With some impressive milestones, Tron Network continues to insist on controlling the payments division of Stablecoin. Recently, the amount of USDT (tether) circulating on Tron has reached an all-time high.

Meanwhile, the number of long-term Tron holders exceeds 2.66 million addresses. This reflects the strong confidence of retail investors and their long-term commitment to this layer-1 blockchain.

Will Tron’s USDT supply exceed Ethereum?

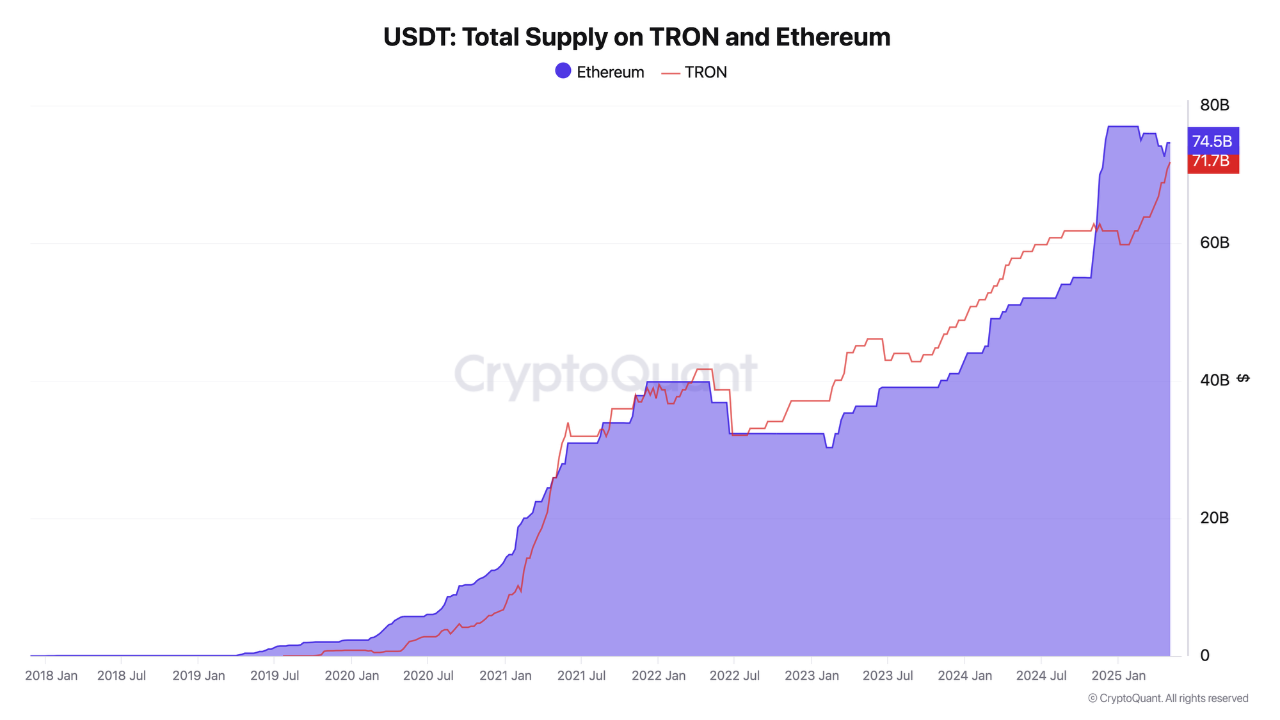

Data from Cryptoquant shows that Tron’s USDT supply has been steadily growing in recent years. Currently, Tron’s USDT market capitalization is reaching a record high, with over $71 billion in circulation.

Meanwhile, Ethereum hosts $74.5 billion in circulation. Tron narrows the gap between traders’ use of USDT with ETH.

Total USDT supply for Tron and Ethereum. Source: Cryptoquant

“This milestone holds Tron’s position as one of the major blockchains in defi space, and could even outweigh the adoption of major chain competitors in the future,” commented analyst Darkfost.

In the context, Stablecoin’s total market capitalization is $242 billion, with Tether (USDT) alone making up $149 billion. In other words, Tron promotes smooth transactions of 29% of Stablecoin’s market capitalization and 47% of USDT’s market capitalization.

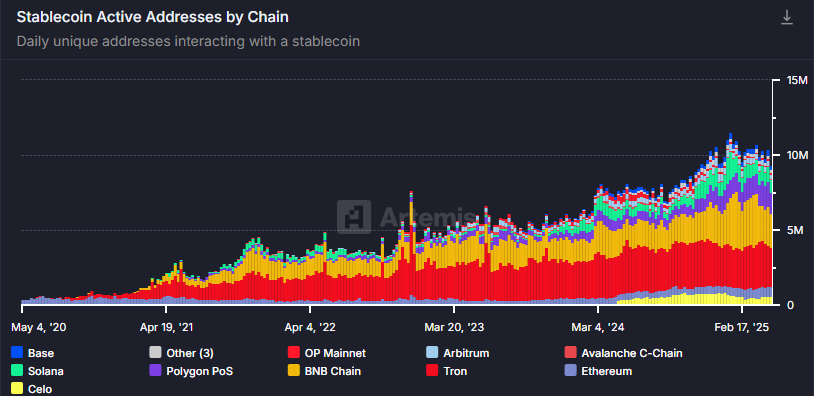

Furthermore, Artemis data shows that Tron accounts for 28% of all active Stablecoin wallet addresses. This makes Tron the top chain in terms of toll revenue.

Stablecoin active address by chain. Source: Artemis

A recent report from Beincrypto reveals that experts predict that Stablecoins will attract strong interest in future VCs. The number of publishers could be ten times higher. New issuers may choose Tron, which will benefit blockchains that can handle $150 billion in Stablecoin trading volume each week.

Tron (TRX) is supported by loyal long-term holders

Cryptoquant also reports that 2.66 million TRX addresses have held tokens without using them for more than a year. These wallets maintain a balance of at least 10 TRX. The 10 TRX is worth just a few dollars, but many retail investors have opted to hold Tron for the long term, even with a small amount of capital.

Analyst CrazzyBlockk believes this metric shows strong user loyalty and sustained engagement. We believe this will support the TRX price in the long term.

Long-term Tron holder (>1 year holder). Source: Cryptoquant.

“The increase in long term holdings is often associated with higher trust and potential for liquidity resilience in the underlying network,” CrazzyBlockk said.

However, some investors argue that Tron’s vitality is heavily dependent on USDT trading. Dune’s data shows that over 3 million Tron wallets are active every day, but most trade only USDT. Therefore, strategic changes in tron and relationships can have a significant impact on TRX’s network and price.

This dependency highlights the weak utilities of trons outside the USDT space. For example, Tron is far behind Solana in the deployment of Meme Coin, and is far behind other chains in decentralized exchange (DEX) trading volumes. Furthermore, Tron appears to lack almost the market share of its actual assets (RWA).

TRON (TRX) price performance chart. Source: Beincrypto.

At the time of writing, the TRX is trading at around $0.25 and has barely moved after falling from its $0.45 high at the end of last year.