One class action lawsuit filed against California-based crypto-friendly Silvergate Bank seeks plaintiffs connected to FTX or Alameda Research accounts.

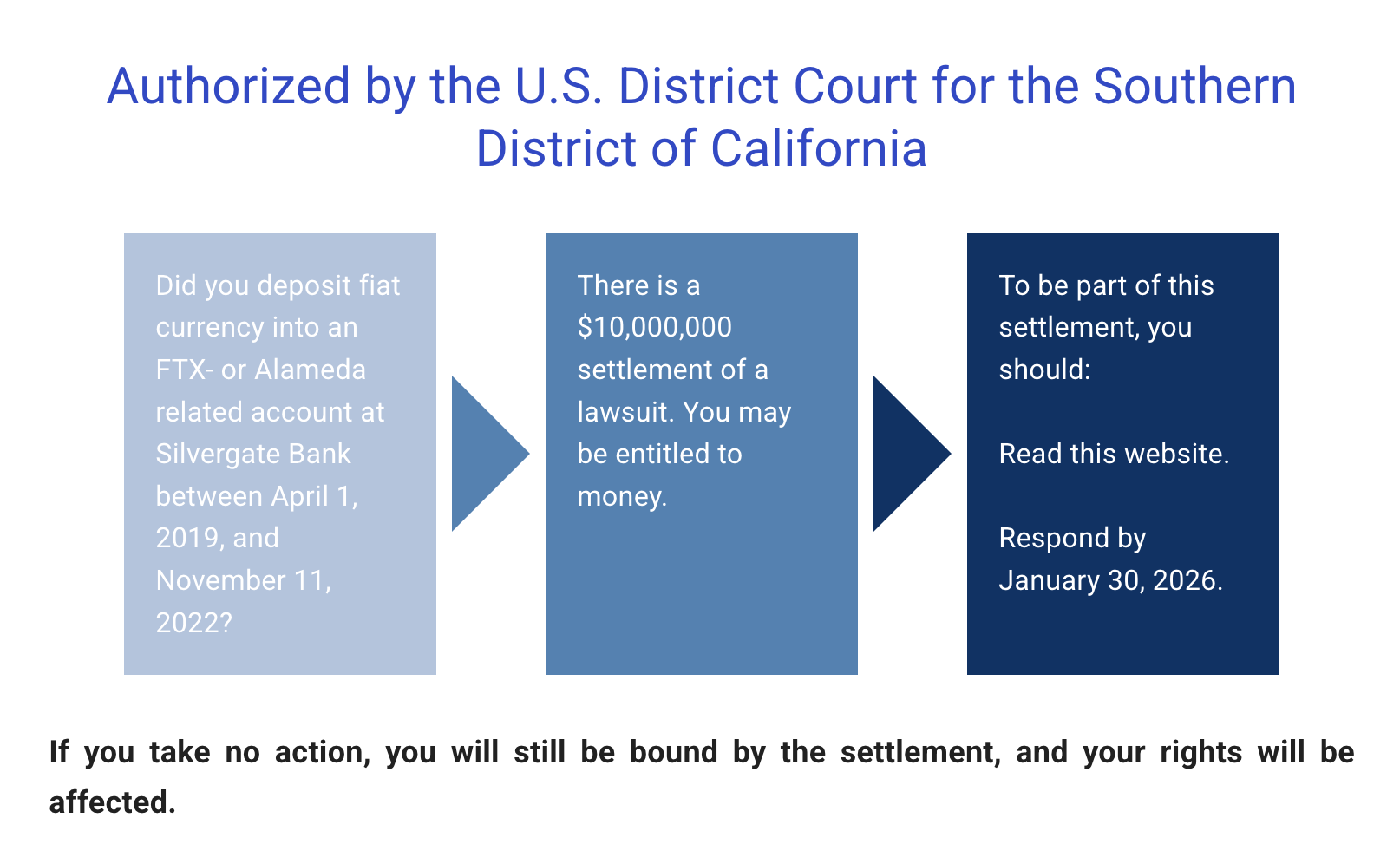

The investor group has asked Silvergate users who deposited fiat currency into “FTX or Alameda-related accounts” between 2019 and 2022 to file a settlement claim in the U.S. District Court for the Southern District of California.

According to the complaint, investors have until January 30 to opt out or file claims as part of a $10 million settlement that “resolves litigation over whether Silver Gate Bank, Silver Gate Capital Corporation, and Alan J. Lane aided and abetted illegal conduct on the part of FTX, Alameda, and Sam Bankman Freed.”

“The settlement is fair, reasonable and appropriate (…),” a Dec. 8 court filing seeking approval said. “This marks a significant recovery from the bankruptcy of Silvergate and will provide additional relief to those affected by the multi-billion dollar collapse of the FTX cryptocurrency exchange beyond what was obtained in the FTX bankruptcy.”

sauce: FTXbanksettlement.com

Judge Ruth Bermudez Montenegro scheduled a final hearing to consider the settlement on February 9, giving investors connected to FTX and Alameda more than a month to file suit. According to court filings, the FTX bankruptcy case has been reached by mail to more than 46,000 potential claimants, which could result in a pro-rata $10 million settlement.

Related: Judge gives green light to class action lawsuit accusing Silvergate Bank of aiding and abetting FTX fraud

Silvergate was one of the few crypto-friendly banks in the US that had a relationship with the FTX exchange at the time of its collapse in November 2022. The bank voluntarily ceased operations in March 2023.

The ongoing story of FTX criminal charges

Although many of the criminal cases involving former FTX and Alameda executives have concluded in the past three years, there are still several civil cases in court, and individuals connected to the exchanges could be prosecuted.

Former FTX CEO Sam Bankman Fried, former Alameda Research CEO Caroline Ellison, and former FTX Digital Markets co-CEO Ryan Salame are serving federal prison sentences for their roles in the financial collapse. Two other FTX executives, Nishad Singh and Gary Wang, were sentenced to prison terms.

Salameh’s wife, Michelle Bond, faces campaign finance charges related to FTX funds in the U.S. District Court for the Southern District of New York. Her defense team argued that prosecutors induced Salameh’s guilty plea with a promise not to press charges against Bond. The next evidentiary hearing in the bond case is scheduled for March 4.

magazine: When privacy and AML laws conflict: Impossible choices for encryption projects