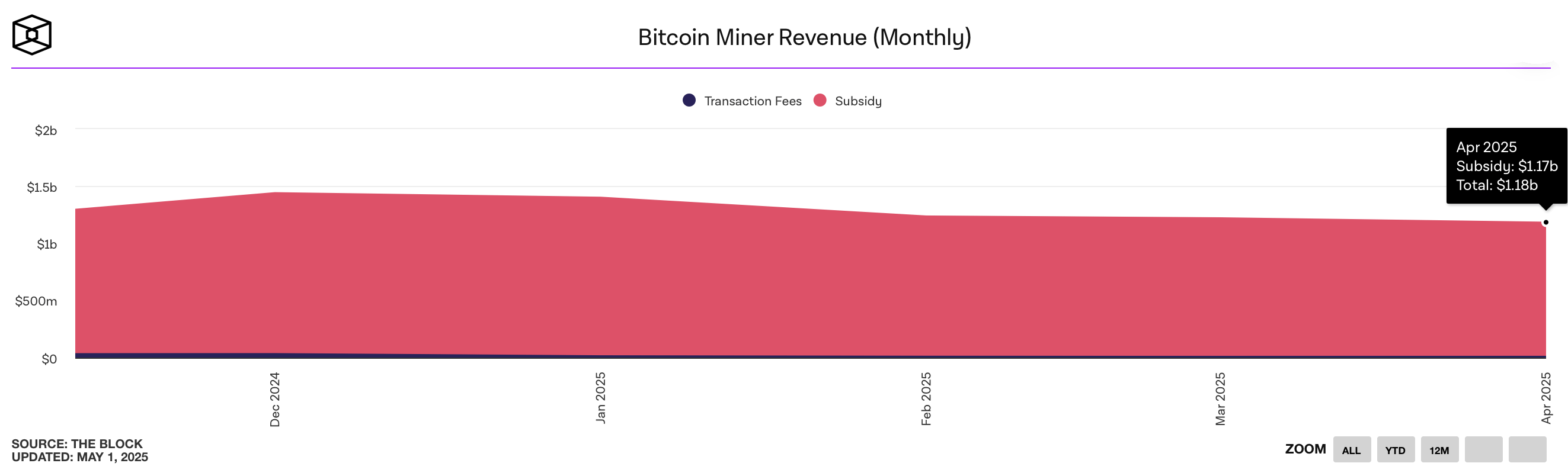

Bitcoin Miner generated $40 million in revenue in April rather than March. It marked the fourth consecutive month of decline since December as the sector continued its downward revenue trend.

April Destruction Bitcoin Miner – Slide again for 4 months in a row

The dip wasn’t dramatic, but it was still contraction. In April, Bitcoin Miner brought in $1.18 billion in total revenue, covering both block subsidies and transaction fees. Compiled data theblock.co. Of that total, the fee was $15.65 million. For comparison, revenues in March reached $1.22 billion, while the shortfall in April reached $40 million.

sauce: theblock.co

Interestingly, trading fees were slightly higher in April, with on-chain fees recorded in March of $1511 million. The overall revenue decline was higher than 30 days ago, consistent with an increase in Hashpris.r second (ph/s) of Sha256 processing power.

On April 1st, Hashpris hovered at $46.88, but by May 1st it had risen to $50.26. Still, miners are fighting a horrific obstacle: network difficulty. The metric is currently at a record 123.23 trillion. If average block times slower, the next scheduled difficulty adjustment for May 4, 2025 is projected to decrease by an estimated 5.47%.

For now, price increases have been one of the few tailwinds for miners, with monthly revenues declining, but contractions have been relatively mild. When miners navigate too thin margins and rising operational thresholds, the market subtly suggests a change in equilibrium. Efficiency is no longer an option. It’s existential.