In April 2023, Bitconnor, who went under the name of Bledman, bought the property for $496,000. This was equivalent to 22.5 BTC at the time. Fast forward to August 2025, the property is currently valued at $570,000, a respectable profit of 15% on the dollar terms. But here’s the kicker. Bitcoin price, his home is now worth just 4.85 BTC, a staggering 78% loss when measured against the world’s most difficult money, highlighting the quiet crash of real estate as a storage asset.

Bledman’s painful personal anecdote, disguised as a rise in Fiat prices, reveals a quiet crisis that wavys across the global real estate market, which is wide open when viewed through the Bitcoin lens.

Quiet crashes in real estate are more pronounced in the US

Mediterranean countries like Spain record annual price growth at 7-8%, and the wider global picture is more uncertain, even with double-digit jumps of value value valued in Portugal.

In North America, the UK, and many other parts of Europe, the pace of property viewing has slowed down dramatically. UBS Global Forecast for 2025 predicts capital value will be “fairly flat” this year after a decline in 2022 and a steady recovery, with the housing sector showing only “conservative uplifts.”

Fiat Erosion: Why are real profits not visible?

On paper, it sounds like a 15% increase over two years is solid. However, inflation is digging into the lent of those Fiat profits. The revised forecast pinned US inflation in 2025 as more than 4%. Adding local volatility from tariffs and global policy changes often means that the true profit margin on property is much lower than the headline figures.

It deteriorates in many emerging markets, with high inflation (sometimes three digits) wiping out nominal profits and even eroding true wealth. For example, Argentina’s annual inflation exceeded 200% in 2023. In other words, property owners often saw an increase in the currency value of areas completely hidden by dramatic losses in purchased electricity.

Bitcoin: The Ultimate Measurement Stick

Zoom out. Since April 2023, Bitcoin has skyrocketed from ~$22,000 to over $118,000, surpassing all major asset classes on the planet, and has warned the profits of dollars made in real estate. The house may be more expensive in Fiat, but it’s very cheap from a BTC standpoint.

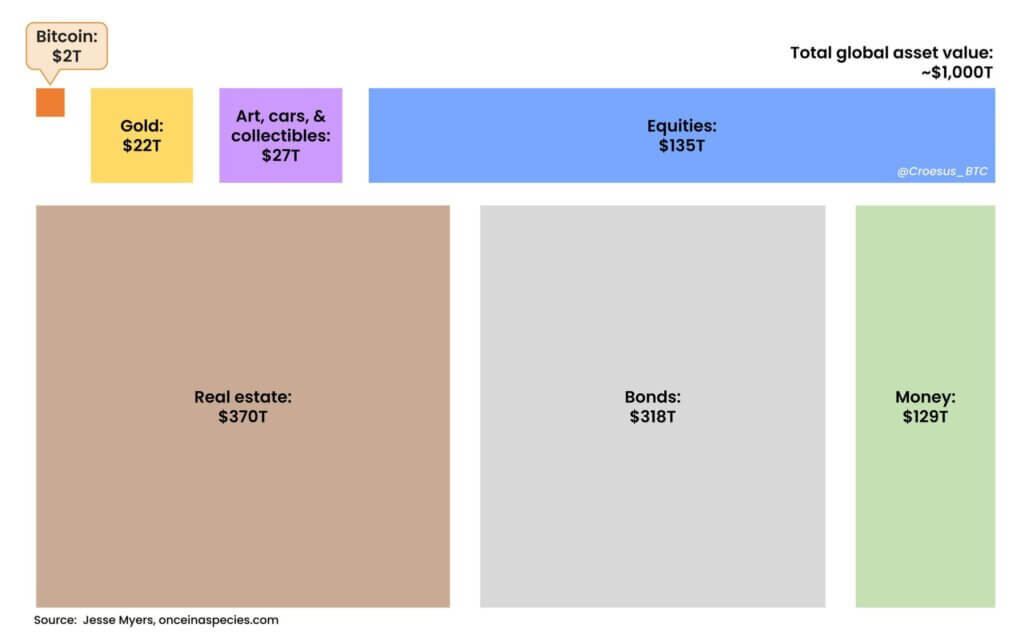

Macro investor and Bitcoin advocate James Rabish has called for the largest addressable asset class and global real estate for wealth seeking inflation protection. He highlighted $998 trillion in capital parked in real estate and other global assets. All of these have steadily lost their position in Bitcoin’s rarity-driven deflation model.

A house looks like a good investment in nominal charts, but when measured against true hard money, it breaks down the actual purchasing power.

“Bitcoin Pizza” Effect: When Value becomes a Parabolic

Exchangeing Bitcoin for other assets has proven to be extremely expensive over the years. Ask Laszlo Hanyecz, who traded 10,000 BTC for two pizzas in 2010. At the time, the coin was worth around $41. Today, those pizzas earn more than $1.1 billion. What appears to be reasonable in Fiat’s terminology has become a legendary loss in the value of Bitcoin, and a warning substance for those who measure wealth with the dollar alone.

Global headlines promote resilient things and even rising real estate prices, but a new reality is emerging for people with a bitcoin perspective. It crashes very much from the perspective of real estate BTC, and inflation further erodes Fiat’s profits.