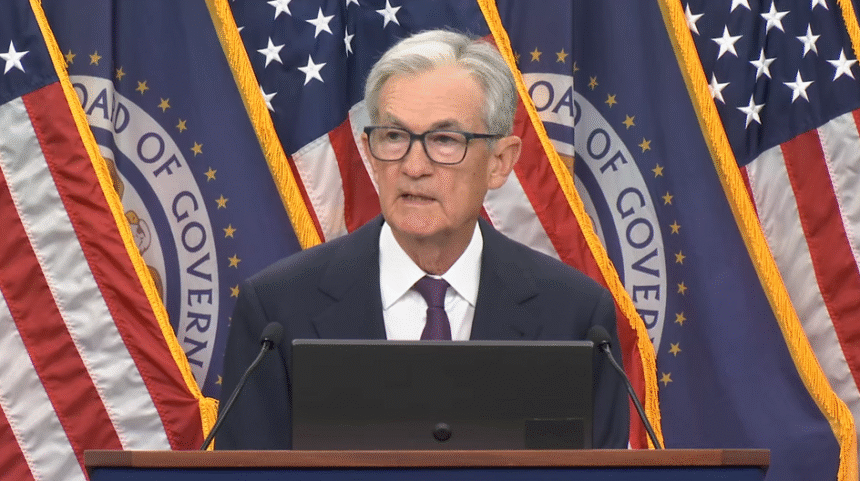

Federal Reserve President Jerome Powell defended the Federal Open Market Committee’s decision to cut interest rates by 25 base points. The scale places the target range from 4% to 4.25% per year, and the movement he described corresponds to the balance between inflation and employment risks.

“Today, the committee decided to lower the base rate at a percentage location and have decided to continue cutting securities,” Powell said in a later speech. He added that the Fed continues to focus on the double mission of maximum employment and price stability. And that the actions adopted will be justified by the slowdown in job creation and inflation rebound over the past few months.

Recent data shows GDP growth has eased to 1.5% in the first half compared to the recorded 2.5% last year. Consumer spending has lost strength, but business investments in teams and intangible assets have increased. Official forecasts are expected to grow at 1.6% in 2024 and 1.8% in 2025.

In the labor market, unemployment rates rose to 4.3% in August, with job creation falling to 29,000 locations a month on average over the past three months. Powell explained that some of the cuts will respond to reduced participation in duties. And slowing down labor growth. The Fed’s forecast points to an unemployment rate of 4.5% at the end of the year.

Annual inflation measured by the PCE price index was 2.7% in August, while the underlying component was 2.9%. These numbers are higher than those registered at the beginning of the year due to rising product prices. In contrast, service inflation maintains a downward trajectory. The median US Central Bank estimate stipulates that this year’s indicator will close by 3% and will drop to 2.1% in 2027.

Powell emphasized that the decision was adopted in the context of tension: the upward risks and employment hall of fame in inflation. “The downward risks to increase employment have changed the balance of risk, and as a result, we believe this meeting would be appropriate to take another step towards a more neutral policy position,” he said.

The market had already discounted the decision. According to a derivative of the CME Group platform, the probability of an annual reduction of 4% before the meeting reached 94%.

Bitcoin responds with volatility

The announcement revealed that Bitcoin (BTC) prices showed incredible volatility. Digital currency retreated from $116,000 in 114,900 minutes. He then regained the ground until he stabilized about $115,500 at the end of this report. Since then, the reaction has been unexpected Rate reductions are usually interpreted as a stimulus to market liquidityin theory, it supports alternative assets such as BTC.

Powell has repeatedly maintained its position as the Fed relies on data and adjusted its monetary policy as inflation and employment evolves. “We are in a position to respond in a timely manner to the potential for economic development,” he said. He also recalled that the forecast did not constitute a closure plan and that the monetary policy path would be subject to uncertainty.

Powell was already peering at the interest rate cuts. As reported by Cryptonoths, he did it in August during the tournament. At the time, I had already argued that the US labor market was in a “hard balance of curiosity” and that there was a slowdown in both the 4.2% unemployment rate and worker demand.

The executive also revealed during the meeting that more sales forecasts were made at interest rates for the rest of the year and since. He said there was an estimate of Prices start from 3.6% at the end of 2025, 3.4% at the end of 2026, and 3.1% at the end of 2027. He also said the trajectory was a fourth percent lower than the trajectory predicted in June.

However, he warned: “As usual, these individual forecasts are subject to uncertainty and not the committee’s plans or decisions.”