Faced with the roaring of macro risk, Bitcoin wrist rest tapes are no more contradiction than timing issues, claiming this week’s edition of Insights (September 20, 160, Week 160): Contributor @CryptoInsightuk, writing “Why is BTC behind?” under the banner, sets a decisively constructive medium-term tone. “That being said, I think we’re closer to the top than the low here,” he adds, but the author still believes that “we’re approaching this most euphoric phase of the bull cycle.”

Why is Bitcoin late?

piece Pin many of today’s mal laziness regarding the reflexivity of sentiment. Crypto-Twitter’s crushing negativity is described as a view-generating feedback loop that makes the market feel heavier than that. “That delay can be frustrating,” the author wrote, noting that the Fear & Greed Index does not display the clustered “extremely greedy” readings that characterize the 2021 double-top.

Related readings

With the exception of the burst of frenzy in late 2024/early 2025, “XRP gatherings coincided with around $50 cents to $2.70 and were eventually topped with around $3.30 to $3.40,” the index hovered far from the blow-off conditions that normally marked the peak of the cycle. The implication is simple. Despite the noise, the market has yet to show a classic euphoria cluster ahead of the top.

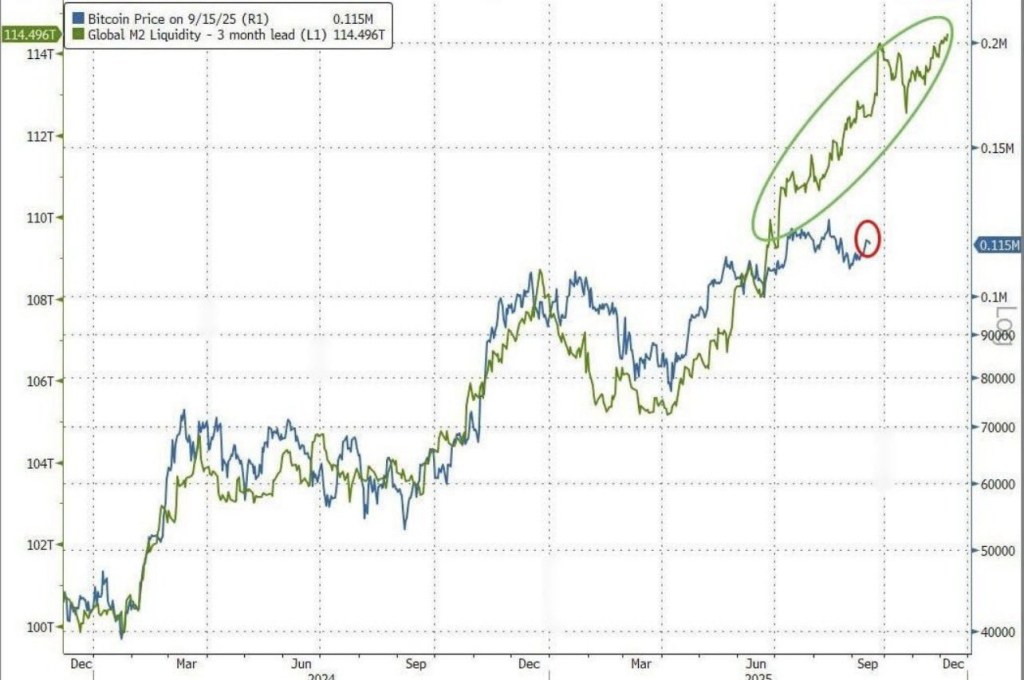

Here, the macro correlations that are often called to explain the decline in leadership and performance of Bitcoin are used to assert delays rather than failures. Above M2 Money Supplythe author repeats a well-tracked 3-month linkage. “Bitcoin and M2 money supply have been closely correlated up until now, but over the last two to three months, M2 has been absolutely high.” From here, readers can “claim that the correlation has collapsed, or claim that Bitcoin is simply behind and has not yet caught up.”

Similar readings range in money. Directional leadership alternates between the two assets, but when Bullion pushes high, BTC’s catch-up means “a move to at least $135,000 compared to the current level of around $115,000.” The shares tell the same story in another register: Nasdaq, Dow Jones, S&P, and Russell 2000 are all-time highs, or near, with Bitcoin “almost chopping to the side” and “looks behind” once again.

Market microstructure adds a critical layer. This letter highlights the interaction between visible fluidity pockets and integrated dynamics. “Every time, when there was a significant increase in liquidity, Bitcoin ultimately did it.” As prices rose, resting liquidity grew thicker. “Red shows the deepest fluidity, followed by orange, green is the lightest,” breakouts became the most powerful when those deep pockets were photographed.

The example given is “running between $70,000 and $100,000,” “following a severe consolidation that followed an explosive breakout.” By that logic, the current map “refers to a movement towards more than $140,000” is a repeated discussion of the amount. Author Hiphor said: “We’ll explain more about price actions like stored energy. The more you consolidate and charge, the bigger the final release.”

What role does Altcoins play?

The most powerful claim on this issue is not about Bitcoin; Altcoin. Both Total2 (Crypto ex-BTC) and Total3 (Crypto ex-BTC and ETH) are said to have “closed daily candles to price discovery.” Total2 “closes its weekly high and is now closed for the second consecutive week,” while Total3 is sitting “at the edge of breaking into a new all-time high.”

Structurally, the report frames a total of 2 as a Wyckoff accumulation and cup-and-handle, and a total of 3 carves an ascending triangle ready for continuation. The combination that tells Bitcoin to “push price discovery while preparing to push to a new high is a set up that the author associates with “mania or happiness.” It is also the basis for clear positioning disclosures. “That’s exactly why it’s fully placed in Altcoins here.”

Related readings

Its spinning view is enhanced by calls about Bitcoin’s domination. The author repeats his long-standing targets. “We’re heading towards at least 35.5 percent levels and potentially even into our 20s.” The historic analogue is not clear. Control has “decreased by 62%” from the 2017 high and “decreased by 46%” from the 2021 high.

If a similar acceleration matches BTC and “rip to a new round high,” the result is “altcoin rally that melts faces that most people can’t even imagine now.” The letter links this purely internal market setup with external catalysts, citing “a major legislative shift in the world’s largest financial economy” and “the potential inflow of trillions of dollars from stability and clear conduct.”

Where is Bitcoin price heading next?

This issue is closed with a complementary technical brief by @thecryptomann1, which focuses on the short-term risk map. For BTC spots, “decision times are fast approaching,” and the zone flags it as “huge” between $111,000 and $115,000. Losing it, “I feel that fluidity around the $105K range is inevitable.” Exchange-Side-Book-Book HeatMaps shows “a mass of fluidity sitting here across all the exchanges.” Analysts don’t force a call to “I don’t know how the market will swing.” And now in the CHOP, they label “dangerous” aggressive speculations.

The second lens passes USDT Dominance (USDT.D)analysts flip to track risk appetites. The metric has been “confined to (a) range for the last 15 or so months,” but structurally “seems like a chart on the way back to the high (actually, it’s a low).” The listed target remains at 3.76%. The logic is intentionally simple. There is room for the risk of progression before Stablecoin control rises before it rises again, with range structure, retention of a retracement of 0.5, sustained trends, and defence of key “blue box” support pointing to “strength.” It underlies a tactical approach. “The way I play has been swinging for a long time until the USDT.D reaches 3.76%.

The short-term “maximum pain” path is sketched with distinctive market sarcasm. The plausible sequence is that “$BTC pushes up to $120,000, everyone panics, goes on long, promotes liquidity below us, then cleans up the low values.” Analysts warn that dropping straight into the “low range of $100,000” is “too obvious,” but in a compressed, biased environment, both upside down liquidity and downside liquidity are attractors. Mood music for traders is summed violently on the line.

At the time of pressing, BTC traded for $112,712.

Featured images created with dall.e, charts on tradingview.com