This is a segment of the LightSpeed Newsletter. Subscribe to read the full edition.

Orca is up 19.6% a week as Orca Dao prepares to deploy its financial assets towards a tokenback initiative.

The governance proposal held last Wednesday for votes will see staking of financial assets to the ORCA variator node.

The ORCA Council will then withdraw the assets for acquisitions over the next 24 months if “deemed appropriate.”

As of today, Orca’s Treasury Department holds 55,127 Sol ($9.9 million) and 503k USDC.

Voting for the proposal will close in about 24 hours, and it is possible that currently a 100% “yes” response and a 51% quorum have already been met.

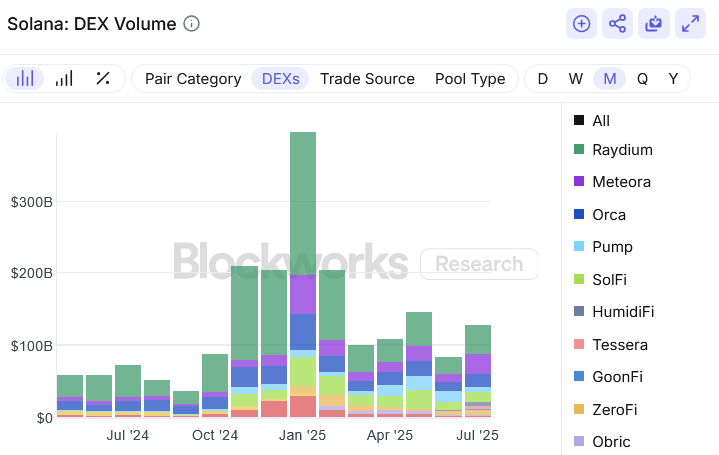

Orca is Solana’s third largest DEX, with trading volumes of around $19 billion to $20 million in July.

On a YTD basis, ORCA generated approximately $115 million in fees.

50% of these fees are directed towards protocol development, while 30% is directed towards the Treasury wallet, which will encourage ORCA buybacks if the aforementioned governance proposals are passed.

The remaining 20% fee will be allocated to another ongoing ORCA repurchase initiative heading towards ORCA staking.

The ORCA team said staking is due to be released in September, so this is a two potential value generation stream of ORCA token holders in the short term.

By market capitalization to revenue standard, ORCA is trading about 24% lower (7.36 times) than Ray (9.63X).

But that’s a big deal when considering the rise of props amms in Solana, pointing to an increasingly ultra-competitive and commoditized Dex landscape.