The surge in cryptocurrency liquidations sends a larger message that some traders have been using more leverage in recent months.

Related books

Average daily wipeouts have jumped from about $28 million long bets and $15 million short bets in the last cycle to about $68 million long bets and $45 million short bets in the current cycle, according to New Glassnode and Fasanara. report. This change made single sales even more intense.

early black friday shock

Reports have revealed that October 10th was the clearest sign of change. Over $640 million in long positions were liquidated per hour on the day as Bitcoin plummeted from $121,000 to $102,000.

Open interest It fell about 22% in less than 12 hours, dropping from nearly $50 billion to $39 billion. Traders sensed the speed of the move. The positions were closed in what Glassnode called one of the most rapid deleveraging events in Bitcoin history.

Futures trading hits record

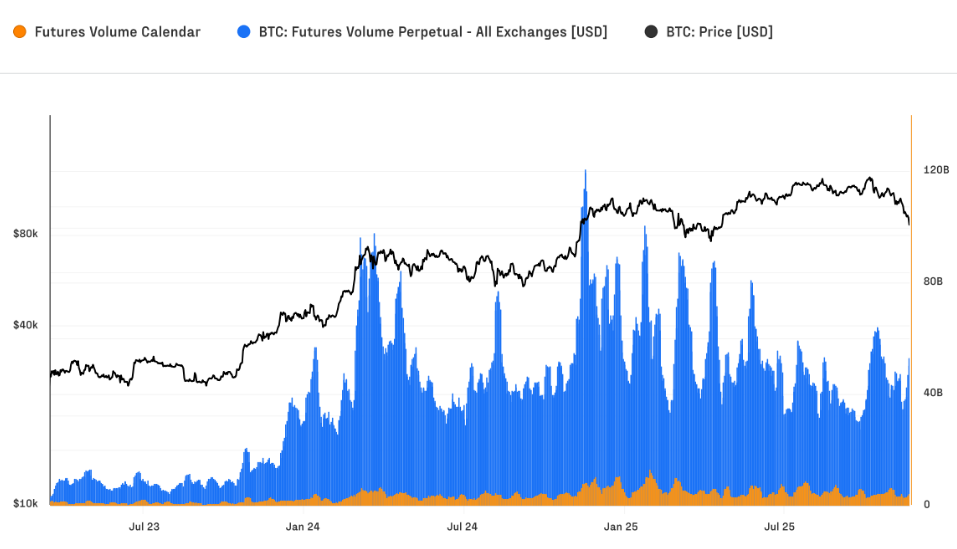

The futures market was inflated. Open interest increased to an all-time high of $68 billion, and daily futures trading volume exceeded $69 billion in mid-October.

Perpetual contracts now account for more than 90% of its activity, concentrating risk on products that continually reset.

The average daily futures wipeout was $68 million for longs and $45 million for shorts, illustrating the cost of large swings.

spot trading doubles

According to reports, spot trading is also becoming more active. Bitcoin’s spot volume Daily amounts have risen to a range of $8 billion to $22 billion, roughly double what was seen in the previous cycle.

The October 10 crash saw hourly spot volume soar to $7.3 billion as many traders bought the dip rather than run for the exits. This trend has helped change where price discovery takes place.

Capital flows and market share

Monthly inflows into Bitcoin have varied from $40 billion to $190 billion, with realized market capitalization reaching a record $1.1 trillion.

Approximately $730 billion has flowed into the network since the November 2022 low, more than in all previous cycles combined.

As a result, Bitcoin’s share of total crypto market capitalization has increased from 38% in late 2022 to 58% today, based on the report’s figures.

Related books

Bitcoin as a payment rail

On the other hand, there is another surprising statistic. In the past 90 days, the Bitcoin network has processed nearly $7 trillion in transfers. This throughput exceeded the throughput handled by major card networks in the same window.

This is cited as a reason why some participants see Bitcoin as an increasingly important means of payment rather than just a store of value.

Bitcoin price fluctuation

As of this writing, Bitcoin is Trading at $93,165up 6.5% in the daily and weekly time frames and nearly 7%.

Featured image from Unsplash, chart from TradingView