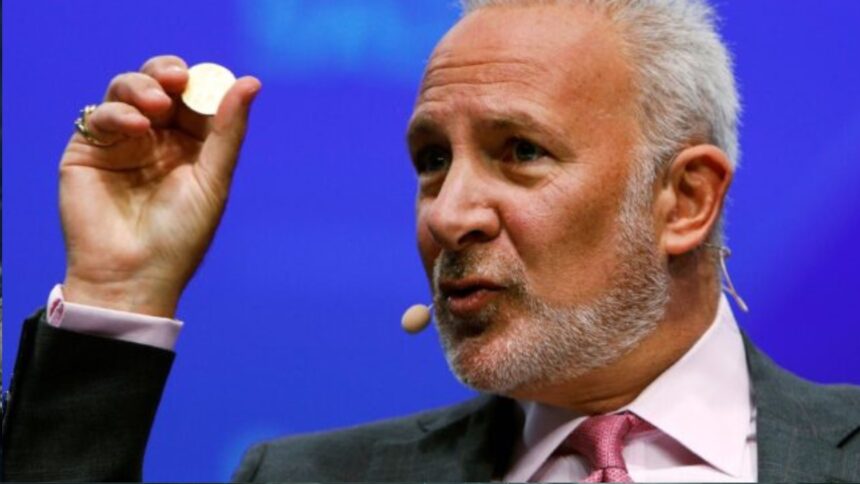

American economist Peter Schiff argues that America is headed for an economic collapse of historic proportions. In his view, the world is witnessing an end to the dollar’s “exorbitant privileges” and a changing era in which gold, rather than Bitcoin (BTC), cements its place as central banks’ undisputed reserve asset.

“Prepare for a historic economic collapse,” Schiff said. His words coincided with an unusual end to the year for precious metals. money is over the wall Silver reached $4,500 per ounce, an increase of 70% in 2025 alone, reaching $75 per ounce.

This metals boom occurs in the context of a weak US currency. The dollar index (DXY) remained close to 98 points, down 9.7% for the year, its worst performance since 2017. Schiff attributes this trend to persistent inflation above the Federal Reserve’s 2% goal. He said this would slowly erode the dollar’s value and cause “unpleasant surprises” for traditional investors in stocks, bonds and dollar deposits, who would see a loss of purchasing power. As a result, many people use precious metals as a refuge.

The economist does not see Bitcoin as an asset that can replace the dollar or gold as a store of value. On the contrary, new criticism of the currency created by Satoshi Nakamoto is once again stirring up controversy. According to Schiff, the investment opportunity for BTC has already ended and he expects it to continue. gradually decreasing towards absolute zero For those who still maintain their assets.

However, its credibility in the digital world has been questioned. Social media quickly reminded him of the history of his predictions failing. “Is it the same as when you said Bitcoin would collapse when it hit $3,500 and told everyone not to buy it?” one user accused him.

Criticism of Schiff has become a genre in itself under the banner of “reverse Schiff.” His ironic theory is that negative predictions for Bitcoin are usually bullish signals.

“Peter Schiff predicting economic collapse is the most reliable bullish signal Bitcoin has,” said another user. “Like a clock.” The term “Schiff signal” also appears as a repeated reenactment of his comments about X and has become a recurring meme.

Bitcoin: safe or risky asset?

In this dialectical debate, Schiff found an unexpected ally in the macroeconomic analyst Henrik Seberg, but for different reasons. Seberg agrees that Bitcoin would not serve as a lifeline in a real crisis. “Bitcoin is not a special asset. It is a risk asset. In fact, a very risky asset,” Seberg said, as recently reported by CriptoNoticias.

According to analysts, Bitcoin only thrives with abundant liquidity. “Rather than acting as a safe asset, Bitcoin will fall along with risk assets,” Seberg warned. suggests a digital currency Could be less than $10,000 If “all bubbles” eventually burst and we end up behaving more like speculative tech stocks than the “digital gold” that many champion.

In his analysis, Seberg does not dismiss Bitcoin as an asset per se, but sees it as part of a larger macro cycle, in which a “blow-off top” (the final stage of a parabolic rally) necessarily precedes the collapse of a bearish/recession phase.

In a climate of global uncertainty, Mr. Schiff’s warning reflects the view shared by some analysts that the international financial system as we know it could undergo significant structural changes.