Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

The soccer price for the Lion and Player is soft. I hate each of my arcu lorem, ultricy kids, or ullamcorper football.

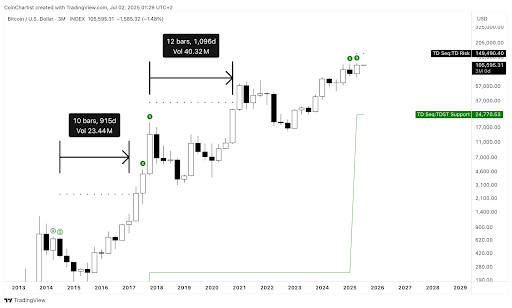

According to a new analysis shared by Crypto analyst Tony “The Bull” Severino, Bitcoin closed its quarterly chart with its completed TD9 sales setup. This is actually interesting. Because it probably adds a long timeline Before Bitcoin reaches More important price targets.

Most of the daily candles of Bitcoin over the past 7 days Mild upward pressure is shown Supported by positive sentiment from various technical analyses. but, According to TD9 setupBitcoin could take up to four years to reach $149,000.

TD9 Setup Tips Slow Climbing to $149,000

TD9 is a Components of TD Sequential Indicatorsis often used to identify trend fatigue, potential reversals, and possible trend changes. Interestingly, what is noteworthy about this particular signal at this point is that it is currently projecting a TD risk level of $149,490. This is essentially a Bitcoin price target. However, if past patterns of TD9 indicators are those that pass through, reaching there may take much longer than the bull expects.

Related readings

In 2017, a similar completed TD9 appeared at $20,000 during the first Bitcoin rally. At the time, the TD risk was projected at $35,000. By late 2020, about four years later, Bitcoin finally invaded beyond that level. Pre-events in 2014 provided the same story.

In 2014, the TD9 setup predicted a TD risk of $2,400, but it took about 3.5 years to cross that threshold. now, Despite today’s bullish feelingsthis historic precedent suggests that a similar year could take before the $149,490 target currently projected by TD risk is ultimately tested or breached.

The above 3 month candlestick price chart provides a visual analysis of this projection. Due to the low cycle in 2014, it took Bitcoin 915 days across 10 quarters of candles to reach its next high. After the 2017 signal, it took 1,096 days (or quarterly quarterly measurements) for BTC to exceed the ultimately forecast TD risk level.

Bitcoin price action when climbing stepwise

Bitcoin has spent the past seven days on a stable but modest uptrend. Low weekly at around $105,430 The current range is between $109,240 and $109,600. During this move, Bitcoin Price Action tested and retested resistance in the $108,200 to $108,800 zone over the last 24 hours. However, it was eventually pushed up high and a was displayed A slow, stable, bullish undertone.

Related readings

At the time of writing, Bitcoin has traded at $109,330, up 2% over the past 24 hours. Currently, it has moved around 36% since reaching its price target of $149,490. However, if Tony Severino’s timeline occurs on TD9 risk setup, it will not be until around July 2029 by the time Bitcoin reaches its $149,490 price target.

Pixabay featured images, charts on tradingView.com