XRP fell below $2.30 this week, wiping out all profits registered in last week’s short-lived rally. The cryptocurrency, which rose 8% to $2.28 last week from $2.06, fell 3.5% from its opening price on Monday and a 7% from its weekly high of $2.36.

Market experts predict that the potential 30% will fall to $1.55

Cryptocurrency analyst Blockbull predicts that XRP It may fall far deeper in the near future. From the Analyst’s April 29th X Post, XRP was unable to break resistance levels at the top of the bull flag pattern on the daily chart.

This technical failure could push the price up to $1.55. “As annoying as hell”Block Bull says 30% has dropped from the height of the pattern, 28.6% from the current level.

Blockbull’s info-based followers could prove that this potential price drop is short and the perfect entry point for investors. Analysts speculate that big money players tend to use this recession in the market to accumulate holdings at bargain rates.

probably $ xrp I’m planning to drop 30% together $ xlm That ive has just been posted.

Bull flag and FIB level bottom make great entries

$1.55 (An annoying like hell)

This is why the rich become rich when you bleed the average man. pic.twitter.com/pg3h30swks

–  Blockbull

Blockbull (@theblockbull) April 29, 2025

(@theblockbull) April 29, 2025

Bitcoin and Ethereum are also struggling, so it’s not just XRP

The downward pressure on XRP is consistent with weaker trends in major cryptocurrencies overall. Bitcoin I’m struggling to cross the $95,000 threshold Ethereum It’s below $1,800. It has been shown that this is a market-wide fix and not a specific XRP issue.

Competing analyses provide more optimistic predictions

Not everyone who monitors the market has a disastrous outlook. Others said XRP can surpass key support levels in short time frames while it is down 6% from $2.28 to $2.14 over two days.

They said that if XRP can hold support for $2.14, the price could return to more than $2.24 in a short period. A more positive prediction indicates that XRP could reach $5 a month. This is the best ever for cryptocurrency.

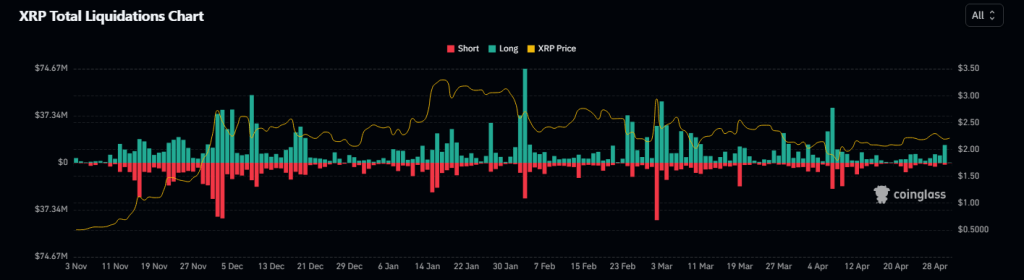

Liquidation data shows market imbalances

Meanwhile, the latest trading statistics by Coinglass show shocking Market Differences. Within 24 hours, a long position of nearly $14 million (betting on rising prices) was settled, with short positions worth just $1.48 million being sold.

This almost 1000% gap indicates that the majority of traders were betting on price increases as the market began to decline.

The sudden sale of such many long positions has been cascaded and has made prices even faster. Open profits also fell 4%, indicating that traders were closed due to increased uncertainty.

As of the latest deals, XRP was $2.20, down 1.14% from the beginning of the day. Investors now have conflicting messages about the possibility of a further decline in the coming days, or perhaps rebounding.

Unsplash featured images, TradingView charts