Concerns are growing over unusual activity surrounding the token launch of Edel Finance, a lending protocol focused on tokenized equities and real-world assets (RWA).

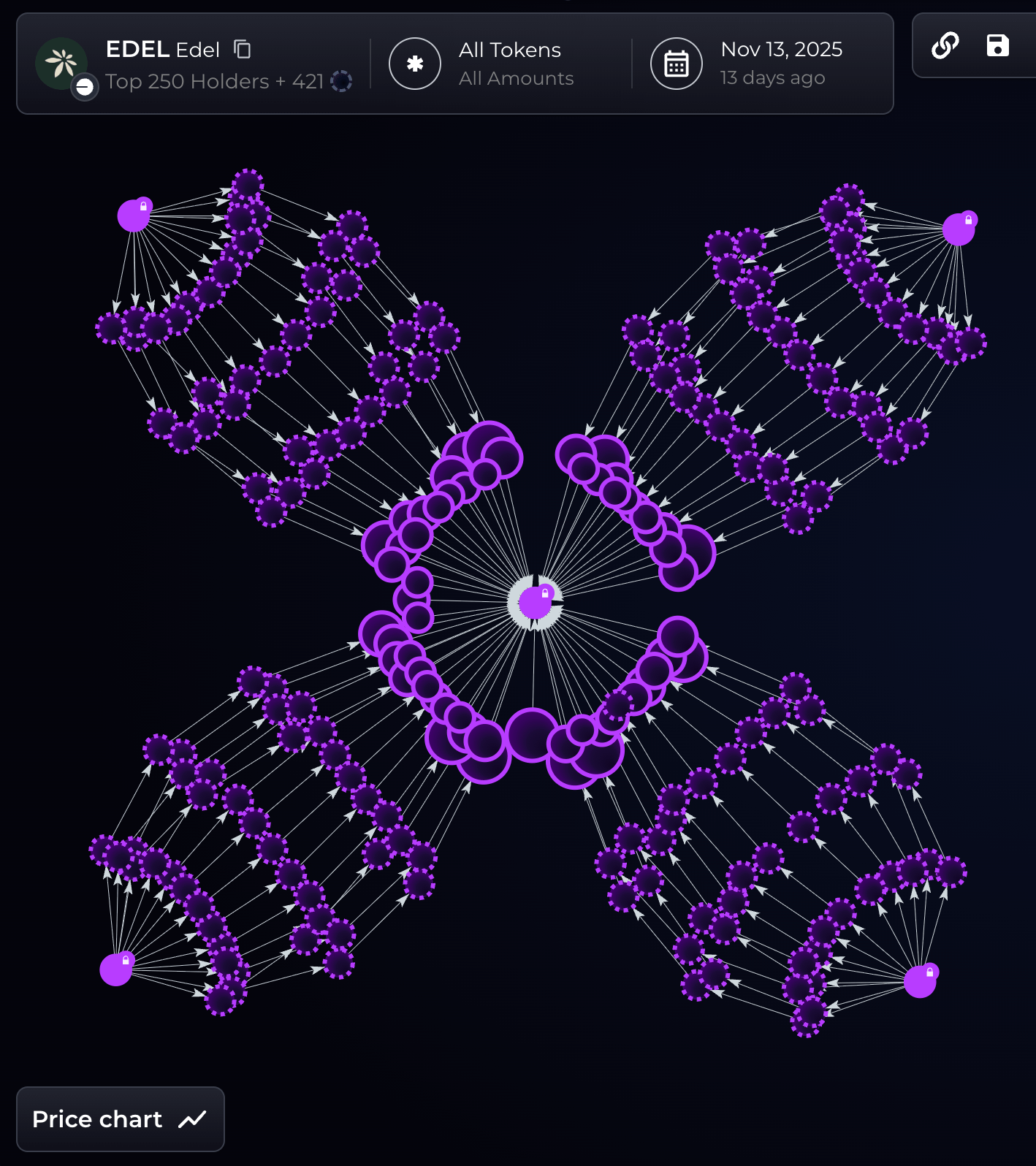

Blockchain analytics platform Bubble Map claimed in an X post on Tuesday that a cluster of around 160 wallets had amassed 30% of the EDEL token supply, worth $11 million, during its launch earlier this month. The platform claimed that the wallets were linked together and the funds were provided shortly before the transaction began.

“Edel Finance targeted 30% of EDEL. It then tried to hide it behind a maze of wallets and liquidity positions,” Bubble Map said. “Just a few hours before $EDEL was launched, around 60 wallets received funding from Binance (…) which collectively captured 30% of the supply and is now worth $11 million.”

In cryptocurrency slang, sniping refers to the use of a cryptocurrency trading bot to automatically purchase a supply of new tokens as soon as they are released to the public. Sniper aims to get in before the general public buys at a cheaper price.

sauce: bubble map

Bubble Map claimed that all wallets were funded with Ether (ETH) almost simultaneously and transferred through a “new wallet layer” before buying up the supply of tokens through the last wallet layer.

Each wallet received 50% of the targeted EDEL, with the remaining 50% distributed across approximately 100 secondary wallets, all of which were reportedly funded through the MEXC exchange.

“A list of all 100 secondary wallets is included directly in the token contract creation code,” creating a “clear link between the team and Sniper,” Bubble Maps said.

Cointelegraph was unable to independently verify the wallet cluster that captured 30% of the token supply.

EDEL/USD, 1 week chart. Source: CoinMarketCap

EDEL, which was founded on November 12, has a market capitalization of approximately $14.9 million, but has fallen 62% over the past week, according to CoinMarketCap.

Edel Finance is a decentralized lending protocol that aims to bring traditional equity to on-chain lending. The team is backed by former employees of State Street, JPMorgan and Airbnb, according to XPage.

Related: More than 8% of Bitcoin traded in one week, market on ‘knife edge’, analyst says

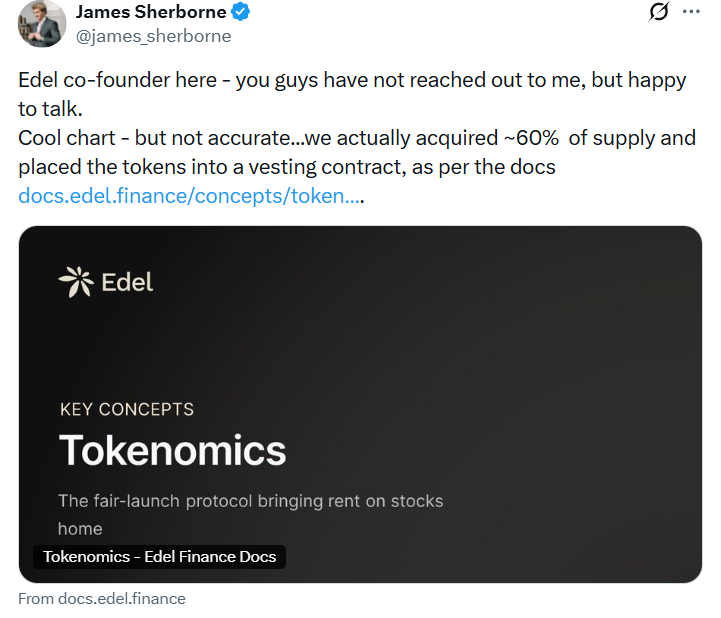

Edel co-founder denies sniper allegation

In response to the findings, Edel Finance co-founder James Sherborne said the team planned to acquire 60% of the token supply, which was then locked into a token vesting agreement.

“Cool chart, but not accurate…According to the documentation, we actually acquired about 60% of the supply and tied the tokens into vesting contracts,” Sherborn wrote in a Tuesday X reply to Bubble Map.

james sherborne

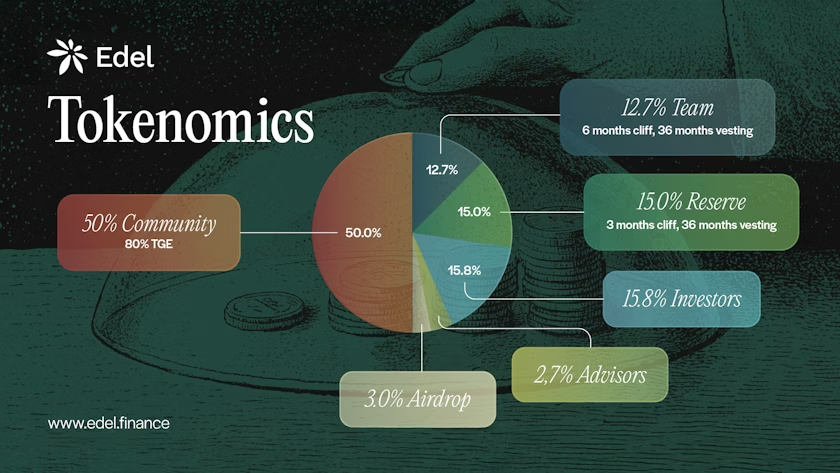

Based on Edel Finance’s tokenomics document shared by Sherborn, only 12.7% of the token supply was allocated to the team through a 36-month vesting schedule consisting of 6-month cliff unlocks.

EDEL Tokenomics. Source: docs.edel.finance

Related: Monad Airdrop Farmer Spends Entire $112,000 MON Reward on Gas for Failed Deal

Despite the team’s quick response, Bubble Maps called the explanation a “Hayden Davis defense,” referring to the controversial co-creator of the official MELANIA and LIBRA and Wolf of Wall Street-themed WOLF meme coins.

Notably, Davis launched a Wolf of Wall Street-themed meme coin with over 80% insider supply, and the token crashed 99% within two days.

“I snipe my token without telling anyone, but trust me it’s okay. If you were real, you would have pre-allocated the supply based on tokenomics,” Bubble Maps responded to Edel co-founder.

Additionally, Bubble Maps added that the 50% EDEL token supply on the vesting schedule comes from token deployers and “has nothing to do with Snipe.”

Cointelegraph has reached out to Edel Finance for comment.

magazine: Inside a farm of 30,000 phone bots, crypto airdrops are being stolen from real users.