Bitcoin derivatives data still shows heavy activity across the future and options market, changing open interest and positioning.

Heavy futures trading has emerged at $110K as the maximum pain level for Bitcoin options

Bitcoin traded at $110,894 on Saturday, September 6, 2025, falling 1.8% over the last 24 hours, with an intraday range of $110,339 to $113,142. Coinglass.com metrics show that open interest in futures is 717,980 BTC ($7.963 billion). CME led by 136,380 BTC ($1.512 billion), accounting for 18.98% of the market followed by a 126,540 BTC ($140.3 billion, 17.62%) vinance and a 89,280 BTC ($99 billion, 12.2%) bibit.

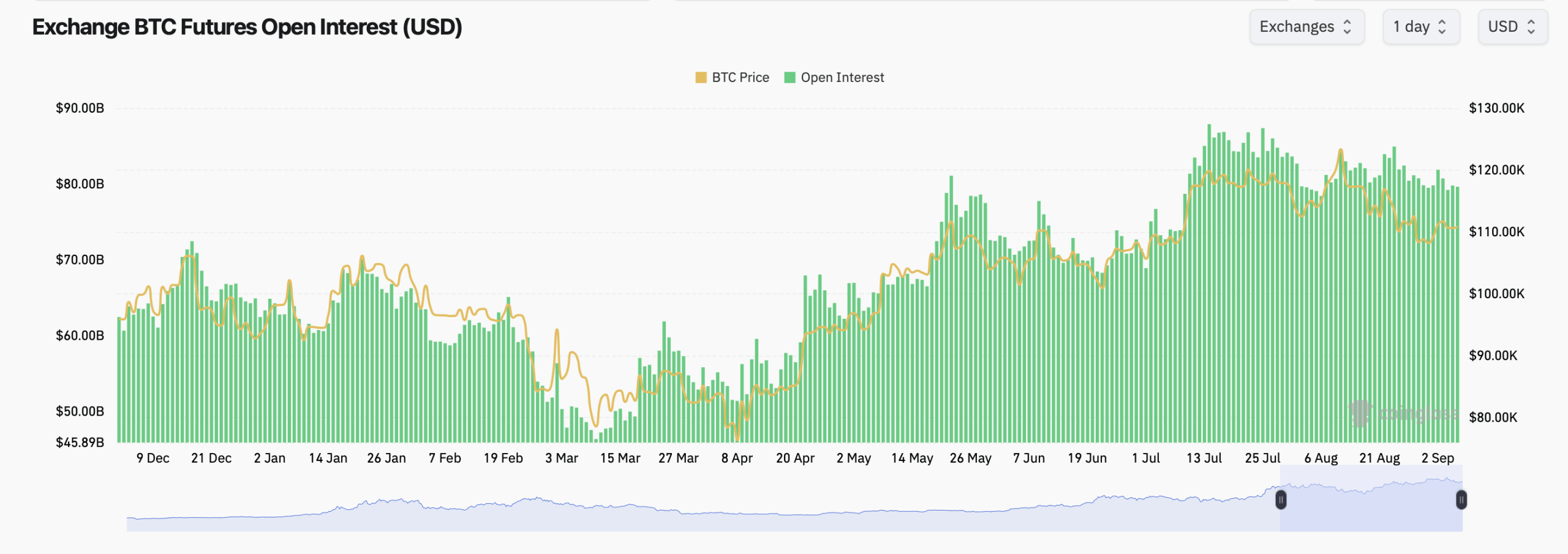

OKX, Gate and Kucoin chase after them, showing Gate the strongest 24-hour increase. BINGX saw the biggest decline, down 15.84% over the past four hours and 7.03% over the day. The indicators show that open interest in the total future has been decreasing modestly since late August, but remains rising compared to the beginning of the year. The value of open interest consistently tracks the price of Bitcoin, which peaked at over $90 billion during the mid-July rally.

As of early September, futures interest was close to $80 billion, reflecting a slight pullback after the summer’s best. In the options market, total public interest reached nearly $60 billion, with activities mainly focusing on Delibit. Cole accounted for 59.27% of open interest at 240,927 BTC versus 40.73% of PUT at 165,572 BTC. Over the past 24 hours, Cole led the volume at 52.19% (15,716 BTC), slightly ahead of Put at just 47.81% (14,397 BTC).

The tilt towards the call indicates stronger demand for upward exposure, but the put remains fairly active. The largest open interest positions include December 26, 2025, $140,000 (10,386 BTC), September 26, 2025, $140,000 phone (9,989 BTC), and September 26, 2025, $95,000 (9,918 BTC). Other notable strikes clustered at around $115,000 to $150,000, with a strong demand for both bullish and bearish contracts.

On the volume side, short-term expiration dates are controlled, including a $110,000 put on September 12th and a $116,000 call on September 26th. Max’s pain, the level at which option holders face the biggest total loss, was close to $110,000 in September satisfaction. This positioning suggests that short-term pricing pressures could be centered around that level as market manufacturers aim to minimize payments.

With Bitcoin trading just above Saturday’s biggest pain, the derivatives market appears to be balanced between bullish call demand and defensive hedges. Still, it’s on the edge of the razor.