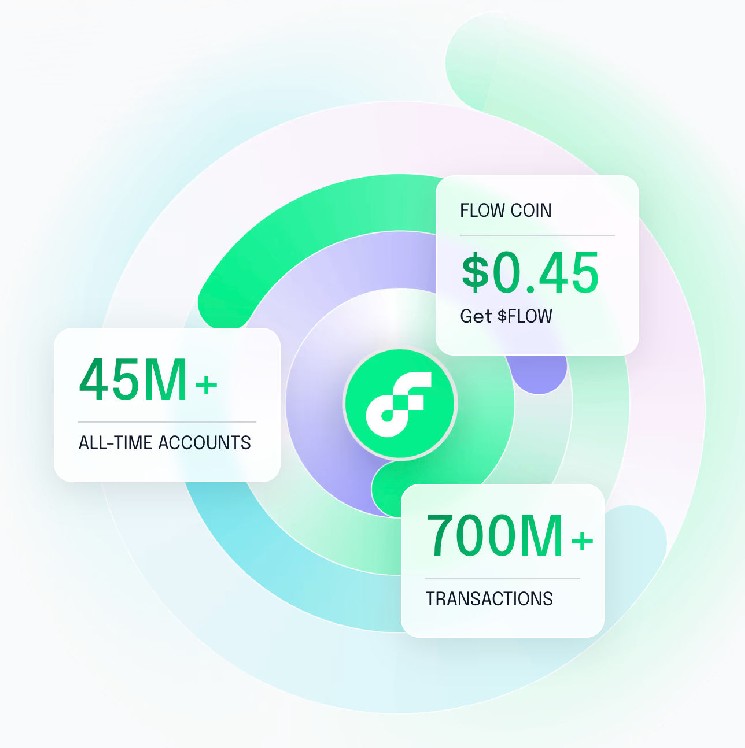

Flow has returned to the spotlight. However, it’s not just the NBA’s top shot. Messari’s newly released Q1 2025 report shows that the flow not only survives the bear, but also building, onboarding and scaling with incredible momentum.

–

According to Messari, Flow has become the fastest growth tier 1 ecosystem for developer growth in the first quarter, but it has garnered $8.1 million in NFT trading volumes and driven $8.1 million through major brand platforms such as NBA Topshot, NFL All Day, Disney and Mattel.

Development Growth + EVM = Actual Momentum

Let’s start with the data. Flow posted weekly developer #1 growth rate for the first quarter across all L1s. With an average of 67.8 core contributors and a 26.5% jump with weekly commitments, the chain is clearly regaining its developer mindshare. Flow’s EVM environment, which was released last year with a Crescendo upgrade, has been postponed in its rewards. Builder solidity compatibility, 800mms block time, and sub-cent rates.

Hackathons also played a major role. The January Flow Asia Hackathon and February Ethglobal Agent virtual events caused a surge in transactions (peaking at 581K) and developer activity.

TVL will hit record highs when defi takes shape

The flow is no longer a cultural chain. The locked total value (TVL) surged 17.7% to $444.4 million, led by a new class of debt protocols, such as Kitty Hunche and other markets. Old Defi leader Increment Finance still holds the largest pool, while Kittypunch’s Stablekitty Stablewap loses 585% QOQ, almost combining an incremental advantage.

Kittypunch TVL: $19.2 million (+585%)

Other markets: $3.9 million (+631%)

Incremental: $19.3 million (down 32%)

Flow is quickly bringing that one reputation. The network is building a variety of definition tools, including curve-style swaps, NFT-FI marketplaces, liquid staking, and even the DAO’s Treasury, which accumulates $flows.

Sports, IP & NFTs are still dominant

Flow’s bread and butter remains an IP-supported digital asset. Sports, collectibles and licensed media have driven much of the activity.

NBA Top Shot: $5.6 million for the first quarter

NFL is full day: $2.5 million

League Fortball League (MFL): $106 million (+130% QOQ)

Hot Wheel Garage V2: +85.7%QOQ

UFC Strike: $360K (+63% goq)

Also, with Opensea consolidation released in the first quarter, NBA Topshot has cracked its top five trending collection for the fourth consecutive week. It is a major milestone for the story of consumer NFT in the post-hype market as well as flow.

Cross-chain play expands

Thanks to new integrations with Layerzero, Axelar and Debridge, Flow is connected to over 100 external networks. Wrapped USDC, PayPal’s PYUSD, and cross-chain swap are now live. The barriers to new users and assets moving freely through the ecosystem are declining.

Additionally, EVM equivalence is right, developers no longer have to choose speed, cost, or complexity. Flow quietly built one of the most complete cross-chain experiences on the market.

Culture meets Tech. Flow’s double identity

The other L1s are chasing liquidity and memokine, but the flows are thriving in lanes where entertainment, technology and consumer adoption are equal. It’s a tough balance, but it’s rewarding:

Jump 144% to your daily active wallet

Daily trading increases by 10.6%

Active Opsy Ecosystem with Mobile First UX

Seamless onboarding for non-crypton natives (see Disney’s Digital Pins and Sagebles)

Flow’s EVM extension and the Defi ecosystem suggest a shift towards more technical use cases, but the actual moat is still cultural. The NBA, NFL, Barbie, Disney and Dr. Seuss not only bring volume, but also trust.

Conclusion

With EVM tools, cross-chain bridges, NFT towing, and rising resistance, Flow shows us what it looks like to build at the same time for both mainstream consumers and crypto native users. If Q1 is any indication, the flow could be the most overlooked candidate heading towards the next wave of adoption.

Dive deeper into the full Messari report