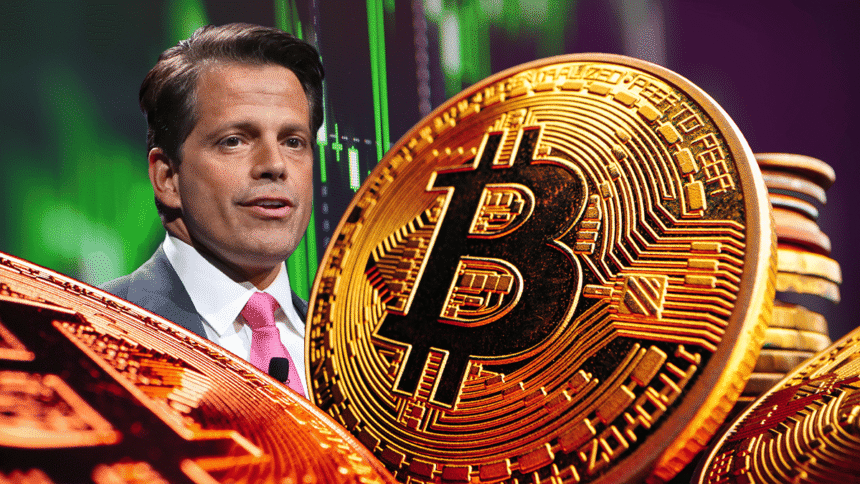

The future of Bitcoin (BTC) continues to attract attention from investors and analysts. Skybridge Capital founder Anthony Scaramucci shared his optimistic vision for currency.

Scaramucci maintains a forecasting company: Bitcoin could reach $180,000-$200,000 by the end of 2025.

“This is a cautious price target,” he said, emphasizing that other forecasts are above those levels. Therefore, the businessman shows that he is not worried about recent revisions.

According to Scaramucci, daily emissions of 450 BTC are limited, and the growing demand supports that optimism.

According to entrepreneurs, the key behind this upward cycle lies in institution adoption. “Three years ago, Bitcoin conferences were dominated by retail investors and businesses in the cryptocurrency sector. Today, institutional investors are reaching the masses,” he said.

A clear example is BlackRock’s iShares Bitcoin Trust (IBIT), the world’s largest Bitcoin ETF, with 747,423 BTC of $840 million. The fund reflects a growing interest in superior institutions to integrate recruitment trends..

Despite the boom, the market is not exempt from volatility. Scaramucci highlighted that some whales with over 1,000 BTC (units with over 1,000 BTC) are selling a large amount of BTC, such as when they settled 80,000 BTC last month.

“There’s a history of property integration and change,” he explained, but he argued. Demand is widespread beyond available supply, and prices rise.

ETF vs. corporate strategy

When comparing investment options, Scaramucci highlighted the relevance of Bitcoin ETFs in cash as an IBit called the “pure bond with Bitcoin.”

He also praised Michael Saylor’s strategy. The strategic company has accumulated 629,376 BTC, urging other companies to issue debt to acquire not only Bitcoin, but also cryptocurrencies such as ethher (ETH), Ethereum, Solana (SOL) and avalanche (avax) to acquire digital assets (ETH).

“Sailor is doing extraordinary things and imitators are showing it,” he said. but, He admitted that ETFs are preferred options by institutions that cannot directly carry Bitcoin.others choose stocks in the company such as strategy.

Voices of opposition

Analyst Willie Wu is also on the rise, ensuring that Bitcoin is well positioned to continue climbing, provided the market liquidity remains strong. However, he warns of the possibility of a major fall once the new maximum is reached, as reported by the encryption.

On his part, SwissBlock’s chief economist Henrik Zeberg offers a more careful perspective. Considering Bitcoin, a highly risky asset that correlates with Nasdaq, Warn that stock market corrections could cause a significant drop.

Turning to the Jackson Hole symposium, Federal Reserve President Jerome Powell speaks this Friday. The market expects signals that could affect the Bitcoin trajectory. Meanwhile, Scaramucci’s forecasts and institutional benefits, led by funds such as IBIT, are not exempt from risk, but they keep the upward narrative alive.