There is currently a split in Ethereum. The big money players have secretly started wasting $350 million since Dec. 26 while the rest of the market watches..

money flow index

This is clearly visible when you look at the data. Money flow indices, which track money coming in and going out, show that small investors aren’t actually putting real cash into these price movements. In other words, if Ethereum rises, they won’t rush to buy.

From December 18th to 24th, the price of Ethereum increased above, However, the money flow index has declined. That’s the opposite of what you want to see. it showsReThe average person just doesn’t believe what’s happening with prices right now.

Experts say retail investors are unlikely to start buying until the money flow index exceeds 37. It’s still below that at the moment. right This raises the question of whether Ethereum can maintain its value without small businesses entering the market.

what the chart says

Chart users believe that the whales are aware of what they are seeing. An inverted head-and-shoulders pattern may be emerging on the Ethereum chart. It may sound complicated, but it means that prices can change from falling to rising if certain conditions are met.

There is another clue worth noting. What traders call a bullish divergence is indicated by the Relative Strength Index (RSI). Ethereum price reached a low between November 4th and December 25th, but the RSI actually reached an even lower low during that period. This usually indicates that selling pressure is starting to ease, even if the price doesn’t show it yet.

but Ethereum has Some walls to break through first. The current maximum is $3,050. obtain After that, the next stop is $3,390.

If Ethereum can break above $3,390, chart observers believe it could rise to $4,400. That’s what the pattern suggests anyway. of course, can do thingsI’m going There are other ways too. drop Less than $2,800 and This whole setup drop down Aside from that, the price could drop to $2,620.

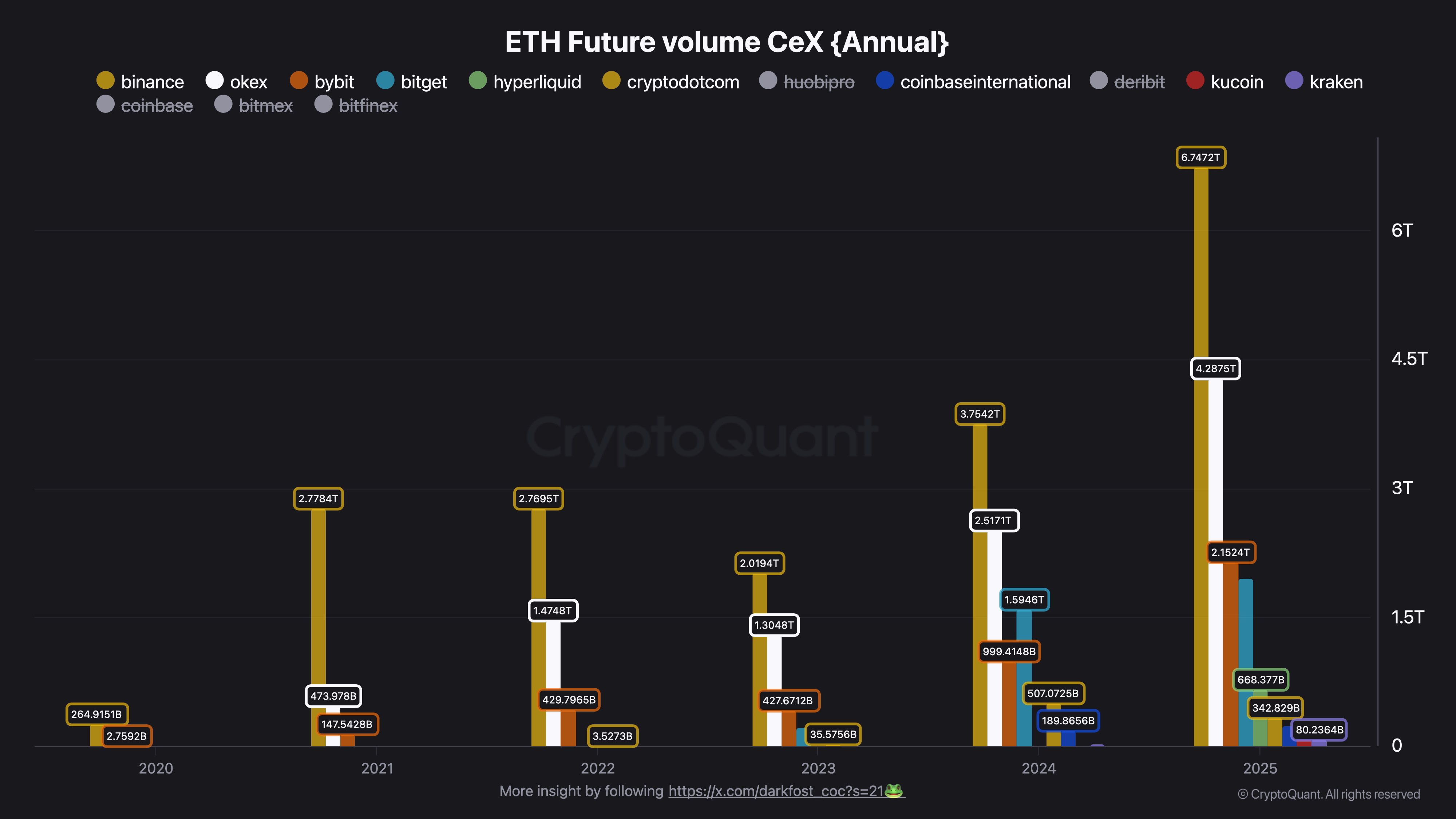

Futures trading has been absolutely insane this year. According to CryptoQuant researcher Darkfost, Binance processed over $6.74 trillion in ETH futures in 2016. 2025. In other words About This is double the amount observed the previous year.

Comparison of price and network performance

As 2025 draws to a close, Ethereum is stuck below $3,000. The second-largest cryptocurrency is trading about 41% below its August high. This is pretty rough considering how much the network itself has improved.

However, actual utilization numbers paint a different picture. Ethereum had a record day on December 24th, reaching an average of over 1.73 million transactions per week. It reached an all-time high. This expansion is being driven by stablecoin trading, DeFi technology, and layer 2 networks.

big players take action

But some major companies are making big strides. On December 28th, BitMine Immersion Technologies purchased approximately 103,000 ETH, increasing its holdings to 257,600 coins, or approximately $750 million. This makes them one of the largest institutional holdings, totaling over 4 million ETH.

Other celebrities are pursuing other tactics. Venice AI’s Erik Voorhees transferred around $5 million in ETH to Bitcoin Cash, while Arthur Hayes is funneling Ethereum funds into other DeFi ventures.

Tokenization of real-world assets is one of the factors that will sustain bulls’ enthusiasm over time. In 2025, this market jumped from $5.6 billion to more than $18.9 billion. With over $12 billion in tokenized assets, Ethereum dominates this market, outpacing rivals such as Solana and BNB Chain. Additionally, the network manages approximately $170 billion worth of stablecoins.

Experts in this field believe that this trend will continue for quite some time. Tom Lee of Fundstrat predicts the price of Ethereum will reach $7,000 to $9,000 by early 2026, citing the adoption of blockchain technology by traditional finance. This is more than just crypto hype, as evidenced by DTCC’s announcement that it will tokenize US Treasury assets on the Canton blockchain.

what happens next

Chart-wise, Ethereum is stuck in a box between $2,900 and $3,000.

Market conditions remain quite volatile. More than 40% of ETH holders are in losses, and the derivatives market is heavily leveraged. Fusaka’s upgrade went smoothly in early December, proving that the technology continues to advance, but whether it can translate into price increases will likely depend on institutional money returning next year.

Whether Ethereum can break out of this range will mainly depend on two things. The question is whether big institutional investors will start buying again, and whether everyday traders will regain the confidence to jump in again. For now, the whales are betting YES, but they’re mostly flying solo.