Companies are adopting XRP: Companies such as Flora Growth, Hyperscale Data, and Webus International are adding XRP to the Treasury Department.

Institutional access will expand: XRP lists on BDAC and South Korea’s major exchanges will boost adoption. Legal clarity could further accelerate demand.

XRP is not just for traders. It is quietly becoming a go-to asset for the corporate Treasury. Recent SEC filings reveal that more companies are adding XRP to their balance sheets.

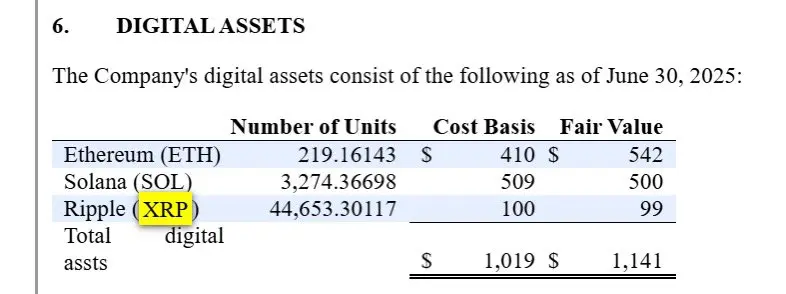

Crypto legal expert Bill Morgan pointed out this growing change. US company Flora Growth revealed that he holds XRP along with Ethereum and Solana on its Form 10-Q. The company says these assets were acquired to strengthen the financial foundation.

Similarly, HyperScale Data is working to publish monthly updates on digital holdings starting with XRP. Subsidiary Ault Capital Group has already invested $10 million in tokens.

This trend is not limited to the US. China-based Webus International has announced its $300 million XRP-focused financial strategy at 6K. Well Engineering, a London-based Vivopower and pharmaceutical distributor, also disclosed XRP holdings, indicating that recruitment is spreading across industry and boundaries.

The agency makes it easier to access

XRP is more accessible to large investors. The tokens are listed on BDACS, a platform that provides secure custody solutions for institutions. This strengthens Ripple’s connection to the Korean market, and exchanges such as UPBI, T Coinone, Korbit already provide deep liquidity. Using BDAC for photos has allowed agencies to deploy XRP more efficiently.

- Read again:

- Ripple responds to US Senate Cryptographs, saying XRP, ETH and SOL could face unfair regulations

- ,

Meanwhile, the recent relocation of $20 million worth of around $60 million, from Upbit to unknown wallets, has sparked speculation among traders. Such major moves often suggest a growing interest and long-term positioning.

What’s ahead

The ripples and SEC cases still fall on balance. Status updates are expected by August 15th and could provide much needed clarity. That expectation has recently promoted 8-10% rallies at XRP prices.

At the time of writing, XRP is trading for $2.97. Market pressure remains, but the bigger story unfolds quietly. The company owns XRP institutions.

XRP is no longer just a cryptocurrency, but is steadily gaining ground as a legitimate corporate financial tool with long-term potential.