Bitcoin (BTC) prices showed strong signs of momentum after consistent profits over the week. The major cryptocurrencies are trading at nearly $94,846, indicating a steady recovery after the previous merger.

Market data suggests that Bitcoin is set to one of the most powerful weekly performances in 2025.

Analysts believe that potential 15% breakout moves could lead to Bitcoin exceeding $109,000 if current terms apply.

Large transaction volumes and whale accumulation promote reliability

Over the past 24 hours, Bitcoin prices have recorded 23,550 large transactions. This number is very close to the seven-day high of 23,740, achieved earlier this week.

High trading activities, particularly from whales and institutions, often indicate an increase in market confidence and accumulation stages.

Market participants are closely watching this surge in transaction volumes. Many analysts suggest that the big players driving Bitcoin are preparing to continue the uptrend.

As seen in previous Bitcoin cycles, this steady rise in activity has usually resulted in stronger price movements in the past.

Source: IntotheBlock

Furthermore, current large trading activities suggest that major investors are still involved in Bitcoin at a higher price level.

This behavior reflects the belief that despite the challenges found in the $95,000 resistance zone, there is room for further growth in assets.

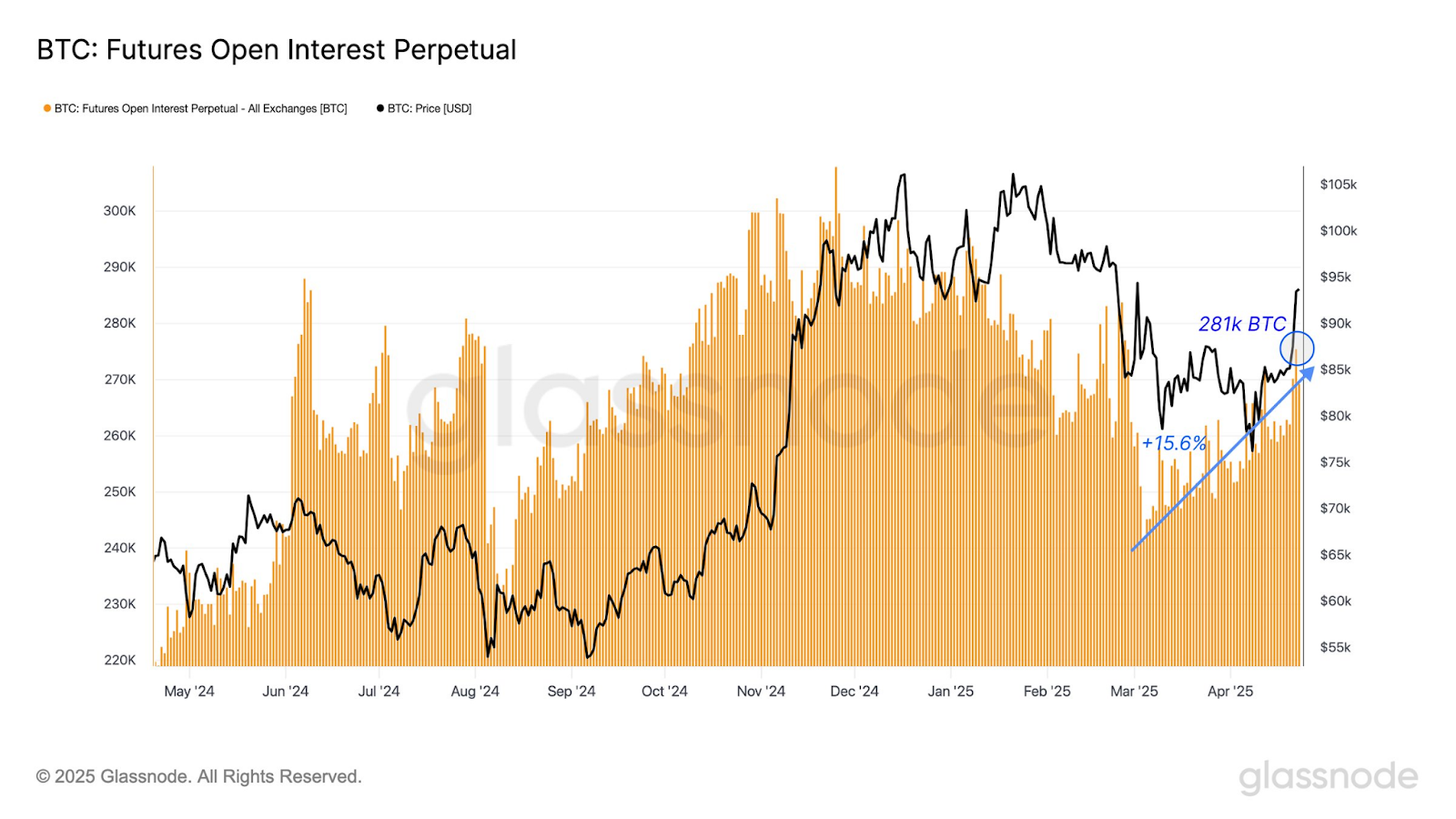

Open interest in Bitcoin futures shows up leverage

Open interest in Bitcoin’s permanent swap has risen to 281,000 BTC, according to GlassNode data.

This figure represents an increase of 15.6% since early March 2025. The growing open interest suggests that traders are increasing leverage exposure as they rebound Bitcoin prices.

Higher leverage can amplify price movements in either direction. This accumulation has led to increased concerns about potential volatility due to liquidation and suspension.

However, in bullish environments, leverage can also accelerate upward movement when prices break major resistance levels.

Source: x

Analysts warn that there is generally low liquidity over the weekend, and when markets reopen, it can lead to price ranges.

Bitcoin finished the week at a height of two months and set the stage for possible market gaps in the coming days as trends continue.

Macro environments support bullish momentum

The broader market environment remains favorable for Bitcoin’s bullish momentum. Factors such as the upcoming Bitcoin Harving Event and a strong inflow into Spot Bitcoin ETFs support purchasing pressure. Many believe these events could continue to raise prices in the coming months.

MicroStrategy founder Michael Saylor recently pointed out that Bitcoin has once again surpassed major stock indices like the Nasdaq and the S&P 500.

Saylor posted on his social media account “Bitcoin is faster,” accompanied by a graphics showing Bitcoin’s price strength.

Furthermore, the number of centralized exchange Bitcoin continues to decline. A decline in exchange-owned Bitcoin supply generally indicates that holders are moving coins into long-term storage, reducing the available supply for transactions.

This trend often leads to strong price movements as demand rises in response to a shrinking supply.

Meanwhile, top executives like Coinbase’s John D’Agostino acknowledge that the correlation between Bitcoin and the stock market could be both positive and negative.

The current positive correlation with stock rises adds another supporter of Bitcoin’s bullish price action.

Price consolidation sets the stage for breakouts over $95,000

Bitcoin went from $95,000 between $84,000 and $88,000 before this spike. This clean breakout from the integration shows that there is a new purchase right that has been revealed in the market.

The $95,000 area has served as a major obstacle in the past. However, price action still portrays Bitcoin’s bullish outlook.

This is to ensure that higher lows and sustainable trends are firmly in charge of the buyer.

So, if Bitcoin’s price is regaining $95,55,000, the technical sign means that the short-term target is at a price level of $98,000.

Source: x

Above $98,000, a few analysts offer under $106,000 in the short term and $109,300 in the long term, resulting in a 15% rating from the current rate.

These factors are backed up by the trend of whale accumulation, higher transaction volumes, and positive macros.

At the time of pressing, Bitcoin traded at $94,089.9, reflecting a 0.02% surge from the intraday low. It achieved a market capitalization of $1.86 trillion, highlighting an increase in investment.

It has increased by 0.18%, but the 24-hour volume has dropped by 22%, currently at $25.13 billion.