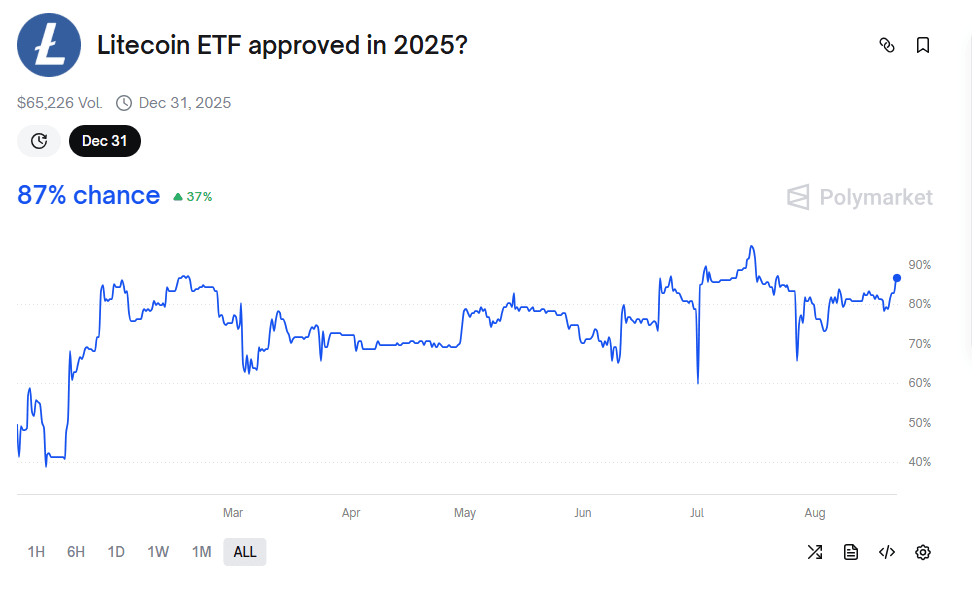

The current probability of Litecoin (LTC) spot ETF approved in 2025 is: 87%According to the forecast platform Polymate. However, recent delays from the US Securities and Exchange Commission (SEC) and competing applications from other crypto assets suggest that while approval is possible, it is not guaranteed.

Polymarket Odds for 2025 Litecoin ETF Approval (Image: Polymarket)

Litecoin’s price action reflects this uncertainty. After climbing to 5 months’ height $133LTC has retreated as ETF rumors and investments in the Corporate Treasury are fueled. I’ll trade $155.60below 5.8% over the last 7 days, And this month 1.7%gives the coin a market capitalization $88.1 billion (coinmarketcap).

Why Litecoin ETFs are important

a Spot Exchange Trading Fund (ETF) Investors can gain exposure to the underlying asset (here, Litecoin) without directly holding or managing it. Spot ETFs differ from futures ETFs because they track the actual market price of an asset.

There are several meanings to approval of the Litecoin ETF.

- Institutional access: Open the door to traditional funds and retirement accounts to allocate capital to LTCs.

- Growth of liquidityETF drives historically higher daily volumes, as seen in Bitcoin Ethereum.

- Market legitimacy: SEC approvals indicate regulatory trust in LTC maturity and resilience.

For now, investors are considering whether Litecoin will become the third major cryptocurrency after Bitcoin and Ethereum.

Current status of Litecoin ETF filing

Several investment managers have applied for Litecoin ETFs.

- Canary capital: Submit first and submit Nasdaq January 15th, 2025.

- Grayscale Investment: Submitted immediately and targeted NYSE ARK.

- Coin share: Participated in races with similar products, adding weight to institutional interests.

Despite these moves, the SEC has Delayed decision With all Litecoin ETF applications October 2025group them with XRP reviews Solana ETFS. The committee cited the need for more public input and further evaluation of fraud prevention standards.

Previously, public comments were open May 26, 2025the objection is accepted June 9, 2025.

SEC’s careful stance

SEC takes a systematic approach to cryptographic ETFs. Bitcoin and Ethereum Spot ETF approvals only occurred after multiple rejections and extensive legal battles.

“We’re looking forward to seeing you in the future,” said Nate Geraci, president of ETF Store.

“The SEC is conducting careful reviews, but approval remains possible if regulatory concerns are addressed by October 2025.”

Key SEC concerns include:

- Market operational risks At the crypto spot market.

- Investor Protection Standards and custody solutions.

- Surveillance and sharing agreement On a regulated exchange.

Until these issues are fully addressed, the delay remains the SEC’s preferred approach.

Forecast market odds and analyst views

- Polymate: 87% chance of approval for LTC ETF in 2025.

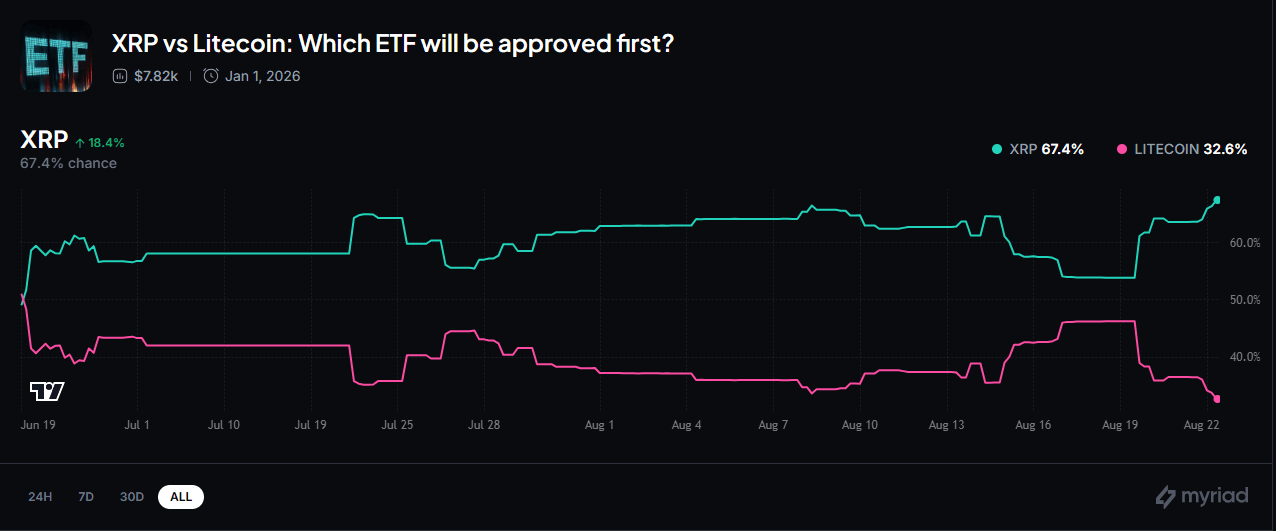

- Myriad: Almost two-thirds of users predict An XRP ETF Approved before Litecoin.

- Last February, Bloomberg ETF analysts James Seifert and Eric Baltunas Estimated There is a 90% chance that US regulators will approve a Spot Litecoin ETF by the end of the year.

- Illia Otychenko (cex.io): It argues that the main driving force of LTC strength in recent years is corporate financial investment, not ETF speculation.

Otychenko points to Mei Pharma’s $100 million Treasury to Litecoin The real catalyst behind the price surge is pointing out that “90% ETF odds have been priced since February.”

About countless odds “XRP vs. Litecoin: Which ETF is first approved?” (Image: countless)

Market adoption signals

Beyond ETF speculation, Litecoin has shown a stable adoption as a payment currency.

- Coingate data: Litecoin explained 14.5% of crypto payments It was processed last month.

- This places the LTC Only the second Bitcoinahead of USDC.

- Payment adoption highlights Litecoin’s long-standing reputation as a high-speed and low-cost network.

Such utilities enhance the case of ETFs by showing actual use beyond speculative trading.

Short-term volatility, long-term positioning

Regulation delays have generated sharp market fluctuations. For example, analysts have focused on recent price ranges. $84.65 to $89.51 When the trader sold in disappointment in the postponement of the SEC.

Still, institutional managers remain ready.

- Grayscale, Bitwise, Coinshare We are continuing to build our ETF infrastructure.

- Market precedents show that once approval comes, the inflow is rapid, as happened with Bitcoin and Ethereum ETFs.

- October 2025 deadline A key milestone for Litecoin, XRP and Solana ETF.

Competing assets: XRP and Solana

Litecoin is not the only asset under review. SEC is considering multiple AltCoin ETF applications simultaneously.

- XRP: Strong community and corporate support. The forecast market first supports XRP approval.

- Solana (Sol)Although it is a rapidly growing ecosystem, regulators can consider decisions related to past SEC litigation against tokens.

The fact that Litecoin, Solana and XRP are reviewed together suggests that the SEC is valuing it AltCoin ETF as a Category Not alone.

Analysts at Bloomberg ETF estimate that there is a 90% chance that US regulators will approve the Spot Litecoin ETF by the end of the year.

Last February, analysts James Seifert and Eric Balknath believe Litecoin has stronger odds than other pending proposals, including 65%, 70% and 75% of XRP, Solana and Dogecoin’s SPOTETF.

What does this mean for Litecoin investors?

For now, investors should expect:

- Continuous volatility It is tied to regulatory headings.

- There is no final decision in front October 2025.

- Institutional influx Only after the ETF is approved can a company be positioned early.

Even if approvals do not arrive immediately, the SEC’s procedural moves indicate that Litecoin continues to consider it. That in itself is an important signal.

Conclusion

The odds of approval for the 2025 Litecoin SpotETF are nearby 85%However, filings that compete with the delays in XRP and Solana’s SEC mean that nothing is guaranteed. The institutional benefits are strong, with multiple asset managers applying for ETFs and companies like Mei Pharma committing to the financial capital.

Final deadline October 2025 It will be decisive. Until then, Litecoin remained stuck between increasing adoption, corporate interests and regulatory attention. While approval can result in inflows and legitimacy, investors must prepare for the process that was drawn out.

resource:

Litecoin LTC Spot ETF polymake odds are approved: https://polymarket.com/event/litecoin-etf-approved-in-2025/litecoin-etf-approved-in-2025

Litecoin Price Action: https://coinmarketcap.com/currencies/litecoin/

Myriad’s odds of “XRP vs. Litecoin: First ETF approved”: https://myriad.markets/markets/xrp-vs-litecoin- which-etf-will-be-approved-first-9f8eab80-5487-4e81-85bb-cbced5cad595