XRP attracted fresh attention after two well-known chart analysts outlined a bullish setup that could push the token much higher if current momentum applies.

Related readings

According to Javon Marks and Ali Martinez, there is a possibility of strong moves as there are straddles of technical signs, but traders are seeing whether key resistance levels will give way.

Analysts see potential breakouts

Trader Javon Marks posted a chart showing what he called a big accumulation pattern. Based on his view, XRP It could rise 226% to $9.90 and if that zone is cleared, a pass to $20 can be opened.

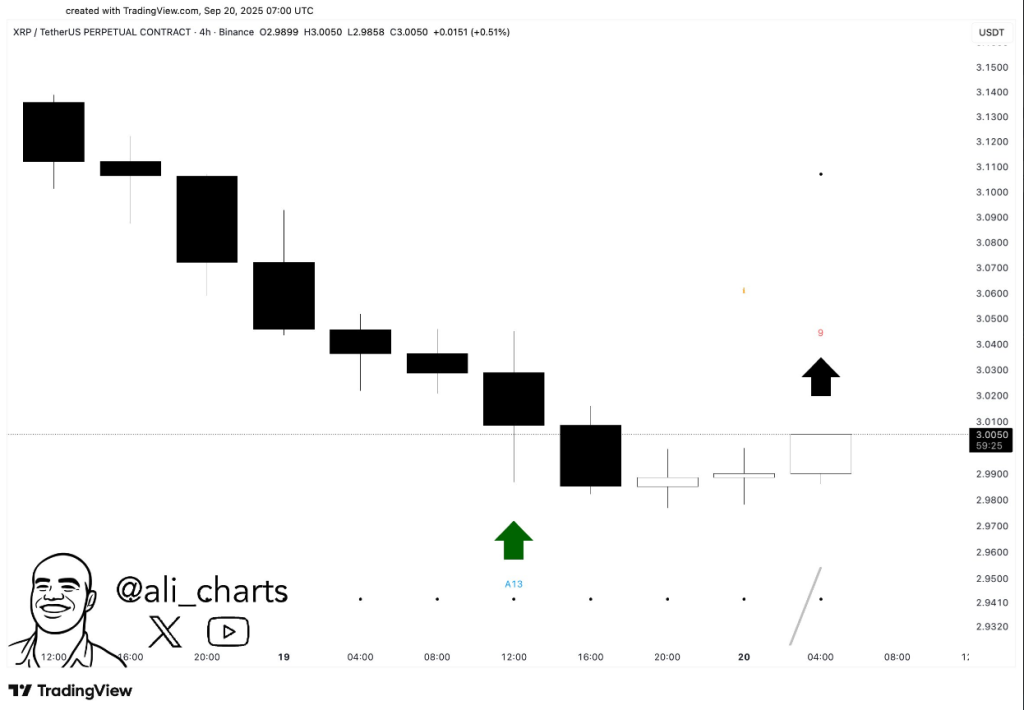

$ xrp According to TD Sequential, it’s a purchase! pic.twitter.com/fy7gtgxeb0

– Ali (@ali_charts) September 20, 2025

Marks compared today’s price structure to the long swings of the previous, bringing a sharp profit after extending the lateral period. Based on a report from Martinez, TD Sequential The purchase signal flashed on the 4 hour chart.

That metric is used by many traders to find when the trend can halt and reverse. Martinez said the recent integration has improved buyer odds, and the short-term trend now supports an upward movement. Both analysts emphasized patterns and metrics rather than the fixed timetables for the rally.

Institutional movements add liquidity

Reports reveal the first US spot XRP ETF Trading began this week. Many developments see it as a sign of growth in facility access. At the same time, CME Group plans to launch futures options for XRP and Solana, allowing it to bring more professional traders and deeper liquidity.

$ xrp Here it appears to be preparing for more than $9.90 in preparation for another +226% surge. pic.twitter.com/ia5jjocdkp

– javon⚡️marks (@javontm1) September 19, 2025

A tokenized fund plan for the XRP ledger has also emerged. Sources say these funds trade like tokens, regulating exposure to investors with faster settlements.

Market reactions are cautious. The XRP holds over $3, but price action slowed down as it approached resistance. Traders are currently looking at whether the token can push beyond the next supply zone or retreat back to integration.

XRP market cap currently at $178 billion. Chart: TradingView

Related readings

Carbon markets can generate demand

On the other hand, there is another argument linking XRP to Tokenized carbon credits. Based on the priorities research forecasts cited in the report, the carbon credit market could expand from around $933 billion in 2025 to more than $16 trillion by 2034.

Other studies noted that the carbon offset segment was around $1.06 trillion in 2023, potentially rising above $3 trillion by 2032.

If credit tokenization gains scale, fast, low-cost rails could be useful for those working on market plumbing. The XRP ledger has been reported to be carbon neutral, and supporters argue it could be an attractive option for transferring tokenized credits.

Still, this is a hypothetical demand case and does not clearly link that possibility directly to a particular XRP price level.

Meta featured images, TradingView chart