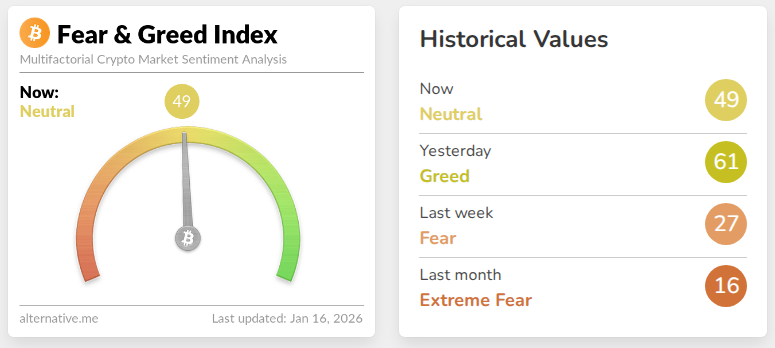

market mood cryptography Optimism soared, then cooled quickly. According to Crypto fear and greed The index fell 12 points on Friday, from 61 to 49.

Related books

That swing moved Gage from the “greedy” to the “neutral” zone in one session. Bitcoin rose about 4.5% to around $97,700 at the beginning of the week, which helped lift sentiment, but the focus shifted to politics and legislation in Washington.

Regulatory concerns rock markets

based on reportthe main impetus was the debate over the Senate version of the long-awaited Cryptocurrency Market Structure Bill. The measure sets out how U.S. regulators will oversee digital assets and includes language tightening rules regarding stablecoin yields.

Several lobbyists and executives stood up. alarm Regarding those terms. Coinbase CEO Brian Armstrong withdrew his support for the proposal, saying it was worse than the current system and bad legislation was harmful.

The backlash prompted the Senate Banking Committee to cancel its planned price increases, and the Senate Agriculture Committee moved its session to late January as lawmakers called for more aid.

Social media sentiment changes based on trader reactions

According to a cryptocurrency analysis company Saintlythere were two different trends in market activity simultaneously. While large holders were building positions, small retail traders were selling.

Despite on-chain data showing accumulation by more experienced wallets, social conversations began to reflect unease after news about the regulation.

The index’s early week high was its highest level since it hit 64 on Oct. 10, when the market crash led to more than $19 billion in liquidations. These past losses are still fresh in investors’ minds.

Buy while retailing with smart money

Reports have shown that prudent capital accumulation can support prices, but headlines shape the short-term mood. Bitcoin is trading at around $95,642 at the time of publication, down around 0.02% over the past 24 hours, according to . CoinGecko.

While this small move shows market resilience, the decline in sentiment indicators shows how fragile confidence is when policy is questioned. Many traders are watching Washington closely, sometimes more closely than the charts.

Related books

Some industry players see the delay as an opportunity

Some in the industry see the postponement as constructive.

David Sachs, a White House adviser on cryptocurrency issues, said the moratorium could help bridge the gap between stakeholders and move the bill closer to implementation.

Ripple CEO Brad Garlinghouse continues to speak with lawmakers, saying the delay is an opportunity to improve the document.

This view stands in contrast to more cautious voices and helps explain the mixed market reaction.

Featured images from The Drive, charts from TradingView