Wall Street finally lost momentum on Tuesday as it was given a high-tech rally that had been dragging the index higher and ended its six-day profit.

According to CNBC data, the S&P 500 closed at 5,940.46, down 0.39%, while the Dow Jones industrial average fell 114.83 points (0.27%) at 42,677.24. The Nasdaq composite followed the same route, losing 0.38% and closed at 19,142.71.

Tech stocks have been dumped quickly after leading the fees for nearly a week. The entire sector lost 0.5%. Nvidia slipped 0.9%, with advanced microdevice, meta platform, Apple and Microsoft all down.

This has been a sharp turnaround from the past few weeks. These names have increased the S&P 500 by more than 20% since its April low. The rally was driven by President Donald Trump’s fresh tariff announcement. The fresh tariffs rattled investors at first, but settled when signs of pullback appeared.

Tech falls as Trump struggles to push tax bills

Tuesday’s session was the first real pause in the market, which is at a relentless rise. Although profits were small on Monday, they added to the steep climb that began five weeks ago. However, its execution was cut off in this session as the market waited for a clearer signal.

Bill Nocce, investment director at US Bank Wealth Management, told CNBC that the big picture is still vague. “We are a fierce gathering related to the failures associated with the introduction of tariffs, emissions of these tariff implementations, and now many of these negotiations are underway, so we are waiting for clarification,” he said. I said.

Meanwhile, Trump faced resistance from his own party. On Tuesday, he did not convince a group of House Republicans to support a major tax bill that has stagnated at the state and local tax credit limits. The opposition is threatening to kill legislation that Trump hoped would pass before Memorial Day weekend.

While most of the technology struggled, Tesla has defied the trend. CEO Elon Musk told Qatar’s Economic Forum that he plans to lead Tesla Next 5 years. “Yes, absolutely certain about that,” Musk said. That small but direct statement helped Tesla stocks rise by 0.5% even if other markets were pulled back.

Investors become bearish, and the Treasury acquires swing after downgrade

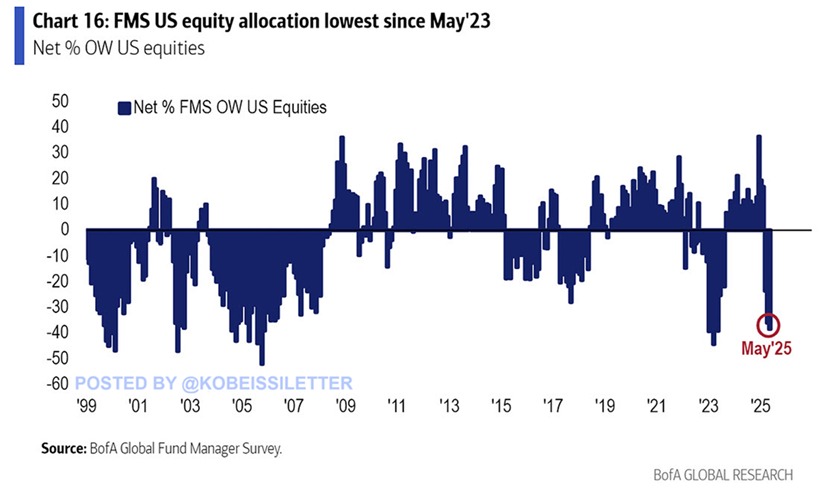

Feelings among the large investors continue to sink. In early May, 38% of institutional investors were underweight relative to US stocks, the lowest figure since May 2023. Except for 2023, this wasn’t that low until the crash in 2008.

And over the past five months, that percentage has fallen by about 70 percentage points. This is the biggest fall ever recorded. Instead, money flows into European stocks. Compared to US stocks, the gap between investors’ overweight stocks has expanded to 75%, the highest since October 2017.

Just four months ago, that same statistic sat on Negative 62. It’s the worst since 2012. Treasury yields were bounced on Tuesday as traders tried to guess what the Federal Reserve would do next.

30 years Financial Returns Three basis points reached 4.969% after violating 5% on Monday. The 10-year yield rose by 1 basis point to land at 4.485%. The slack has been eased since it exceeded 4.5% the day before.

A yield conflict occurred after Moody’s rating knocked down the US credit rating from AAA to AA1, placing it in the same layer as Fitch and S&P dropped in 2023 and 2011, respectively. Vishnu Varathan, head of Macro Research at Mizuho Securities, did not underestimate the move. He called it “clearly significantly worse” in his memo. However, he also said downgrades are “insignificant” for the market today.

Despite the yield responses potentially stricken by vulnerable investors’ trust, Varathan explained that it doesn’t destroy a bigger recovery. He writes that there is no “immediate shock” or forced sales from changes, as downgrades do not undermine the liquidity or collateral value of the US Treasury.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do that with Defi in future WebClass. Save your spot