Ethereum has recently faced intense sales pressures near the $4.8K region, reflecting the high volatility seen across the wider crypto market. The long-term bullish structure remains intact, but ETH has now been brought back to important support areas.

The key question is whether buyers can protect this zone or whether deeper fixes are on the horizon.

ETH Price Technology Analysis

By Shayan

Daily Charts

On the daily charts, Ethereum clearly enters a corrective phase, with sales pressure and profit distribution focusing on momentum. This decline has led to assets moving towards psychological support of $4K. This also coincides with the midline of the channel, reaching a pivotal level for the continuation of the trend.

If the buyer successfully defends this zone, ETH can be integrated before making another push higher. However, the decisive breakdown below $4K could expose the following key support to around $3.5,000: Despite current retracements, momentum has cooled significantly, but the wider upward trend remains in effect.

4-hour chart

In the lower time frame, Ethereum has recently surpassed resistance and turned violently, breaking below the recent higher bass, surpassing resistance, an early sign of a potential market structural shift.

Currently, prices are stable around the 4K $4K region. This confluence makes $4K an important battlefield between bulls and bears. For now, ETH effectively ranges between 4k and $48,000, with liquidity clusters concentrated at both extremes.

The market could remain in the horizontal integration phase until a breakout occurs. That said, a sudden bearish breakdown below $4K could cause a cascade of liquidation and flip the broader bullish outlook into a bearish scenario.

On-Chain Analysis

By Shayan

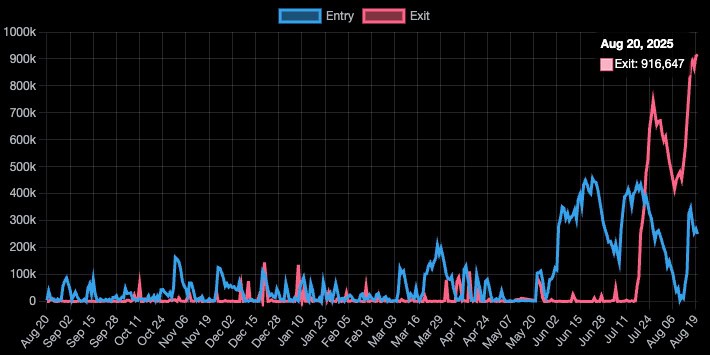

The Ethereum Network has created a serious imbalance in the dynamics of validator dynamics, with historically surges in validator exits and rapid declines in new entries. As of August 20, 2025, over 916,000 validators have queued the exits, the largest exit queue ever recorded.

Unlike previous short-lived spikes, this trend has accelerated over the past two months, indicating that it is more than just temporary fluctuations, and instead reflects growing concern amongst stakers.

This development has great significance in its chains. Variators leaving the network will regain access to 32 ETH deposits and earning rewards generated. A significant portion of that could return to circulation. If even a portion of this ETH is directed towards sales, it could create substantial supply-side pressure on the market.

In fact, the rapidly expanding exit queue serves as an early warning signal for mounting mount-side risks. Without a corresponding new wave of demand to absorb unlocked ETH, Ethereum could face a period of scalable volatility in which the market struggles to balance supply. This setup increases the chances of short-term underside pressure, improving staker emotions, or undermines the wider bullish structure unless new buyers take a critical step.