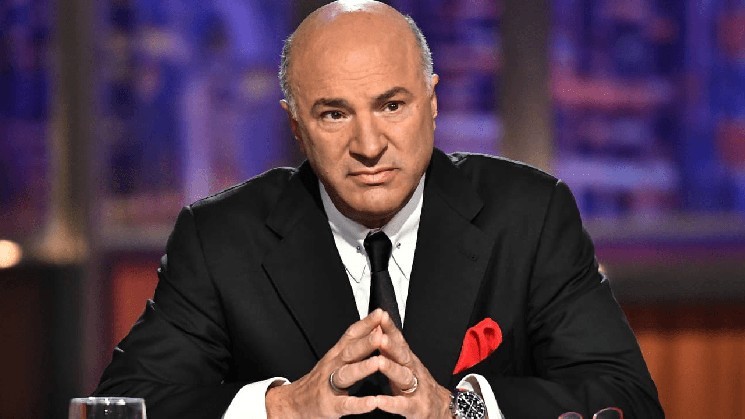

In a recent interview, Kevin O’Leary, a shark tank personality known as “Mr. Wonderfor,” said that when a significant amount of capital flows into the crypto sector, it inevitably attracts its flagship digital asset, Bitcoin.

O’Leary says that only Bitcoin unlocks institutional capital

Kevin O’Leary offered a candid and strategic take on Bitcoin (BTC) in his latest Coindesk interview, presenting it as the cornerstone of a serious crypto portfolio. He highlighted that Bitcoin has recently been detached from traditional stock indexes. This is a development he deems important, suggesting that the assets are matured into a clear investment category.

Gold has long been institutional favor, but O’Leary pointed out that Bitcoin is beginning to assert its status as a hedge and valuable reservoir. He disclosed his portfolio allocation. This is a broader exposure to the crypto sector, including infrastructure plays such as Coinbase and Robinhood, which holds 1.5% in Bitcoin.

He believes these platforms will benefit greatly if regulatory frameworks such as the Genius Act and the Stablecoin Act are passed to streamline digital payments and dramatically reduce costs. Investors in the facility said they have toe toe to the crypto, and the default entry is Bitcoin (not Ethereum or Layer 2 tokens).

“If you want to be exposed to crypto volatility, it’s Bitcoin,” O’Leary said. “I mean, it’s not eth. It’s not a place to go unless you start to understand the usefulness of it. And then, “Why am I just eth? Why am I not in L2?”

O’Leary added:

So I don’t think it’s going to become ETH for the billions waiting to enter the code. That would be Bitcoin in itself. Frankly, there are a lot of people who say I don’t need anything else. If you want to be exposed to crypto volatility, you just need to buy Bitcoin. And they weren’t wrong.

He argued that regulations were the next important milestone. Trillions of institutional capitals continue as Crypto is clearly portrayed as compliant and auditable by US law. O’Leary’s Crystal Ball Prediction? Bitcoin is likely to attract nearly $100,000 more than $80,000 by mid-May, backed by new decoupling from stocks and promises of regulatory clarity.