Bitcoin prices have recovered strongly over the past week, recovering from a low of $74,000 earlier this month, and are currently trading above $95,000.

This upward movement represents a 12% increase over the past seven days, indicating a potential change in short-term market sentiment following weeks of correction and volatility. Despite this upward trajectory, some underlying indicators suggest that investors are cautious, especially within the derivatives market.

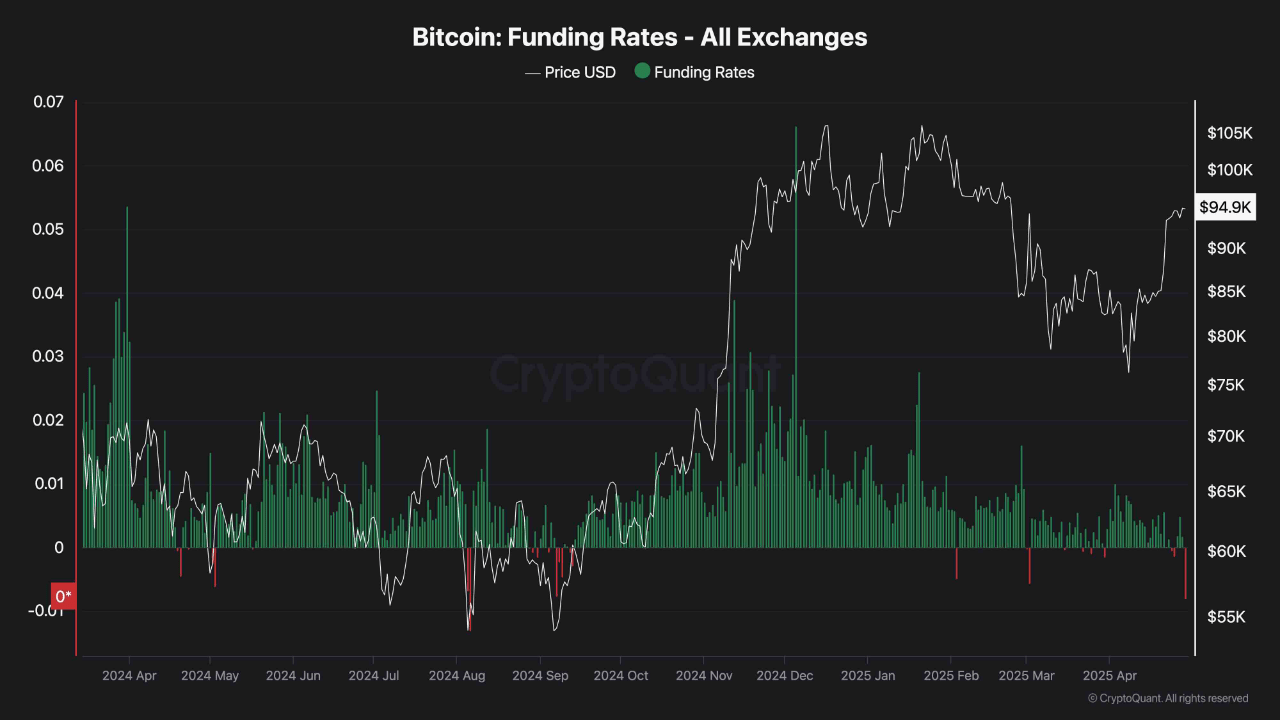

Bitcoin’s negative funding rate will be returned during price gatherings

The crypto staple analyst known as ShayanBTC points to the development of developments between price action and financing rates, particularly in perpetual futures contracts. Funding rates serve as a measure of trader sentiment and indicate whether long positions dominate.

Although the price of Bitcoin has risen, Shayan has revealed that recent funding rate behavior suggests that many participants are hedging against potential negative risks.

Divergence raises questions about whether current meetings will be maintained or whether short-term retraces could occur before further continuation. Shayan emphasized that even if the price was pushed to $95,000, Bitcoin’s funding rate was once again negative.

This dynamic reflects trends observed during long-term revisions between March and October 2024, with funding rates remaining negative during intermittent gatherings. Negative funding rates usually indicate the dominance of short positions or hedging behaviors among traders in the derivatives market.

Analysts suggest that this new divergence may reflect the lack of convictions at the rally, with participants preparing for the possibility of a reversal at key levels of resistance.

Shayan also noted that the current structure shows similarity to the previous period in which the market saw a temporary drawback before resuming upward movement.

In this context, traders may be engaged in distribution strategies by reducing risk exposure or selling strength. The presence of careful positioning at the time of price rises indicates a market imbalance that can often lead to short-term corrections.

STH Realization Prices and Structural Considerations

Meanwhile, BTC’s Short-Term Holder Realization Price (STH-RP) is also a metric worth valuing Bitcoin macro trends. STH-RP reflects the average cost base of coins held by recent market participants.

Sustainable bull markets often maintain price levels above STH-RP, according to on-chain data. Currently, Bitcoin remains close to this threshold, and the ability to hold or break it above could shape short-term momentum.

Shayan’s analysis concludes that while pullbacks can occur in the short term, differences between rising prices and lower funding rates can lead to healthier accumulation and shaking weaker hands could strengthen the overall market structure.

Special images created with Dall-E, TradingView chart