Onchain Gold has made its cumulative trading volume higher than ever, as exchanges like Coinbase and Hyperliquid are seeking tokens in stock.

This trend began in April, when spot gold prices skyrocketed due to economic uncertainty driven by US tariff policies. However, now that the crypto market has recovered from its April low, Onchain Gold Trading Activition is not only sustaining, but also accelerating.

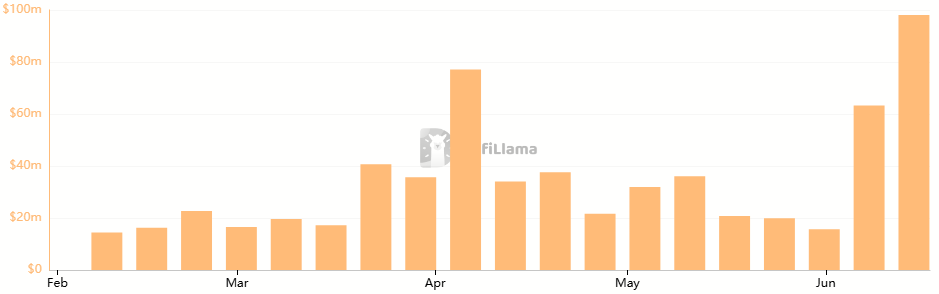

Over the past two weeks, the aggregated trading volumes of Tether Gold (XAUT) and Paxos Gold (PAXG) reached $236 million, with PAXG making up about 68% of the total.

This is an increase of 247% over the past two weeks and a 43% increase from the two weeks that started trending in April.

PAXG Trading Volume – Defilama

Spot Gold has grown particularly well recently as the Middle East conflict continues to drive uncertainty across global markets. Spot Gold has risen 2% last month and 29% over the past six months.

Tokenized Stock

The sustained demand for on-chain commodity trading may be closely monitored by companies seeking to provide tokenized stocks and by Defi protocols. Two particularly noteworthy entities are Coinbase, the largest centralized exchange (CEX) in the United States, and High Lipid, the leading decentralized permanent futures exchange.

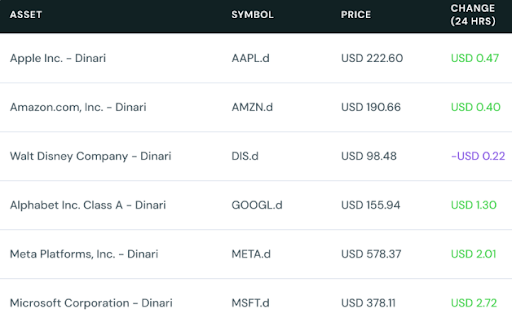

While watching speculators launch blockchain-based stocks as they watch two giants race, Dinari, a decentralized protocol that provides Dshares, has quietly surged tokenized stocks that Dinari has religiously become.

Dinari Reading Dshares -Dinari

The total value of Dinari is locked (TVL) has increased 760% since the beginning of March, when Coinbase’s CFO Alesia Haas hinted at activation. “We might be able to propose security tokens…and I’m excited to see US innovation and turn on more and more assets,” she said at the time.

Speculation rose significantly this week when Reuters reported that Coinbase was seeking approval from the Securities and Exchange Commission (SEC) to provide stock trading via blockchain.