The technical indicators suggest that Bitcoin (BTC) could surpass $140,000 by the end of 2025 despite the ongoing integration phase.

The forecast is based on the outlook from prominent online cryptocurrency analysts. Trade shot,who, TradingView Posting on September 30th, I highlighted the 20-period moving average of assets (1W MA20) as an important guide to this goal.

Experts observe that this indicator has historically led to a bullish continuation of Bitcoin and defines momentum now.

Since April 2025, Bitcoin has been on the uptrend with each weekly closing above the 1W MA20. This threshold, particularly in the rare cases where price action fell below this threshold in June 2023, the decline continued until we tested or approached the long-term blue trendline, the 1W MA50.

Recent market behavior has reinforced this level of importance. Since August 25th, Bitcoin has closed for a week beyond the 1W MA20, solidifying its role as support. This confirmation will enhance higher priced cases as long as the levels continue to be retained.

Historically, when Bitcoin bounces off this structure, the rally has exceeded 90%. Even the weakest advances in the current cycle reached 96.38%. A similar move from the current setup forecasts an upside target of around $145,000 by December.

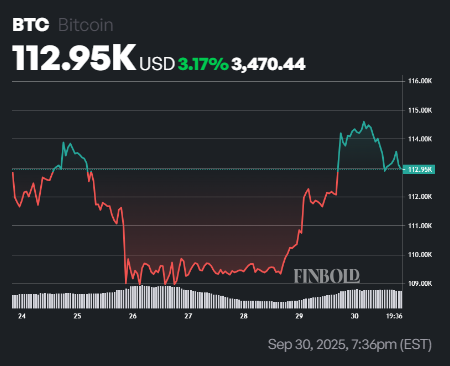

Bitcoin price analysis

At the time of pressing, Bitcoin was trading at $113,000, slightly correcting 0.7% in the last 24 hours, earning almost 3% in the past week.

Currently, Bitcoin is just under $113,849 for the 50-day SMA, but it maintains a strong lead at $104,380 for the 200-day SMA.

This setup reflects a healthy long-term uptrend as it is a key indicator of sustained bullish momentum as its prices are well above the 200-day average.

However, a small trading in a 50-day SMA suggests short-term consolidation rather than immediate breakout intensity.

Meanwhile, the 14-day RSI at 52.51 has a neutral stance, with the acquisition not being oversold and showing balanced momentum.

Featured Images via ShutterStock